by Calculated Risk on 10/31/2012 09:53:00 AM

Wednesday, October 31, 2012

Chicago PMI: Activity "Idled"

From the Chicago ISM:

October 2012: The Chicago Purchasing Managers reported October's Chicago Business Barometer idled, up just 0.2 to a still contractionary 49.9.New orders improved slightly from 47.4 to 50.6 in October. Employment was at 50.3, down from 52.0 in September.

Business Activity measures reflected weakness in five of seven indexes, most notably as the rate of expansion in Production and Employment slowed while New Orders stalled near neutral and Order Backlogs remained in contraction.

EMPLOYMENT: 33 month low;

INVENTORIES: slipped into contraction;

PRICES PAID: inflation slowed a bit;

This was below expectations of a reading of 51.0.

MBA:Refinance Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/31/2012 07:03:00 AM

From the MBA: Refinance Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week to the lowest level since the end of August. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.The refinance index has declined for four straight weeks, but is still at a high level.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.65 percent from 3.63 percent, with points decreasing to 0.39 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

This index is not indicating a pickup in purchase activity.

Tuesday, October 30, 2012

Wednesday: Markets Open, Chicago PMI, Delayed Surveys

by Calculated Risk on 10/30/2012 08:20:00 PM

US Markets will be open on Wednesday. Currently S&P 500 futures are up slightly.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 9:45 AM, the Chicago Purchasing Managers Index for October will be released. The consensus is for an increase to 51.0, up from 49.7 in September.

• Weather delayed: The October National Multi Housing Council (NMHC) Quarterly Apartment Survey will be released either Wednesday or Thursday. This is a key survey for apartment vacancy rates and rents.

• Weather delayed: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

The last question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Earlier on House Prices:

• Case-Shiller: House Prices increased 2.0% year-over-year in August

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

HVS: Q3 Homeownership and Vacancy Rates

by Calculated Risk on 10/30/2012 05:23:00 PM

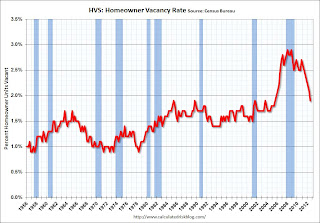

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2012 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high.

It might show the trend, but I wouldn't rely on the absolute numbers. My understanding is the Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was unchanged from Q2 at 65.5%, and down from 66.3% in Q3 2011.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The HVS homeowner vacancy rate declined to 1.9% from 2.1% in Q2. This is the lowest level since 2005 for this report.

The HVS homeowner vacancy rate declined to 1.9% from 2.1% in Q2. This is the lowest level since 2005 for this report.

The homeowner vacancy rate has peaked and is now declining, although it isn't really clear what this means. Are these homes becoming rentals? Anyway - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate was unchanged from Q2 at 8.6%, and down from 9.8% in Q3 2011.

The rental vacancy rate was unchanged from Q2 at 8.6%, and down from 9.8% in Q3 2011.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates have declined sharply.

Earlier on House Prices:

• Case-Shiller: House Prices increased 2.0% year-over-year in August

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Update: House Price Seasonality

by Calculated Risk on 10/30/2012 02:58:00 PM

The Not Seasonally Adjusted (NSA) house price indexes will show month-to-month declines soon. I expect the CoreLogic index to show month-to-month declines in the September report, and the Case-Shiller Composite 20 (NSA) to decline month-to-month in October. This will not be a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern.

Even in normal times house prices tend to be stronger in the spring and early summer, then in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think house prices have already bottomed, and will be up slightly year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through August). Right now it looks like CoreLogic will turn negative in the September report (CoreLogic is 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust. (I was one of several people to question this change in the seasonal factor - and this lead to Case-Shiller reporting the NSA numbers).

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust. (I was one of several people to question this change in the seasonal factor - and this lead to Case-Shiller reporting the NSA numbers).

It appears the seasonal factor has stopped increasing, and I expect that over the next several years, the seasonal factors will slowly move back towards the previous levels.