by Calculated Risk on 9/28/2012 05:01:00 PM

Friday, September 28, 2012

Fannie Mae and Freddie Mac Serious Delinquency rates declined in August

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in August to 3.44% from 3.50% July. The serious delinquency rate is down from 4.03% in August last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 3.36%, from 3.42% in July. Freddie's rate is down from 3.49% in August 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%. This is the lowest level for Freddie since August 2009.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates some progress, the "normal" serious delinquency rate is under 1% - and it looks like it will be several years until the rates back to normal.

Restaurant Performance Index increases in August

by Calculated Risk on 9/28/2012 12:55:00 PM

From the National Restaurant Association: Stronger Sales, Traffic Bolster Restaurant Performance Index in August

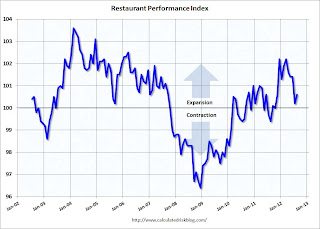

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.6 in August, up 0.4 percent from July and the first increase in five months. August represented the tenth consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Growth in the RPI was driven largely by improving same-store sales and customer traffic results in August,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Six out of 10 restaurant operators reported positive same-store sales in August, while customer traffic readings bounced back from July’s net decline.”

“In contrast, the Expectations Index remained dampened compared to recent stronger levels, with restaurant operators retaining a cautious outlook for sales growth and the economy in the months ahead,” Riehle added.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in August, up from 100.2 in July (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Misc: Chicago PMI declines, Consumer Sentiment in September at 78.3

by Calculated Risk on 9/28/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.

This was below the consensus forecast of 79.0 and still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

From the Chicago ISM:

The Chicago Purchasing Managers reported the Chicago Business Barometer fell to 49.7, its lowest level in three years.The Chicago PMI was well below the consensus forecast of 53.1.

• EMPLOYMENT: 2 1/2 year low; [declined to 52.0 from 57.1 in August]

• NEW ORDERS, ORDER BACKLOGS, and SUPPLIER DELIVERIES: 3 month moving averages lowest since mid 2009; [new orders declined to 47.4 from 54.8]

• PRICES PAID: third consecutive monthly gain

Personal Income increased 0.1% in August, Spending increased 0.5%

by Calculated Risk on 9/28/2012 08:45:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $15.0 billion, or 0.1 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.2 billion, or 0.5 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in August, compared with an increase of 0.4 percent in July. ... The price index for PCE increased 0.4 percent in August, compared with an increase of less than 0.1 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent in August, the same increase as in July.

...

Personal saving -- DPI less personal outlays -- was $444.8 billion in August, compared with $492.2 billion in July. Personal saving as a percentage of disposable personal income was 3.7 percent in August, compared with 4.1 percent in July

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Using the two-month method, it appears real PCE will increase around 1.3% annualized in Q3 - another weak quarter for GDP growth (June PCE was weak, so maybe PCE will increase 1.6%).

A key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up only 1.6%. In August, core PCE increase at a 1.3% annualized rate.

Thursday, September 27, 2012

Friday: Personal Income and Outlays, Consumer Sentiment, Chicago PMI

by Calculated Risk on 9/27/2012 08:50:00 PM

The beatings continue in Europe ...

From the NY Times: Despite Public Protests, Spain’s 2013 Budget Plan Includes More Austerity

The Spanish government on Thursday presented a draft budget for 2013 with a package of tax increases and spending cuts that it said would guarantee the country could meet deficit-cutting targets agreed to with the rest of the euro zone.And from the NY Times: Greece Agrees on New Package of Budget Cuts and Taxes

...

The 2013 budget plan released Thursday is meant to help carry out a sweeping long-term austerity package outlined by Mr. Rajoy in July, which is aimed at reducing the central government’s budget deficit by 65 billion euros, or $84 billion, over two and a half years.

The plan involves an average cut of almost 9 percent in the spending of each government ministry next year. The salaries of civil servants will be frozen for a third consecutive year.

The government of Prime Minister Antonis Samaras must now present the proposed actions — $15 billion in cuts to pensions, salaries and state spending, and at least $2.6 billion in new taxes — for further discussion with the foreign lenders, who have demanded them in return for releasing the next portion of aid to the stricken country.On Friday:

...

The government did not release specifics of the agreement, though it is said to call for a rise in the retirement age to 67 from 65.

• At 8:30 AM ET, the Personal Income and Outlays report for August will be released. The consensus is for a 0.2% increase in personal income in August, and for 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

This will give us two months of data (July and August) to estimate consumer spending in Q3.

• At 9:45 AM, the Chicago Purchasing Managers Index for September. The consensus is for an increase to 53.1, up from 53.0 in August.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 79.0, down from the preliminary September reading of 79.2, and up from the August reading of 74.3.

A final question for the September economic prediction contest: