by Calculated Risk on 10/24/2012 11:55:00 AM

Wednesday, October 24, 2012

New Home Sales and Distressing Gap

New home sales have averaged 364,000 on an annual rate basis through September. That means sales are on pace to increase 19% from last year (and based on the last few months, sales will probably increase more than 20% this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 364 | 19% |

| 12012 pace through September. | ||

But even with a 20%+ increase this year, 2012 will be the 3rd or 4th lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, and it is possible - with a fairly strong last three months - that sales will be close to, or even above, the 375,000 sales in 2009.

Click on graph for larger image.

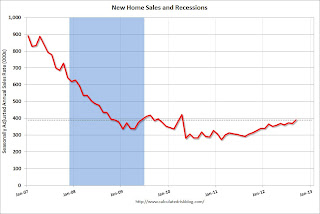

Click on graph for larger image.This graph shows new home sales over the last few years. Although sales have increased this year, total sales are still very low. The two tax credit related "peaks" were at 418 thousand and 422 thousand, and sales are still below those levels.

Given the current low level of sales, and current market conditions (supply and demand), sales will probably continue to increase over the next few years. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

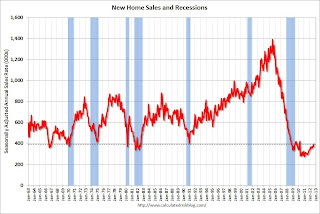

Here is an update to the distressing gap graph.

Note: I started posting this graph four years ago when the "distressing gap" first appeared!

Note: I started posting this graph four years ago when the "distressing gap" first appeared!This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through September. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales graphs

New Home Sales at 389,000 SAAR in September

by Calculated Risk on 10/24/2012 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 389 thousand. This was up from a revised 368 thousand SAAR in August (revised down from 373 thousand). This is the highest level since April 2010 (tax credit related bounce).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in September 2012 were at a seasonally adjusted annual rate of 389,000 ... This is 5.7 percent above the revised August rate of 368,000 and is 27.1 percent above the September 2011 estimate of 306,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply declined in September to 4.5 months. August was revised up to 4.6 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of September was 145,000. This represents a supply of 4.5 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in September. The combined total of completed and under construction is just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In September 2012 (red column), 31 thousand new homes were sold (NSA). Last year only 24 thousand homes were sold in September. This was the sixth weakest September since this data has been tracked (above 2011, 2010, 2009, 1981 and 1966). The high for September was 99 thousand in 2005.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 364 thousand SAAR over the first 9 months of 2012, after averaging under 300 thousand for the previous 18 months. Sales are finally above the lows for previous recessions too.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 364 thousand SAAR over the first 9 months of 2012, after averaging under 300 thousand for the previous 18 months. Sales are finally above the lows for previous recessions too.This was slightly above expectations of 385,000, and was another fairly solid report. This indicates an ongoing recovery in residential investment.

MBA:Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/24/2012 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 13 percent from the previous week to the lowest level since late August. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.63 percent from 3.57 percent, with points increasing to 0.45 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down about 20% over the last three weeks, but activity is still very high - and will probably remain high with mortgage rates near record lows.

The MBA expects mortgage originations to decline next year: MBA Sees 2013 Residential Mortgage Originations Hitting $1.3 Trillion, Revises 2012 Estimate Upward to $1.7 trillion

The Mortgage Bankers Association (MBA) expects to see $1.3 trillion in mortgage originations during 2013, largely driven by a spillover of refinances into the first half of the year. MBA also upwardly revised its estimate of originations for 2012 to $1.7 trillion. MBA expects to see purchase originations climb to $585 billion in 2013, up from a revised estimate of $503 billion for 2012. In contrast, refinances are expected to fall to $785 billion in 2013, down from a revised estimate of $1.2 trillion in 2012.

“We expected 2012 originations to be front-loaded in the first half of the year, with refis falling off with rate increases. Instead we saw the refinance market grow during the year due to a combination of low rates, thanks to QE3 and slowing global growth because of continuing problems in Europe, and adjustments in the HARP and FHA refinance programs,” said Jay Brinkmann, MBA’s Chief Economist. “We expect 2013 refinance originations to play out like our original expectations for 2012, with a long tail of refis extending through the first half of the year followed by a rapid drop-off in the second half.”

Brinkmann continued, “In contrast, we expect a 16% increase in purchase originations in 2013 over 2012, with every quarter in 2013 exceeding the same quarter of 2012. The increase in purchase volumes will be driven by continued modest growth in the economy, an increase in owner-occupied sales financed with mortgages as opposed to cash purchases by investors, an increase in new home sales and a small increase in average home prices. "

The second graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

The second graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.The MBA expects this index to start increasing in 2013.

Tuesday, October 23, 2012

Wednesday: New Home Sales, FOMC Announcement

by Calculated Risk on 10/23/2012 09:03:00 PM

The FHFA house price index for August was released late today (GSE loans). FHFA House Price Index Up 0.7 Percent in August:

U.S. house prices rose 0.7 percent on a seasonally adjusted basis from July to August, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). The previously reported 0.2 percent increase in July was revised downward to a 0.1 percent increase. For the 12 months ending in August, U.S. prices rose 4.7 percent. The U.S. index is 15.9 percent below its April 2007 peak and is roughly the same as the June 2004 index level.This was above the consensus of a 0.4% increase in August.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for October. The consensus is for a reading of 51.5, unchanged from September.

