by Calculated Risk on 10/26/2012 03:32:00 PM

Friday, October 26, 2012

Zillow forecasts Case-Shiller House Price index to show 1.7% Year-over-year increase for August

Note: The Case-Shiller report to be released next Tuesday is for August (really an average of prices in June, July and August).

Zillow Forecast: August Case-Shiller Composite-20 Expected to Show 1.7% Increase from One Year Ago

On Tuesday Oct. 30, the Case-Shiller Composite Home Price Indices for August will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 1.7 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 1.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from July to August will be 0.2 percent for the 20-City Composite and 0.3 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series, the August Zillow Home Value Index data and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

As the housing market recovery continues, home prices are expected to modestly appreciate, with growth rates being below “normal” pre-housing recession levels. Zillow’s Home Value Index for September was released on Monday night and shows the largest quarterly appreciation since March 2006, showing that the market is regaining some of its strength. National home values are up 3.2 percent from year-ago levels and have now seen four consecutive quarters of appreciation. While the national housing market is showing consistent signs of improvement, the recovery is uneven across the country. Some markets, such as Phoenix, Riverside and Miami are doing exceptionally well, while St. Louis and Atlanta are still faltering. Part of the strong home value appreciation we are seeing is driven by acute inventory shortages in many markets with foreclosures and foreclosure re-sales down and many people still locked up in negative equity, limiting overall supply. In these last months of 2012, Case-Shiller indices are expected to moderate and likely report monthly declines toward the end of the year tracking the Zillow Home Value Index. Monthly depreciation toward the end of the year is largely a function of declining overall monthly sales volume, which will increase the percentage of foreclosure re-sales in the transactional mix being tracked by Case-Shiller.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | August 2011 | 156.51 | 153.49 | 142.97 | 140.11 |

| Case-Shiller (last month) | July 2012 | 157.3 | 154.85 | 144.61 | 142.1 |

| Zillow June Forecast | YoY | 1.2% | 1.2% | 1.7% | 1.7% |

| MoM | 0.7% | 0.3% | 0.5% | 0.2% | |

| Zillow Forecasts1 | 158.4 | 155.3 | 145.4 | 142.4 | |

| Current Post Bubble Low | 146.52 | 149.19 | 134.10 | 136.45 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.1% | 4.1% | 8.4% | 4.4% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

LPS: House Price Index increased 0.2% in August

by Calculated Risk on 10/26/2012 02:20:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses August closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.2 Percent for the Month; Up 2.6 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on August 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 23.0% from the peak in June 2006.

In May, the LPS HPI was up 0.4% year-over-year, in June, the index was up 0.9% year-over-year, and 1.8% in July, and now 2.6% in August. This is steady improvement on a year-over-year basis. Note: Case-Shiller for August will be released this coming Tuesday.

Comments on Q3 GDP and Investment

by Calculated Risk on 10/26/2012 12:15:00 PM

The Q3 GDP report was weak, with 2.0% annualized real GDP growth, but slightly better than expected. Final demand increased in Q3 as personal consumption expenditures increased at a 2.0% annual rate (up from 1.5% in Q2), and residential investment increased at a 14.4% annual rate (up from 8.5% in Q2).

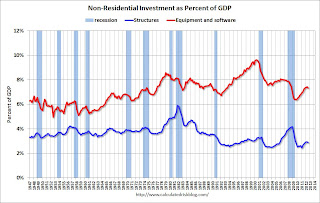

Investment in equipment and software was flat in Q3, and investment in non-residential structures was negative. However, it appears the drag from state and local governments will end soon (after declining for 3 years).

Overall this was another weak report indicating sluggish growth.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q3 for the sixth consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment was unchanged in Q3 (compared to Q2). This followed twelve consecutive quarters with a positive contribution.

The contribution from nonresidential investment in structures was negative in Q3. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

However the drag from state and local governments is ongoing, although the drag in Q3 was very small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

In real terms, state and local government spending is now back to 2001 levels, even with a larger population.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue (although the recovery in RI will be sluggish compared to previous recoveries). Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2013 (with the usual caveats about Europe and policy errors in the US).

Earlier with revision graphs:

• Real GDP increased 2.0% annual rate in Q3

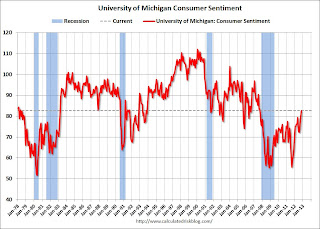

Final October Consumer Sentiment at 82.6

by Calculated Risk on 10/26/2012 09:55:00 AM

Note: I'll have much more on GDP soon.

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.

This was slightly below the consensus forecast of 83.1. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving.

Real GDP increased 2.0% annual rate in Q3

by Calculated Risk on 10/26/2012 08:38:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2012 (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.3 percent.

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and residential fixed investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The acceleration in real GDP in the third quarter primarily reflected an upturn in federal government spending, a downturn in imports, an acceleration in PCE, a smaller decrease in private inventory investment, an acceleration in residential fixed investment, and a smaller decrease in state and local government spending that were partly offset by downturns in exports and in nonresidential fixed investment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the advance estimate for Q3 GDP.

A few comments:

• Consumer spending picked up a little. Real personal consumption expenditures increased 2.0 percent in the third quarter, compared with an increase of 1.5 percent in the second.

• Residential investment increased. Real residential fixed investment increased 14.4 percent, compared with an increase of 8.5 percent.

• State and local government made a negative contribution to GDP for the twelfth straight quarter, but the negative contribution was very minor.

This was slightly above expectations. I'll have more on GDP later ...