by Calculated Risk on 10/17/2012 05:41:00 PM

Wednesday, October 17, 2012

LA area Port Traffic: Moving Sideways

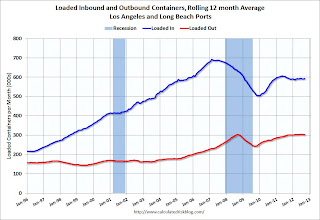

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up slightly, and outbound traffic is down slightly compared to the 12 months ending in August.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase next month, but probably not by much.

DataQuick: California Foreclosure Activity Lowest Since Early 2007

by Calculated Risk on 10/17/2012 02:54:00 PM

From DataQuick: California Foreclosure Activity Lowest Since Early 2007

Three and a half years after peaking, the number of California homes entering the foreclosure process fell last quarter to the lowest level since the early stages of the housing bust. Mortgage default filings hit their lowest point since first-quarter 2007, due in large part to a stronger economy and housing market and more short sales, a real estate information service reported.

A total of 49,026 Notices of Default (NoD) were recorded on residential properties during the third quarter. That was down 10.2 percent from 54,615 for the prior three months, and down 31.2 percent from 71,275 in third-quarter 2011, according to San Diego-based DataQuick.

Last quarter's number was the lowest since 46,760 NoDs were recorded in first-quarter 2007. NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

...

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 26.0 percent of statewide resale activity last quarter. That was up from an estimated 24.0 percent the prior quarter and up from 22.9 percent of all resales a year earlier. The estimated number of short sales last quarter rose 19.0 percent from a year earlier.

Foreclosure resales accounted for 20.0 percent of all California resale activity last quarter, down from a revised 27.8 percent the prior quarter and 34.2 percent a year ago. The figure peaked at 57.8 percent in the first quarter of 2009. The level of foreclosure resales - homes foreclosed on in the prior 12 months - varied significantly by county last quarter, from 5.5 percent in San Francisco County to 35.5 percent in Sutter County.

NoD filings fell last quarter across all home price categories. But mortgage defaults remained far more concentrated in California's most affordable neighborhoods.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. This year will probably the lowest since 2006.

The current level is still far above the peak of the previous housing bust (in 1996). Note: House prices stopped falling in 1996 in California, even though foreclosure activity was still historically high in 1997.

Lawler: Table of Short Sales and Foreclosures for Selected Cities in September

by Calculated Risk on 10/17/2012 01:35:00 PM

CR Note: On Monday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional).

Economist Tom Lawler has been digging up similar data, and he sent me the following table yesterday for several more distressed areas. A couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in most areas. For two cities, Las Vegas and Reno, short sales are now three times foreclosures, although that is related to the new foreclosure rules in Nevada. Both Phoenix and Sacramento had over twice as many short sales as foreclosures. A year ago, there were many more foreclosures than short sales in most areas. Minneapolis is an exception with more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. Chicago is essentially unchanged from a year ago.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

| Minneapolis | 10.1% | 13.1% | 25.2% | 32.9% | 35.3% | 46.0% |

| Mid-Atlantic (MRIS) | 12.4% | 12.6% | 9.4% | 14.4% | 21.8% | 27.0% |

| California* | 27.0% | 23.8% | 17.7% | 33.8% | 44.7% | 57.6% |

| Orlando | 28.0% | 25.6% | 24.0% | 35.9% | 52.0% | 61.5% |

| Sacramento | 35.4% | 26.1% | 15.4% | 37.9% | 50.8% | 64.0% |

| Charlotte | 15.3% | 20.9% | ||||

| Chicago | 40.6% | 40.0% | ||||

| Hampton Roads VA | 25.4% | 31.6% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Houston | 16.1% | 19.4% | ||||

| Birmingham AL | 26.6% | 31.8% | ||||

| *share of existing home sales, based on property records | ||||||

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 10/17/2012 10:54:00 AM

Three-fourths of the way through 2012, single family starts are on pace for about 520 thousand this year, and total starts are on pace for about 750 thousand. That is an increase of about 20% from 2011.

The following table shows annual starts (total and single family) since 2005 and an estimate for 2012.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 20121 | 750.0 | 23.2% | 520.0 | 20.8% |

| 12012 estimated | ||||

And the growth in housing starts should continue. My estimate is the US will probably add around 12 million households this decade, and assuming no excess supply, total housing starts would be 1.2 million per year, plus demolitions and 2nd home purchases. So housing starts could come close to doubling the 2012 level over the next several years - and that is one of the key reasons I think the US economy will continue to grow.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Starts are moving up, but the increase in completions has just started (wait a few months!).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Starts are moving up, but the increase in completions has just started (wait a few months!).

Housing Starts increased sharply to 872 thousand SAAR in September

by Calculated Risk on 10/17/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 872,000. This is 15.0 percent above the revised August estimate of 758,000 and is 34.8 percent above the September 2011 rate of 647,000.

Single-family housing starts in September were at a rate of 603,000; this is 11.0 percent above the revised August figure of 543,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 894,000. This is 11.6 percent above the revised August rate of 801,000 and is 45.1 percent above the September 2011 estimate of 616,000.

Single-family authorizations in September were at a rate of 545,000; this is 6.7 percent above the revised August figure of 511,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Total housing starts were at 872 thousand (SAAR) in September, up 15.0% from the revised August rate of 758 thousand (SAAR). Note that August was revised up from 750 thousand.

Single-family starts increased 11.0 to 603 thousand in September.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 80% from the bottom start rate, and single family starts are up 70% from the low.

This was way above expectations of 765 thousand starts in September. This was partially because of the volatile multi-family sector, but single family starts were up sharply too - and above 600 thousand SAAR for the first time since 2008. Right now starts are on pace to be up about 25% from 2011.