by Calculated Risk on 10/10/2012 02:00:00 PM

Wednesday, October 10, 2012

Fed's Beige Book: Economic activity "expanded modestly", Residential real estate showed "widespread improvement"

Reports from the twelve Federal Reserve Districts indicated that economic activity generally expanded modestly since the last report.And on real estate:

Consumer spending was generally reported to be flat to up slightly since the last report. A number of Districts characterized retail sales as expanding at a modest pace ...

Residential real estate showed widespread improvement since the last report. All twelve Districts reported that existing home sales strengthened, in some cases substantially. Selling prices were steady or rising. Boston, Atlanta, Minneapolis, Dallas and San Francisco noted declining or tight inventories, which have put upward pressure on prices. Modest price increases were reported in the New York, Richmond, Chicago, and Kansas City Districts. New York and Richmond reported relatively strong demand at the high and low ends of the market, whereas Philadelphia and Kansas City noted relative strength for mid-range homes; Boston indicated a shift in the mix toward lower or medium priced homes. New home construction and sales were more mixed but still mostly improved: increased construction and/or new home sales were reported in the Atlanta, Chicago, St. Louis, Kansas City, Dallas and San Francisco Districts. Multi-family construction, in particular, was described as robust in the Boston, New York, Atlanta, Chicago, and Dallas Districts. Residential rental markets continued to be characterized as strong, even in the New York and Atlanta Districts where rents increased somewhat less strongly than in recent months."Prepared at the Federal Reserve Bank of New York and based on information collected on or before September 28, 2012."

Commercial real estate markets were mixed since the last report. Office markets showed signs of softening in the northeastern Districts--Boston, New York and Philadelphia--with New York remarking on substantial new supply coming on the market in early 2013. In contrast, Atlanta, Minneapolis and San Francisco noted some improvement, while most other Districts reported stable or mixed market conditions. Industrial markets showed some strength in the New York, Philadelphia, Cleveland and Atlanta Districts, while conditions were described as sluggish in Richmond and mixed in St. Louis. Atlanta noted weakness in the market for retail space. Commercial construction activity was also mixed: Atlanta, Minneapolis and Kansas City reported some improvement in non-residential construction activity, while Richmond and Dallas noted that activity was sluggish.

More sluggish "modest" growth. And more positive comments on residential real estate ...

Further Discussion on Labor Force Participation Rate

by Calculated Risk on 10/10/2012 12:26:00 PM

On a Monday I wrote Understanding the Decline in the Participation Rate. Here are a few definitions - and a couple of graphs - that might help understand the issues.

Definitions from the BLS:

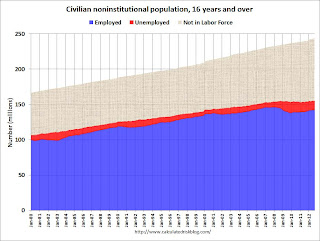

Civilian noninstitutional population: "consists of persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities and homes for the aged) and who are not on active duty in the Armed Forces". If you look at the first graph below, the total of the Blue, Red, and light brown areas is the Civilian noninstitutional population.

"The civilian labor force consists of all persons classified as employed or unemployed". This is Blue and Red combined on the first graph.

"The labor force participation rate represents the proportion of the civilian noninstitutional population that is in the labor force." So this is Blue and Red, divided by all areas combined.

"The employment-population ratio represents the proportion of the civilian noninstitutional population that is employed." This is Blue divided by the total area.

"The unemployment rate is the number of unemployed as a percent of the civilian labor force." This is Red divided by Red and Blue combined. This is the REAL unemployment rate (some claim U-6 is the "real rate", but that is nonsense - although U-6 is an alternative measure of underemployment, it includes many people working part time).

Click on graph for larger image.

Click on graph for larger image.

There are some bumps in the total area - usually when there is a decennial census. These are due to changes in population controls.

Note that the Blue area collapsed in 2008 and early 2009, and started increasing in 2010. This shows the increase in employment over the last few years. Over the last few years, the red area (unemployment) has been decreasing.

However the combined area, the civilian labor force, has not increased much - even though the civilian noninstitutional population has been increasing. Some people argue that this evidence of a large number of people who left the labor force because of the weak labor market - and that the actual unemployment rate should be much higher than 7.8%.

However, as I noted on Monday, some decrease in the labor force participation rate was expected, and it appears most of the decline in the participation rate can be explained by demographic shifts.

The second graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census.

The second graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census.

This graph shows two key shifts. First, baby boomers now moving into lower participation rate age groups (look at increase in the 55-to-59 and 60-to-64 groups from 2000 to 2010).

A second key demographic is the significant increase in people in the 15-to-19 and 20-to-24 age groups. These groups have lower participation rates usually because of school enrollment - and enrollment has been increasing.

Taken together, it is clear why the labor force hasn't increase as quickly as the civilian noninstitutional population, and therefore, why a decline in the labor force participation rate was expected.

BLS: Job Openings "essentially unchanged" in August, Up year-over-year

by Calculated Risk on 10/10/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

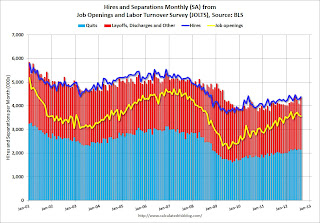

The number of job openings in August was 3.6 million, essentially unchanged from July.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in August was up from 2.4 million at the end of the recession in June 2009. ... The number of job openings in August (not seasonally adjusted) increased over the year for total nonfarm and total private, and was little changed for government.

...

In August, the quits rate was unchanged for total nonfarm, total private, and government. The number of quits was 2.1 million in August, up from 1.8 million at the end of the recession in June 2009. ... Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

Quits decreased slightly in August, and quits are up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

This suggests a gradually improving labor market.

MBA: Mortgage Purchase activity highest since June

by Calculated Risk on 10/10/2012 07:02:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

“Refinance applications declined somewhat last week although volume is still near three-year highs, and purchase applications increased to the highest level since June, with both conventional and government volumes increasing,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Rates on 30-year fixed-rate loans remain historically low, benefitting both prospective homebuyers and those seeking to refinance.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.56 percent from 3.53 percent, with points increasing to 0.39 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The 30 year contract rate increased for the first time after declining for six consecutive weeks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index is up about 7% over the last three weeks and is at the highest level since June.

However the purchase index has been mostly moving sideways over the last two years.

Tuesday, October 09, 2012

Wednesday: Beige Book, JOLTS

by Calculated Risk on 10/09/2012 09:11:00 PM

On Wednesday:

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect refinance activity to remain strong with low mortgage rates.

• At 10:00 AM, the Job Openings and Labor Turnover Survey (JOLTS) for August will be released by the BLS. The number of job openings has generally been trending up.

• Also at 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for August will be released. The consensus is for a 0.4% increase in inventories.

• At 2:00 PM, the Federal Reserve will release the "Beige Book". This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".