by Calculated Risk on 10/18/2012 08:30:00 AM

Thursday, October 18, 2012

Weekly Initial Unemployment Claims increase sharply to 388,000

The DOL reports:

In the week ending October 13, the advance figure for seasonally adjusted initial claims was 388,000, an increase of 46,000 from the previous week's revised figure of 342,000. The 4-week moving average was 365,500, an increase of 750 from the previous week's revised average of 364,750.The previous week was revised up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 365,500. This is just above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were higher than the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom. The large swings over the last two weeks were related to timing and technical factors, and is a reason to use the 4-week average.

Wednesday, October 17, 2012

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 10/17/2012 08:24:00 PM

A couple of articles on housing:

An interesting comment via Nick Timiraos at the WSJ: Why Housing Construction Is Rebounding

Gains in construction should lift the economy. Glenn Kelman, chief executive of real-estate brokerage Redfin, writes in an op-ed at Quartz that builders have been completing “half-built projects” with “skeleton crews” for much of the past year. That hasn’t done too much for job growth. “It takes fewer cooks to prepare leftovers for dinner,” he writes.This could be part of the reason that construction employment is lagging, but I also think we will see upward revisions (the preliminary benchmark revision indicated a fairly large upward revision for construction employment). The construction jobs are coming ...

And from Neil Irwin at the WaPo: September figures may provide signs of a housing recovery

First, it helps to understand how deep, and sustained, this housing depression has been. Residential investment — essentially, housing construction and sales activity — has been below 3 percent of gross domestic product every quarter since the fourth quarter of 2008, closing in on four years. Before this downturn, it had never fallen below 3 percent for even a single quarter (the data go back to 1947).Here is a graph to go along with Irwin's article:

...

Here’s the thing, however: The overbuilding of houses during the boom years, while real, was not extraordinary by historical standards. The underbuilding of houses has been far greater than the excess housing construction during the boom relative to demographic trends.

... other factors are probably major culprits in the housing weakness of the past four years: A terrible job market that has made people unwilling or unable to get a mortgage, an overhang of foreclosures that has kept the market for houses from clearing and extreme caution by banks and other lenders that has made it hard to get mortgages.

Now each of those trends seems to be healing.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of residential investment (RI) as a percent of GDP. Currently RI is 2.4% of GDP; just above the record low. I expect RI to recover back towards 4% of GDP over the next few years giving a boost to GDP and employment.

On Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 339 thousand. Look for a larger than normal upward revision to last week's report (apparently one large state was late with their quarterly filing).

• At 10:00 AM, the Philly Fed Survey for October will be released. The consensus is for a reading of 0.5, up from minus 1.9 last month (above zero indicates expansion).

• Also at 10:00 AM, the Conference Board Leading Indicators for September will be released. The consensus is for a 0.2% increase in this index.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

LA area Port Traffic: Moving Sideways

by Calculated Risk on 10/17/2012 05:41:00 PM

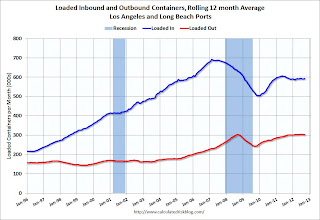

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up slightly, and outbound traffic is down slightly compared to the 12 months ending in August.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase next month, but probably not by much.

DataQuick: California Foreclosure Activity Lowest Since Early 2007

by Calculated Risk on 10/17/2012 02:54:00 PM

From DataQuick: California Foreclosure Activity Lowest Since Early 2007

Three and a half years after peaking, the number of California homes entering the foreclosure process fell last quarter to the lowest level since the early stages of the housing bust. Mortgage default filings hit their lowest point since first-quarter 2007, due in large part to a stronger economy and housing market and more short sales, a real estate information service reported.

A total of 49,026 Notices of Default (NoD) were recorded on residential properties during the third quarter. That was down 10.2 percent from 54,615 for the prior three months, and down 31.2 percent from 71,275 in third-quarter 2011, according to San Diego-based DataQuick.

Last quarter's number was the lowest since 46,760 NoDs were recorded in first-quarter 2007. NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

...

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 26.0 percent of statewide resale activity last quarter. That was up from an estimated 24.0 percent the prior quarter and up from 22.9 percent of all resales a year earlier. The estimated number of short sales last quarter rose 19.0 percent from a year earlier.

Foreclosure resales accounted for 20.0 percent of all California resale activity last quarter, down from a revised 27.8 percent the prior quarter and 34.2 percent a year ago. The figure peaked at 57.8 percent in the first quarter of 2009. The level of foreclosure resales - homes foreclosed on in the prior 12 months - varied significantly by county last quarter, from 5.5 percent in San Francisco County to 35.5 percent in Sutter County.

NoD filings fell last quarter across all home price categories. But mortgage defaults remained far more concentrated in California's most affordable neighborhoods.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. This year will probably the lowest since 2006.

The current level is still far above the peak of the previous housing bust (in 1996). Note: House prices stopped falling in 1996 in California, even though foreclosure activity was still historically high in 1997.

Lawler: Table of Short Sales and Foreclosures for Selected Cities in September

by Calculated Risk on 10/17/2012 01:35:00 PM

CR Note: On Monday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional).

Economist Tom Lawler has been digging up similar data, and he sent me the following table yesterday for several more distressed areas. A couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in most areas. For two cities, Las Vegas and Reno, short sales are now three times foreclosures, although that is related to the new foreclosure rules in Nevada. Both Phoenix and Sacramento had over twice as many short sales as foreclosures. A year ago, there were many more foreclosures than short sales in most areas. Minneapolis is an exception with more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. Chicago is essentially unchanged from a year ago.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

| Minneapolis | 10.1% | 13.1% | 25.2% | 32.9% | 35.3% | 46.0% |

| Mid-Atlantic (MRIS) | 12.4% | 12.6% | 9.4% | 14.4% | 21.8% | 27.0% |

| California* | 27.0% | 23.8% | 17.7% | 33.8% | 44.7% | 57.6% |

| Orlando | 28.0% | 25.6% | 24.0% | 35.9% | 52.0% | 61.5% |

| Sacramento | 35.4% | 26.1% | 15.4% | 37.9% | 50.8% | 64.0% |

| Charlotte | 15.3% | 20.9% | ||||

| Chicago | 40.6% | 40.0% | ||||

| Hampton Roads VA | 25.4% | 31.6% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Houston | 16.1% | 19.4% | ||||

| Birmingham AL | 26.6% | 31.8% | ||||

| *share of existing home sales, based on property records | ||||||