by Calculated Risk on 9/29/2012 08:11:00 AM

Saturday, September 29, 2012

Summary for Week Ending Sept 28th

The economic data was mostly weak last week. Q2 GDP growth was revised down to 1.3% annualized (from an already anemic 1.7%), durable goods orders declined sharply (although mostly due to the volatile transportation sector), personal income barely increased in August, and the September Chicago PMI declined to the lowest level in 3 years.

There were a few positives: Even though new home sales were slightly below expectations, sales are still up solidly from last year. House prices, according to Case-Shiller, are now up 1.2% year-over-year. Mortgage delinquencies continued to decline. And initial weekly unemployment claims declined in the previous week.

This suggests the economy is still growing sluggishly.

Here is a summary of last week in graphs:

• New Home Sales at 373,000 SAAR in August

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 373 thousand. This was down slightly from a revised 374 thousand SAAR in July (revised up from 372 thousand). Sales in June were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was below expectations of 380,000, but this was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

"The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate."

"The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate."

This graph shows the three categories of inventory starting in 1973: Completed, under construction and not started.

The inventory of completed homes for sale was at a record low 38,000 units in August. The combined total of completed and under construction is at the lowest level since this series started.

• Case-Shiller: House Prices increased 1.2% year-over-year in July

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).

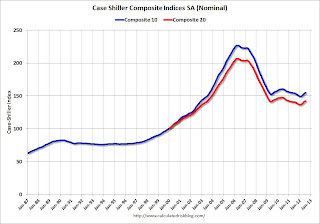

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and up 0.4% in July (SA). The Composite 10 is up 3.7% from the post bubble low set in March (SA).

The Composite 20 index is off 31.2% from the peak, and up 0.4% (SA) in July. The Composite 20 is up 4.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.6% compared to July 2011.

The Composite 20 SA is up 1.2% compared to July 2011. This was the second year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

This was at the consensus forecast and the recent change to a year-over-year increase is significant.

• Real House Prices, Price-to-Rent Ratio

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

This graph shows the Case-Shiller National index, Case-Shiller composite 20 and Corelogic indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the Case-Shiller National index, Case-Shiller composite 20 and Corelogic indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Here is a graph of the price-to-rent ratio using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a graph of the price-to-rent ratio using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Personal Income increased 0.1% in August, Spending increased 0.5%

The BEA released the Personal Income and Outlays report for August: "Personal income increased $15.0 billion, or 0.1 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.2 billion, or 0.5 percent."

The BEA released the Personal Income and Outlays report for August: "Personal income increased $15.0 billion, or 0.1 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.2 billion, or 0.5 percent."This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Using the two-month method, it appears real PCE will increase around 1.3% annualized in Q3 - another weak quarter for GDP growth (June PCE was weak, so maybe PCE will increase 1.6%).

A key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up only 1.6%. In August, core PCE increase at a 1.3% annualized rate.

• Regional Manufacturing Surveys mixed

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat From the Dallas Fed: Texas Manufacturing Growth Picks Up

From the Richmond Fed: Manufacturing Activity Ticked Up in September; New Orders Turned Positive

The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 1st, and these surveys suggest another weak reading close to 50.

• Weekly Initial Unemployment Claims decline to 359,000

And here is a long term graph of weekly claims:

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 374,000.

This was below the consensus forecast of 376,000.

Mostly moving sideways this year, but moving up recently.

• Consumer Sentiment in September at 78.3

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.This was below the consensus forecast of 79.0 and still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

• Other Economic Stories ...

• Chicago Fed: Economic Activity Weakened in August

• LPS: Mortgage delinquencies decreased in August

• Restaurant Performance Index increases in August

• DOT: Vehicle Miles Driven decreased 0.3% in July

• NAR: Pending home sales index declined 2.6% in August

Friday, September 28, 2012

Bank Failure #43 in 2012: First United Bank, Crete, Illinois

by Calculated Risk on 9/28/2012 07:13:00 PM

Green leaves shift from gold to red

As have balance sheets

by Soylent Green is People

From the FDIC: Old Plank Trail Community Bank, National Association, New Lenox, Illinois, Assumes All of the Deposits of First United Bank, Crete, Illinois

As of June 30, 2012, First United Bank had approximately $328.4 million in total assets and $316.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $48.6 million. ... First United Bank is the 43rd FDIC-insured institution to fail in the nation this year, and the seventh in Illinois.The FDIC has really slowed down!

Fannie Mae and Freddie Mac Serious Delinquency rates declined in August

by Calculated Risk on 9/28/2012 05:01:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in August to 3.44% from 3.50% July. The serious delinquency rate is down from 4.03% in August last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 3.36%, from 3.42% in July. Freddie's rate is down from 3.49% in August 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%. This is the lowest level for Freddie since August 2009.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates some progress, the "normal" serious delinquency rate is under 1% - and it looks like it will be several years until the rates back to normal.

Restaurant Performance Index increases in August

by Calculated Risk on 9/28/2012 12:55:00 PM

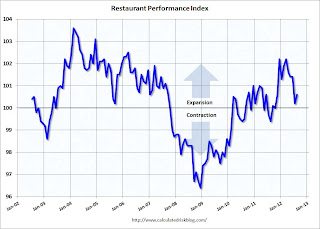

From the National Restaurant Association: Stronger Sales, Traffic Bolster Restaurant Performance Index in August

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.6 in August, up 0.4 percent from July and the first increase in five months. August represented the tenth consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Growth in the RPI was driven largely by improving same-store sales and customer traffic results in August,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Six out of 10 restaurant operators reported positive same-store sales in August, while customer traffic readings bounced back from July’s net decline.”

“In contrast, the Expectations Index remained dampened compared to recent stronger levels, with restaurant operators retaining a cautious outlook for sales growth and the economy in the months ahead,” Riehle added.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in August, up from 100.2 in July (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Misc: Chicago PMI declines, Consumer Sentiment in September at 78.3

by Calculated Risk on 9/28/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.

This was below the consensus forecast of 79.0 and still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

From the Chicago ISM:

The Chicago Purchasing Managers reported the Chicago Business Barometer fell to 49.7, its lowest level in three years.The Chicago PMI was well below the consensus forecast of 53.1.

• EMPLOYMENT: 2 1/2 year low; [declined to 52.0 from 57.1 in August]

• NEW ORDERS, ORDER BACKLOGS, and SUPPLIER DELIVERIES: 3 month moving averages lowest since mid 2009; [new orders declined to 47.4 from 54.8]

• PRICES PAID: third consecutive monthly gain