by Calculated Risk on 11/06/2012 03:20:00 PM

Tuesday, November 06, 2012

Lawler: Table of Short Sales and Foreclosures for Selected Cities in September

Economist Tom Lawler sent me this today with this note: "I found a few more realtor reports on distressed sales shares for the third quarter."

Previous comments: A couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in most areas. For two cities, Las Vegas and Reno, short sales are now three times foreclosures, although that is related to the new foreclosure rules in Nevada. Both Phoenix and Sacramento had over twice as many short sales as foreclosures. A year ago, there were many more foreclosures than short sales in most areas. Minneapolis is an exception with more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. Chicago is essentially unchanged from a year ago.

And previously from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

| Sacramento | 35.4% | 26.1% | 15.4% | 37.9% | 50.8% | 64.0% |

| Minneapolis | 10.1% | 13.1% | 25.2% | 32.9% | 35.3% | 46.0% |

| Mid-Atlantic (MRIS) | 12.4% | 12.6% | 9.4% | 14.4% | 21.8% | 27.0% |

| Orlando | 28.0% | 25.6% | 24.0% | 35.9% | 52.0% | 61.5% |

| California (DQ)* | 27.0% | 23.8% | 17.7% | 33.8% | 44.7% | 57.6% |

| California (CAR) | 24.3% | 21.0% | 12.3% | 27.5% | 37.0% | 48.7% |

| Lee County, FL*** | 21.4% | 21.4% | 15.9% | 31.5% | 37.3% | 52.9% |

| Colorado** | 6.5% | 6.1% | 12.3% | 19.8% | 18.7% | 25.8% |

| King Co. WA** | 16.0% | 10.0% | 10.0% | 22.0% | 25.0% | 32.0% |

| Hampton Roads VA | 25.4% | 31.6% | ||||

| Miami-Dade | 47.4% | 59.6% | ||||

| Northeast Florida | 44.7% | 49.0% | ||||

| Chicago | 40.6% | 40.0% | ||||

| Rhode Island | 23.9% | 28.9% | ||||

| Miami-Dade | 47.4% | 59.0% | ||||

| Charlotte | 15.3% | 20.9% | ||||

| Columbus OH** | 25.2% | 30.5% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 26.6% | 31.8% | ||||

| Houston | 16.1% | 19.4% | ||||

| *share of existing home sales, based on property records | ||||||

| **Third Quarter | ||||||

| *** SF only | ||||||

CoreLogic: House Price Index declined seasonally in September, Up 5.0% Year-over-year

by Calculated Risk on 11/06/2012 11:30:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® September Home Price Index Rises 5 Percent Year-Over-Year

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 5 percent in September 2012 compared to September 2011. This change represents the biggest increase since July 2006 and the seventh consecutive increase in home prices nationally on a year-over-year basis. On a month-over-month basis, including distressed sales, home prices decreased by 0.3 percent in September 2012 compared to August 2012.

...

Excluding distressed sales, home prices nationwide also increased on a year-over-year basis by 5 percent in September 2012 compared to September 2011. On a month-over-month basis excluding distressed sales, home prices increased 0.5 percent in September 2012 compared to August 2012, the seventh consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that October 2012 home prices, including distressed sales, are expected to rise by 5.7 percent on a year-over-year basis from October 2011 and fall by 0.5 percent on a month-over-month basis from September 2012 as sales exhibit a seasonal slowdown going into the winter.

...

“Home price improvement nationally continues to outpace our expectations, growing 5 percent year-over-year in September, the best showing since July 2006,” said Mark Fleming, chief economist for CoreLogic. “While prices on a month-over-month basis are declining, as expected in the housing off-season, most states are exhibiting price increases. Gains are particularly large in former housing bubble states and energy-industry concentrated states."

Click on graph for larger image.

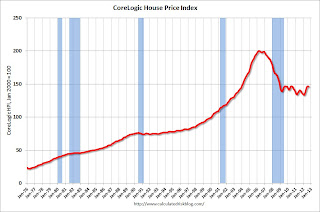

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.3% in September, and is up 5.0% over the last year.

The index is off 26.9% from the peak - and is up 9.7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

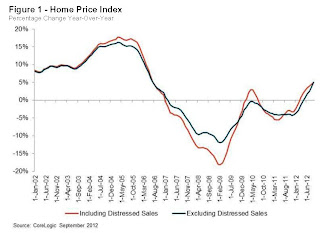

The second graph is from CoreLogic. The year-over-year comparison has been positive for seven consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for seven consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in September, and will probably stay negative on a month-to-month basis until the March 2013 report is released. The key for the next several months will be to watch the year-over-year change.

BLS: Job Openings "essentially unchanged" in September, Up year-over-year

by Calculated Risk on 11/06/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in September was 3.6 million, essentially unchanged from August.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in September was up from 2.4 million at the end of the recession in June 2009.

...

In September, the quits rate was little changed for total nonfarm, total private, and government. The number of quits was 2.0 million in September compared to 1.8 million at the end of the recession in June 2009.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in September to 3.561 million, down slightly from 3.661 million in August. The number of job openings (yellow) has generally been trending up, and openings are only up about 2% year-over-year compared to September 2011.

Quits decreased in September, and quits are down slightly year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

The trend suggests a gradually improving labor market.

Greece Update

by Calculated Risk on 11/06/2012 08:51:00 AM

From Masa Serdarevic at the Financial Times Alphaville: Athens grinds to a halt

The Greek parliament will vote late Wednesday on the structural reforms and budget cuts demanded by the Troika. Reports suggest that the government will be able to get a majority. But in a last minute attempt to derail the vote, the country’s two main labour unions called a 48 hour general strike that started today.Alphaville has some photos of the strike - it looks like a complete mess. Live footage of the strike is here (or talking heads).

From the WSJ: Europe, Central Bank Spar Over Athens Aid

Europe's governments and the European Central Bank are at odds about who should shoulder the financial burden of giving Greece more time to repay its loans and remain part of the euro zone.Still no way out.

The search for a solution for Greece, whether by forgiving some of the money it owes or giving it yet more bailout loans, has come back to haunt the currency union ahead of the ECB's monthly policy meeting on Thursday.

Greece faces a key Treasury-bill repayment in less than two weeks, and the money isn't there unless governments provide additional aid or the ECB agrees to lend Greek banks the money to roll over the debt.

Monday, November 05, 2012

Tuesday: Presidential Election

by Calculated Risk on 11/05/2012 08:02:00 PM

The key event tomorrow is the US election.

Brad Plumer at the WaPo lists a number of projections: Pundit accountability: The official 2012 election prediction thread

Here are the electoral vote predictions from various modelers, political scientists and pundits from around the Internet. All predictions are as of Monday evening. And yes, this will be a fun thread to revisit the day after the election.There is quite a range of predictions. As I've noted, my economic forecasts assume President Obama will be reelected.

Ezra Klein had a great piece today: Neither Obama nor Romney will turn America into a bleak hellscape

We’re at the end of a long and bitter election, and so perhaps it’s worth taking a deep breath and admitting something that typically doesn’t get said until one candidate or the other delivers his concession speech: America will survive either way. Which isn’t to say the policy differences between the candidates aren’t real, and large. They are. But it’s not the end-times showdown that the two sides often suggest.Tuesday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for September will be released by the BLS. The number of job openings has generally been trending up, and openings were up about 13% year-over-year compared to August 2011.