• At 10:00 AM, New Home Sales for September will be released by the Census Bureau. The consensus is for an increase in sales to 385 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 373 thousand in August. Watch for possible upgrades to the sales rates for previous months.

• At 2:15 PM, the FOMC Meeting statement will be released. No significant changes are expected. I posted a FOMC preview yesterday.

• During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: REO by State and Owner Occupied Units by State

by Calculated Risk on 10/23/2012 07:26:00 PM

To help put the previous post in perspective, I've added the number of owner occupied units as of April 1, 2010 (from the decennial Census), and the percent of units that are REO.

REOs are only part of the puzzle. This just shows how many lender Real Estate Owned (REO) units for each state. But look at New Jersey. There are very few REOs in New Jersey, but there are many properties in the foreclosure process.

If you look at the NY Fed site, they mark the judicial foreclosure states with a black square. Many of the judicial states are backlogged. See Serious Mortgage Delinquencies and In-Foreclosure by State for graphs of the percent of loans in foreclosure and serious delinquent by state (as of the end of Q2).

Here are a repeat of Tom Lawler's comments:

Folks interested in REO inventories by state might want to take at look at the website below from the FRB of New York. According to the FRBoNY, the data were “provided by CoreLogic under contract.”

An Assessment of the Distressed Residential Real Estate Situation

The site shows a map and you have to click on each state to get data, and I couldn’t get DC (I don’t think it was available!), but here’s the data for June 30, 2012

| Number of REO by State, June 2012 | |||

|---|---|---|---|

| Number of REO | Owner Occupied Housing Units April, 2010 | Percent of Units REO | |

| Northeast | |||

| Connecticut | 2,345 | 925,286 | 0.25% |

| Maine | 910 | 397,417 | 0.23% |

| Massachusetts | 7,501 | 1,587,158 | 0.47% |

| New Hampshire | 2,847 | 368,316 | 0.77% |

| New Jersey | 1,979 | 2,102,465 | 0.09% |

| New York | 2,557 | 3,897,837 | 0.07% |

| Pennsylvania | 7,712 | 3,491,722 | 0.22% |

| Rhode Island | 2,110 | 250,952 | 0.84% |

| Vermont | 264 | 181,407 | 0.15% |

| South | |||

| Alabama | 7,644 | 1,312,589 | 0.58% |

| Arkansas | 1,027 | 768,156 | 0.13% |

| Delaware | 1,163 | 246,724 | 0.47% |

| District of Columbia | NA | 112,055 | NA |

| Florida | 44,677 | 4,998,979 | 0.89% |

| Georgia | 33,537 | 2,354,402 | 1.42% |

| Kentucky | 4,442 | 1,181,271 | 0.38% |

| Louisiana | 4,756 | 1,162,299 | 0.41% |

| Maryland | 4,614 | 1,455,775 | 0.32% |

| Mississippi | 2,907 | 777,073 | 0.37% |

| North Carolina | 12,005 | 2,497,900 | 0.48% |

| Oklahoma | 3,009 | 981,760 | 0.31% |

| South Carolina | 5,775 | 1,248,805 | 0.46% |

| Tennessee | 10,575 | 1,700,592 | 0.62% |

| Texas | 22,528 | 5,685,353 | 0.40% |

| Virginia | 8,810 | 2,055,186 | 0.43% |

| West Virginia | 1,780 | 561,013 | 0.32% |

| Midwest | |||

| Illinois | 33,584 | 3,263,639 | 1.03% |

| Indiana | 7,548 | 1,747,975 | 0.43% |

| Iowa | 2,792 | 880,635 | 0.32% |

| Kansas | 3,540 | 753,532 | 0.47% |

| Michigan | 38,275 | 2,793,342 | 1.37% |

| Minnesota | 16,761 | 1,523,859 | 1.10% |

| Missouri | 10,821 | 1,633,610 | 0.66% |

| Nebraska | 1,184 | 484,730 | 0.24% |

| North Dakota | 128 | 183,943 | 0.07% |

| Ohio | 18,533 | 3,111,054 | 0.60% |

| South Dakota | 471 | 219,558 | 0.21% |

| Wisconsin | 9,807 | 1,551,558 | 0.63% |

| West | |||

| Alaska | 494 | 162,765 | 0.30% |

| Arizona | 12,465 | 1,571,687 | 0.79% |

| California | 49,299 | 7,035,371 | 0.70% |

| Colorado | 8,596 | 1,293,100 | 0.66% |

| Hawaii | 936 | 262,682 | 0.36% |

| Idaho | 2,131 | 404,903 | 0.53% |

| Montana | 826 | 278,418 | 0.30% |

| Nevada | 7,882 | 591,480 | 1.33% |

| New Mexico | 2,575 | 542,122 | 0.47% |

| Oregon | 4,452 | 944,485 | 0.47% |

| Utah | 4,193 | 618,137 | 0.68% |

| Washington | 7,461 | 1,673,920 | 0.45% |

| Wyoming | 905 | 157,077 | 0.58% |

| Total (ex-DC) | 443,133 | 75,986,074 | 0.58% |