by Calculated Risk on 10/22/2012 09:13:00 AM

Monday, October 22, 2012

"The US bright spot"

From Kate Mackenzie at FT Alphaville: The US bright spot

It seems odd — and it may well be short-lived — but the US is beginning to shape up as a rare bright spot in the world economy. Or indeed almost the only bright spot in the world’s economy, except for the Gulf petro-states. That is, if you were to base such an assessment solely on Japan’s September export data, released on Monday.Actually it isn't that "odd" as Mackenzie mentions in a note at the bottom: "The FT’s Martin Wolf made a comment along these lines in Sydney last week. Plus, Cardiff has been looking at (very) tentative signs of an upturn in housing and construction for some time now, and that was before Jamie Dimon picked up on it."

Japan’s preliminary September trade data tell a story not dissimilar to China’s — exports to Europe are slowing (unsurprisingly) by a lot, down 26 per cent for the month, year-on-year. Asian exports also fell, by 8.3 per cent. But US exports rose 0.9 per cent. The six months between April and September show a more striking contrast: exports to North America rose 16.6 per cent; while for Asia they fell 4.7 per cent and for Western Europe, there was a 20.8 per cent decline.

This is another reminder that Europe and China pose downside risks, but right now the US is doing better than most other areas.

Sunday, October 21, 2012

Sunday Night Futures

by Calculated Risk on 10/21/2012 09:14:00 PM

Later in the week, there are several key economic releases (Q3 GDP, New Home sales, Durable Goods) and an FOMC announcement on Wednedsy. There are no releases scheduled for tomorrow ...

• Expected: LPS "First Look" Mortgage Delinquency Survey for September.

• At 9:00 PM ET, the Third Presidential Debate: President Obama and former Governor Romney debate Foreign policy at Lynn University in Boca Raton, Florida.

The Asian markets are red tonight, with the Nikkei down 1.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are down slightly.

Oil prices are down with WTI futures down to $90.05 and Brent down at $110.66 per barrel.

Weekend:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

Three more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Gasoline Prices down 8 cents over last 2 weeks

by Calculated Risk on 10/21/2012 06:24:00 PM

From Reuters: Average U.S. retail gas prices drop 8 cents in two weeks: survey

Gasoline prices averaged $3.7529 per gallon on October 19, down from $3.8375 on October 5, Trilby Lundberg, editor of the Lundberg Survey, said.Those of us in California are still waiting for the "dramatic crash"! We are still paying well over $4 per gallon because of the recent refinery issues (I filled up Friday and paid $4.50 per gallon, but it looks like prices have fallen further over the last 2 days).

...

Lundberg said further declines in retail gas prices are expected if the cost of crude oil does not rise substantially. She added that in California, gasoline prices could have a "dramatic crash" after refinery problems caused a spike two weeks ago.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.60 per gallon. That is about 8 cents below the current level according to Gasbuddy.com, and I expect prices to fall further. Note: Brent crude spot prices is at $110.76 per barrel (WTI is down to $90.05)

Gasoline prices have been on a roller coaster all year. Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent spike.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

DOT: Vehicle Miles Driven increased 1.2% in August

by Calculated Risk on 10/21/2012 12:21:00 PM

The Department of Transportation (DOT) reported Friday:

Travel on all roads and streets changed by 1.2% (3.0 billion vehicle miles) for August 2012 as compared with August 2011. Travel for the month is estimated to be 262.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.9% (17.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 57 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in August compared to August 2011. In August 2012, gasoline averaged of $3.78 per gallon according to the EIA. Last year, prices in August averaged $3.70 per gallon - but even with the increase in gasoline prices, miles driven increased year-over-year in August.

Gasoline prices were up in August compared to August 2011. In August 2012, gasoline averaged of $3.78 per gallon according to the EIA. Last year, prices in August averaged $3.70 per gallon - but even with the increase in gasoline prices, miles driven increased year-over-year in August.Just looking at gasoline prices suggest miles driven will be down in September - especially with the very high prices in California. Nationally gasoline prices averaged $3.91 in September, up sharply from $3.67 a year ago.

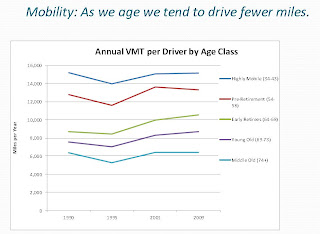

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.I also suspect miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline.

With all these factors, it may be years before we see a new peak in miles driven.

Yesterday:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

On Greece: More Austerity, More Recession, More Extremism

by Calculated Risk on 10/21/2012 09:42:00 AM

The first two articles discuss the rise of extremism in Greece as the country suffers through another year of recession (the unemployment rate in Greece is over 25%). The third article notes that the next tranche of aid is expected by mid-November.

From the NY Times: Amid the Echoes of an Economic Crash, the Sounds of Greek Society Being Torn (ht Ann). An excerpt:

The government just passed a law allowing supermarkets to sell expired food at discounted prices. The price of home heating oil has tripled since 2009, and many apartment blocks are voting not to buy any since too many tenants can’t afford it.And from the WaPo: Anti-immigrant Golden Dawn rises in Greece

As he stood outside a supermarket in a middle-class neighborhood here, a man who gave his name only as Stefanos, 70, said that his biggest fear was that Greece would reach a point “where for every five people unemployed, only one is working.”

“When that one person comes out of the supermarket, the other five are waiting for him outside to grab his groceries,” he said.

As the talks drag on between the government of Prime Minister Antonis Samaras and Greece’s foreign lenders over politically toxic new austerity measures in exchange for more aid, the news media are filled every day with leaks about possible cuts to salaries and pensions, leading to a state of constant, low-grade panic.

...

As she shopped for vegetables at an outdoor market recently, Angeliki Christaki, 58, said she was growing more worried. “We’re heading toward a scenario of civil war,” she said. “But that’s only natural when the rich are against the poor, when the extreme right wing fights the extreme left wing.”

“I was personally crushed when I saw young kids in a Golden Dawn protest,” she said. “I could not believe my eyes.”

At first glance, the shop on a nondescript street in this chaotic capital looks standard-issue military. Fatigues. Camouflage. Hunting gear. Deeper inside, the political message emerges. Black T-shirts emblazoned with modified swastikas — the symbol of the far-right Golden Dawn party — are on sale. A proudly displayed sticker carries a favorite party slogan: “Get the Stench out of Greece.”From the Athens News: Samaras: Certainty of next loan tranche by mid-November

By “stench,” the Golden Dawn — which won its first-ever seats in the Greek Parliament this spring and whose popularity has soared ever since — means immigrants, broadly defined as anyone not of Greek ancestry.

Prime Minister Antonis Samaras on Friday expressed certainty that a 31.5-billion-euro tranche of the EC-ECB-IMF bailout package will be disbursed by mid-November, preferably in its entirety, as soon as a report by the troika is adopted.Yesterday:

Speaking in Brussels at the end of a two-day EU summit, Samaras explained that a new summit will not be required to approve the disbursement, adding that the country's current cash reserves would run out on November 16.

emphasis added

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st