by Calculated Risk on 10/03/2012 10:00:00 AM

Wednesday, October 03, 2012

ISM Non-Manufacturing Index increases in September

The September ISM Non-manufacturing index was at 55.1%, up from 53.7% in August. The employment index decreased in September to 51.1%, down from 53.8% in August. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: September 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in September for the 33rd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 55.1 percent in September, 1.4 percentage points higher than the 53.7 percent registered in August. This indicates continued growth this month at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 59.9 percent, which is 4.3 percentage points higher than the 55.6 percent reported in August, reflecting growth for the 38th consecutive month. The New Orders Index increased by 4 percentage points to 57.7 percent. The Employment Index decreased by 2.7 percentage points to 51.1 percent, indicating growth in employment for the second consecutive month but at a slower rate. The Prices Index increased 3.8 percentage points to 68.1 percent, indicating higher month-over-month prices when compared to August. According to the NMI™, 12 non-manufacturing industries reported growth in September. Respondents' comments continue to be mixed; however, the majority indicate a slightly more positive perspective on current business conditions."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.5% and indicates faster expansion in September than in August. The internals were mixed with the employment index down, but new orders up.

ADP: Private Employment increased 162,000 in September

by Calculated Risk on 10/03/2012 08:18:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 162,000 from August to September, on a seasonally adjusted basis. The estimated gains in previous months were revised lower: the July increase was reduced by 17,000 to an increase of 156,000, while the August increase was reduced by 12,000 to an increase of 189,000This was above the consensus forecast of an increase of 140,000 private sector jobs in September. The BLS reports on Friday, and the consensus is for an increase of 113,000 payroll jobs in September, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector expanded 144,000 in September, down from 175,000 in August.

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

MBA: Mortgage Refinance Applications increases sharply, Highest Since 2009

by Calculated Risk on 10/03/2012 07:01:00 AM

From the MBA: Mortgage Refinance Applications Highest Since 2009 as Rates Reach Record Lows in Latest MBA Weekly Survey

The Refinance Index increased 20 percent from the previous week. This was the highest Refinance Index recorded in the survey since April of 2009. The seasonally adjusted Purchase Index increased 4 percent from one week earlier.

“Refinance application volume jumped to the highest level in more than three years last week as each of the five mortgage rates in MBA's survey dropped to new record lows in the survey,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Financial markets continue to adjust to QE3, as the ongoing presence of the Federal Reserve as a significant buyer of mortgage-backed securities applies downward pressure on rates."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.53 percent from 3.63 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is at the highest level since 2009. Refinance activity has been generally moving up over the last year, and really took off last week.

The second graph shows the MBA mortgage purchase index. The purchase index is up 5% over the last two weeks.

The second graph shows the MBA mortgage purchase index. The purchase index is up 5% over the last two weeks.However the purchase index has been mostly moving sideways over the last two years.

Tuesday, October 02, 2012

Wednesday: Apartment Vacancy Rate, ISM Service Index, ADP Employment

by Calculated Risk on 10/02/2012 09:16:00 PM

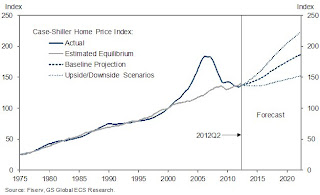

Goldman Sachs released a research note today on house prices: "House Price News Continues to Be Good". In the note, economists Hui Shan and Sven Jari Stehn provide some projections:

[W]e provide an upside and a downside scenario for house prices in addition to our baseline projection. ... We construct the upside and downside cases by incorporating both economic scenarios and modeling uncertainties. ... Although our methodology does not allow us to precisely estimate the probability of each constructed scenario, one can roughly consider the upside and downside as the one standard deviation above and below the baseline.

[Our] model now projects house price gains of 2.0% from mid-2012 to mid-2013, and 2.8% in the year thereafter (Exhibit 1). This baseline forecast is broadly in line with the latest consensus forecast. Exhibit 1 also shows our scenario analysis, pointing to house price appreciation of 9.1% (4.1% for 2012Q2-2013Q2 and 5.0% for 2013Q2-2014Q2) and -0.4% (-0.2% for 2012Q2-2013Q2 and -0.2% for 2013Q2-2014Q2) over the next two years, respectively, for the upside and downside alternative scenarios.

Click on graph for larger image.

Click on graph for larger image.Here is exhibit 1 from the research note showing Goldman's baseline forecast, and upside and downside scenarios.

On Wednesday:

• Early: Reis will release the Q3 2012 Apartment vacancy rates. Last quarter Reis reported that the apartment vacancy rate declined to 4.7% in Q2 from 4.9% in Q1 2012. This was the lowest vacancy rate since Q4 2001.

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Excerpt a surge in refinance activity with low mortgage rates.

• At 8:15 AM, the ADP Employment Report for September will be released. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

• At 10:00 AM, the ISM non-Manufacturing Index for September will be released. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Housing: Inventory down 21% year-over-year in early October

by Calculated Risk on 10/02/2012 07:25:00 PM

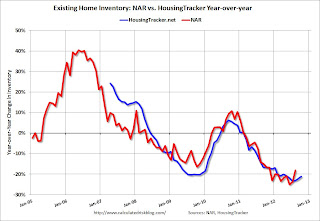

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 21.4% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through early October.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. Inventory only increased a little this spring and has been declining for the last five months by this measure. It looks like inventory peaked early this year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early October listings, for the 54 metro areas, declined 21.4% from the same period last year.

HousingTracker reported that the early October listings, for the 54 metro areas, declined 21.4% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already pretty low. I doubt we will see 20% year-over-year declines next summer!