by Calculated Risk on 10/23/2012 09:03:00 PM

Tuesday, October 23, 2012

Wednesday: New Home Sales, FOMC Announcement

The FHFA house price index for August was released late today (GSE loans). FHFA House Price Index Up 0.7 Percent in August:

U.S. house prices rose 0.7 percent on a seasonally adjusted basis from July to August, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). The previously reported 0.2 percent increase in July was revised downward to a 0.1 percent increase. For the 12 months ending in August, U.S. prices rose 4.7 percent. The U.S. index is 15.9 percent below its April 2007 peak and is roughly the same as the June 2004 index level.This was above the consensus of a 0.4% increase in August.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for October. The consensus is for a reading of 51.5, unchanged from September.

• At 10:00 AM, New Home Sales for September will be released by the Census Bureau. The consensus is for an increase in sales to 385 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 373 thousand in August. Watch for possible upgrades to the sales rates for previous months.

• At 2:15 PM, the FOMC Meeting statement will be released. No significant changes are expected. I posted a FOMC preview yesterday.

• During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: REO by State and Owner Occupied Units by State

by Calculated Risk on 10/23/2012 07:26:00 PM

To help put the previous post in perspective, I've added the number of owner occupied units as of April 1, 2010 (from the decennial Census), and the percent of units that are REO.

REOs are only part of the puzzle. This just shows how many lender Real Estate Owned (REO) units for each state. But look at New Jersey. There are very few REOs in New Jersey, but there are many properties in the foreclosure process.

If you look at the NY Fed site, they mark the judicial foreclosure states with a black square. Many of the judicial states are backlogged. See Serious Mortgage Delinquencies and In-Foreclosure by State for graphs of the percent of loans in foreclosure and serious delinquent by state (as of the end of Q2).

Here are a repeat of Tom Lawler's comments:

Folks interested in REO inventories by state might want to take at look at the website below from the FRB of New York. According to the FRBoNY, the data were “provided by CoreLogic under contract.”

An Assessment of the Distressed Residential Real Estate Situation

The site shows a map and you have to click on each state to get data, and I couldn’t get DC (I don’t think it was available!), but here’s the data for June 30, 2012

| Number of REO by State, June 2012 | |||

|---|---|---|---|

| Number of REO | Owner Occupied Housing Units April, 2010 | Percent of Units REO | |

