by Calculated Risk on 10/15/2012 06:54:00 PM

Monday, October 15, 2012

Sacramento September House Sales: Percentage of distressed sales lowest in years

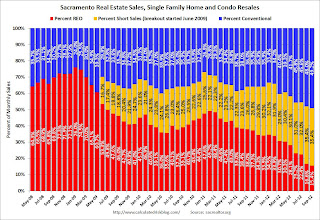

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement although the percent of distressed sales is still very high.

In September 2012, 50.8% of all resales (single family homes and condos) were distressed sales. This was down from 52.0% last month, and down from 64.0% in September 2011. The percentage of REOs fell to 15.4%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.4%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were over twice as many short sales as REO sales in September. The gap between short sales and REO sales is increasing.

Total sales were down 10% from September 2011, however conventional sales were up 23% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - some decline in overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 63.4% from last September, and listings were down 11.1% in September compared to August.

Cash buyers accounted for 35.9% of all sales (frequently investors), and median prices were up 9.6%% from last September.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.

The Housing Bottom and the Unemployment Rate

by Calculated Risk on 10/15/2012 04:47:00 PM

Early this year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph (and a repeat of some analysis).

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

Housing plays a key role for employment too. Here is an update to a graph I've been posting for a few years. This graph shows single family housing starts (through August) and the unemployment rate (inverted) also through September. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing last year. This was one of the reasons the unemployment rate remained elevated.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the recent recession with the huge overhang of existing vacant housing units, this key sector didn't participate. This time the unemployment rate started falling before housing starts picked up. Going forward I expect housing activity to increase and help push down the unemployment rate. Unfortunately I expect the housing recovery to be somewhat sluggish.

Correction on Mortgage Modifications

by Calculated Risk on 10/15/2012 01:48:00 PM

On Sunday, I wrote that private modifications were performing better than HAMP. According to the Q2 OCC report, HAMP modifications have a lower redefault rate than private mods:

HAMP modifications perform better than other modifications. Of the 565,751 HAMP modifications implemented since the third quarter of 2009, 68.2 percent remained current, compared with 53.4 percent of other modifications implemented during the same period.The OCC report covers about "60% of all first-lien mortgages in the United States" whereas the Hope Now report I mentioned on Sunday includes data from the non-bank servicers (not included in the OCC report) and is scaled to cover the entire first lien market. I'll have more on modifications soon (Mark Hanson called modifications the "new subprime").

...

Servicers modified 2,543,133 mortgages from the beginning of 2008 through the end of the fourth quarter of 2011. At the end of the first quarter of 2012, 50.7 percent of these modifications remained current or were paid off. Another 7.1 percent were 30 to 59 days delinquent, and 15.1 percent were seriously delinquent. Almost 11 percent were in the process of foreclosure, and 6.3 percent had completed the foreclosure process. More recent modifications that emphasized reduced payments, affordability and sustainability have outperformed modifications implemented in earlier periods.

Also, as a followup to a question in the comments, here is a "heat map" from Zillow on where properties owners have negative equity. Note: you can zoom in on the map, and put the cursor over an area - it will show the distribution of equity.

FNC: Residential Property Values increased 0.3% in August

by Calculated Risk on 10/15/2012 10:57:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their August index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.3% in August compared to July (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.5% and 0.8% in August. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since this index is NSA, the month-to-month changes will probably turn negative in September or October. The key then will be to watch the year-over-year change and also to compare the month-to-month change to previous years. This was the first month-to-month increase for the month of August since 2005.

The year-over-year trends continued to show improvement in August, with the 100-MSA composite up 1.5% compared to August 2011. The FNC index turned positive on a year-over-year basis last month - that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through August 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Some of the month-to-month gain is seasonal since this index is NSA. The key is the indexes are now showing a year-over-year increase.

The August Case-Shiller index will be released in two weeks, on Tuesday, October 30th.

Retail Sales increased 1.1% in September

by Calculated Risk on 10/15/2012 08:30:00 AM

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted), and sales were up 5.4% from September 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $412.9 billion, an increase of 1.1 percent from the previous month and 5.4 percent above September 2011.. ... The July to August 2012 percent change was revised from 0.9 percent to 1.2 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for August were revised up to a 1.2% increase (from 0.9% increase).

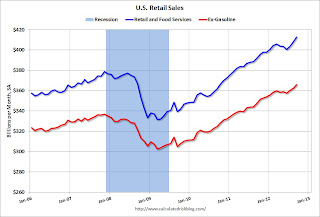

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.6% from the bottom, and now 9.0% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that retail sales ex-gasoline are increasing, but that gasoline prices have boosted retails sales over the last two months.

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that retail sales ex-gasoline are increasing, but that gasoline prices have boosted retails sales over the last two months.Excluding gasoline, retail sales are up 20.9% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.3% on a YoY basis (5.4% for all retail sales). Retail sales ex-autos increased 1.1% in September.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.