by Calculated Risk on 10/10/2012 10:00:00 AM

Wednesday, October 10, 2012

BLS: Job Openings "essentially unchanged" in August, Up year-over-year

From the BLS: Job Openings and Labor Turnover Summary

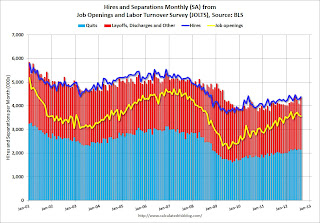

The number of job openings in August was 3.6 million, essentially unchanged from July.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in August was up from 2.4 million at the end of the recession in June 2009. ... The number of job openings in August (not seasonally adjusted) increased over the year for total nonfarm and total private, and was little changed for government.

...

In August, the quits rate was unchanged for total nonfarm, total private, and government. The number of quits was 2.1 million in August, up from 1.8 million at the end of the recession in June 2009. ... Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

Quits decreased slightly in August, and quits are up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

This suggests a gradually improving labor market.

MBA: Mortgage Purchase activity highest since June

by Calculated Risk on 10/10/2012 07:02:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

“Refinance applications declined somewhat last week although volume is still near three-year highs, and purchase applications increased to the highest level since June, with both conventional and government volumes increasing,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Rates on 30-year fixed-rate loans remain historically low, benefitting both prospective homebuyers and those seeking to refinance.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.56 percent from 3.53 percent, with points increasing to 0.39 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The 30 year contract rate increased for the first time after declining for six consecutive weeks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index is up about 7% over the last three weeks and is at the highest level since June.

However the purchase index has been mostly moving sideways over the last two years.

Tuesday, October 09, 2012

Wednesday: Beige Book, JOLTS

by Calculated Risk on 10/09/2012 09:11:00 PM

On Wednesday:

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect refinance activity to remain strong with low mortgage rates.

• At 10:00 AM, the Job Openings and Labor Turnover Survey (JOLTS) for August will be released by the BLS. The number of job openings has generally been trending up.

• Also at 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for August will be released. The consensus is for a 0.4% increase in inventories.

• At 2:00 PM, the Federal Reserve will release the "Beige Book". This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

Lawler: "Distressed" home sales shares in Reno, Vegas, and Phoenix

by Calculated Risk on 10/09/2012 04:32:00 PM

Economist Tom Lawler sent me the table below with a one word discussion: "Wow".

CR Note: We've been tracking several distressed areas across the country, and a couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up just about everywhere. For two of the cities below, short sales are three times foreclosures - and more than double in Phoenix. That is a huge change. A year ago, there were many more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year.

The three cities in the table below - Reno, Vegas, and Phoenix - were some of the hardest hit areas in the country. The decline in in distressed sales in Phoenix (from 64.1% in Sept 2011 to 39.9% in Sept 2012) is stunning. But we have to remember that 40% distressed is still extremely high.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

Las Vegas September Real Estate: Sales decline, Inventory down year-over-year

by Calculated Risk on 10/09/2012 12:49:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

From the GLVAR: GLVAR reports local home prices, short sales continuing to climb

According to GLVAR, the total number of local homes, condominiums and townhomes sold in September was 3,298. That’s down from 3,688 in August and down from 4,108 total sales in September 2011.A few key points:

...

GLVAR reported a total of 3,805 condos and townhomes listed for sale on its MLS at the end of September, down 0.7 percent from 3,830 condos and townhomes listed for sale on its MLS at the end of August and down 7.8 percent from one year ago.

The number of available homes listed for sale without any sort of pending or contingent offer also fell from the previous month and year. By the end of September, GLVAR reported 3,943 single-family homes listed without any sort of offer. That’s down 1.0 percent from 3,981 such homes listed in August and down 63.1 percent from one year ago.

...

Meanwhile, 44.8 percent of all existing local homes sold during September were short sales. That’s up from 43.7 percent in August, up from 23.5 percent one year ago, and the highest short sale percentage GLVAR has ever recorded.

Continuing a trend of declining foreclosure sales in recent months, bank-owned homes accounted for 13.6 percent of all existing home sales in September, down from 16.9 percent in August.

• Inventory declined slightly in September, and total inventory is down 7.8% from September 2011. However, for single family homes without contingent offers, inventory is still down sharply from a year ago (down 63.1% year-over-year).

• Short sales are more than triple foreclosures now. The GLVAR reported 44.8% of sales were short sales, and only 13.6% foreclosures. We've seen a shift from foreclosures to short sales in most areas (not just in areas with new foreclosure laws).

• The percent distressed sales was extremely high at 58.4% in September (short sales and foreclosures), but down from 60.6% in August.

• There is a push to complete short sales, from the article:

[H]omeowners have been rushing to short-sell their homes by the end of 2012, when the Mortgage Forgiveness Debt Relief Act is set to expire unless Congress acts to extend it. If Congress does not extend this law by Dec. 31, she said any amount of money a bank writes off in agreeing to sell a home as part of a short sale will become taxable when sellers file their income taxes.