| Northeast | |||

| Connecticut | 2,345 | 925,286 | 0.25% |

| Maine | 910 | 397,417 | 0.23% |

| Massachusetts | 7,501 | 1,587,158 | 0.47% |

| New Hampshire | 2,847 | 368,316 | 0.77% |

| New Jersey | 1,979 | 2,102,465 | 0.09% |

| New York | 2,557 | 3,897,837 | 0.07% |

| Pennsylvania | 7,712 | 3,491,722 | 0.22% |

| Rhode Island | 2,110 | 250,952 | 0.84% |

| Vermont | 264 | 181,407 | 0.15% |

| South | |||

| Alabama | 7,644 | 1,312,589 | 0.58% |

| Arkansas | 1,027 | 768,156 | 0.13% |

| Delaware | 1,163 | 246,724 | 0.47% |

| District of Columbia | NA | 112,055 | NA |

| Florida | 44,677 | 4,998,979 | 0.89% |

| Georgia | 33,537 | 2,354,402 | 1.42% |

| Kentucky | 4,442 | 1,181,271 | 0.38% |

| Louisiana | 4,756 | 1,162,299 | 0.41% |

| Maryland | 4,614 | 1,455,775 | 0.32% |

| Mississippi | 2,907 | 777,073 | 0.37% |

| North Carolina | 12,005 | 2,497,900 | 0.48% |

| Oklahoma | 3,009 | 981,760 | 0.31% |

| South Carolina | 5,775 | 1,248,805 | 0.46% |

| Tennessee | 10,575 | 1,700,592 | 0.62% |

| Texas | 22,528 | 5,685,353 | 0.40% |

| Virginia | 8,810 | 2,055,186 | 0.43% |

| West Virginia | 1,780 | 561,013 | 0.32% |

| Midwest | |||

| Illinois | 33,584 | 3,263,639 | 1.03% |

| Indiana | 7,548 | 1,747,975 | 0.43% |

| Iowa | 2,792 | 880,635 | 0.32% |

| Kansas | 3,540 | 753,532 | 0.47% |

| Michigan | 38,275 | 2,793,342 | 1.37% |

| Minnesota | 16,761 | 1,523,859 | 1.10% |

| Missouri | 10,821 | 1,633,610 | 0.66% |

| Nebraska | 1,184 | 484,730 | 0.24% |

| North Dakota | 128 | 183,943 | 0.07% |

| Ohio | 18,533 | 3,111,054 | 0.60% |

| South Dakota | 471 | 219,558 | 0.21% |

| Wisconsin | 9,807 | 1,551,558 | 0.63% |

| West | |||

| Alaska | 494 | 162,765 | 0.30% |

| Arizona | 12,465 | 1,571,687 | 0.79% |

| California | 49,299 | 7,035,371 | 0.70% |

| Colorado | 8,596 | 1,293,100 | 0.66% |

| Hawaii | 936 | 262,682 | 0.36% |

| Idaho | 2,131 | 404,903 | 0.53% |

| Montana | 826 | 278,418 | 0.30% |

| Nevada | 7,882 | 591,480 | 1.33% |

| New Mexico | 2,575 | 542,122 | 0.47% |

| Oregon | 4,452 | 944,485 | 0.47% |

| Utah | 4,193 | 618,137 | 0.68% |

| Washington | 7,461 | 1,673,920 | 0.45% |

| Wyoming | 905 | 157,077 | 0.58% |

| Total (ex-DC) | 443,133 | 75,986,074 | 0.58% |

Lawler: Estimated REO Inventories by State

by Calculated Risk on 10/23/2012 04:42:00 PM

CR Note: This is a very useful website. The estimate of lender Real Estate Owned (REO) in June was very close to the bottom up estimate using data from the FHA, Fannie, Freddie, the FDIC and more.

From economist Tom Lawler:

Folks interested in REO inventories by state might want to take at look at the website below from the FRB of New York. According to the FRBoNY, the data were “provided by CoreLogic under contract.”

An Assessment of the Distressed Residential Real Estate Situation

The site shows a map and you have to click on each state to get data, and I couldn’t get DC (I don’t think it was available!), but here’s the data for June 30, 2012

| Number of REO by State, June 2012 | |

|---|---|

| Northeast | |

| Connecticut | 2,345 |

| Maine | 910 |

| Massachusetts | 7,501 |

| New Hampshire | 2,847 |

| New Jersey | 1,979 |

| New York | 2,557 |

| Pennsylvania | 7,712 |

| Rhode Island | 2,110 |

| Vermont | 264 |

| South | |

| Alabama | 7,644 |

| Arkansas | 1,027 |

| Delaware | 1,163 |

| District of Columbia | |

| Florida | 44,677 |

| Georgia | 33,537 |

| Kentucky | 4,442 |

| Louisiana | 4,756 |

| Maryland | 4,614 |

| Mississippi | 2,907 |

| North Carolina | 12,005 |

| Oklahoma | 3,009 |

| South Carolina | 5,775 |

| Tennessee | 10,575 |

| Texas | 22,528 |

| Virginia | 8,810 |

| West Virginia | 1,780 |

| Midwest | |

| Illinois | 33,584 |

| Indiana | 7,548 |

| Iowa | 2,792 |

| Kansas | 3,540 |

| Michigan | 38,275 |

| Minnesota | 16,761 |

| Missouri | 10,821 |

| Nebraska | 1,184 |

| North Dakota | 128 |

| Ohio | 18,533 |

| South Dakota | 471 |

| Wisconsin | 9,807 |

| West | |

| Alaska | 494 |

| Arizona | 12,465 |

| California | 49,299 |

| Colorado | 8,596 |

| Hawaii | 936 |

| Idaho | 2,131 |

| Montana | 826 |

| Nevada | 7,882 |

| New Mexico | 2,575 |

| Oregon | 4,452 |

| Utah | 4,193 |

| Washington | 7,461 |

| Wyoming | 905 |

| Total (ex-DC) | 443,133 |

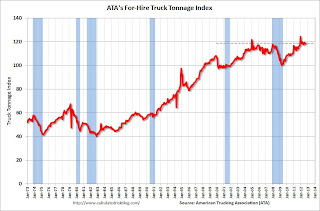

ATA Trucking Index increases in September

by Calculated Risk on 10/23/2012 01:58:00 PM

Note: ATA Chief Economist Bob Costello says, for trucking, the pickup in housing is offsetting the "flattening in manufacturing output".

From ATA: ATA Truck Tonnage Index Rose 0.4% in September

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.4% in September after falling 0.9% in August. In September, the SA index equaled 118.7 (2000=100). The level in September was the same as in January 2012, so the index has been on a flat trend-line over the past 9 months. Compared with September 2011, the SA index was 2.4% higher, the smallest year-over-year increase since December 2009.Note from ATA:

...

“The year-over-year deceleration in tonnage continued during September, although I was encouraged that the seasonally adjusted index edged higher from August,” ATA Chief Economist Bob Costello said. Costello noted again this month that the acceleration in housing starts, which is helping truck tonnage, is being countered by a flattening in manufacturing output and elevated inventories throughout the supply chain."

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 2.4% year-over-year - but has been mostly moving sideways in 2012.

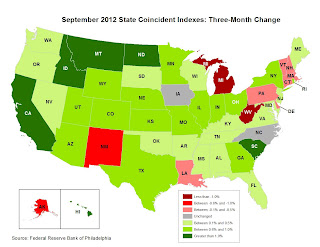

Fed: State Coincident Indexes in September show improvement

by Calculated Risk on 10/23/2012 12:08:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2012. In the past month, the indexes increased in 39 states, decreased in five states, and remained stable in six states, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 37 states, decreased in 11 states, and remained stable in two states, for a three-month diffusion index of 52. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in September and 0.6 percent over the past three months.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 41 states had increasing activity, up from 33 in August (including minor increases). This is the second consecutive year with a weak spot during the summer, and improvement towards the end of the year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map was all green earlier this year and is starting to turn mostly green again.