by Calculated Risk on 9/25/2012 04:06:00 PM

Tuesday, September 25, 2012

Misc: Richmod Fed Mfg Survey Improves, Consumer Confidence increases

Catching up on a few earlier releases ...

• From the Richmond Fed: Manufacturing Activity Ticked Up in September; New Orders Turned Positive

In September, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained thirteen points to 4 from August's reading of −9. Among the index's components, shipments rose eight points to 9, new orders picked up twenty-seven points to end at 7, and the jobs index held steady at −5.This expansion followed three months of contraction in this index and was better than expected.

• From the Conference Board: Consumer Confidence Index® Increases in September. Index Improves Nine Points

The Conference Board Consumer Confidence Index®, which had declined in August, improved in September. The Index now stands at 70.3 (1985=100), up from 61.3 in August.This was above expectations.

• From the FHFA: FHFA House Price Index Up 0.2 Percent in July

U.S. house prices rose 0.2 percent on a seasonally adjusted basis from June to July, according to the Federal Housing Finance Agency’s monthly House Price Index. ... For the 12 months ending in July, U.S. prices rose 3.7 percent.Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio

Philly Fed: State Coincident Indexes in August show weakness

by Calculated Risk on 9/25/2012 02:00:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2012. In the past month, the indexes increased in 25 states, decreased in 12 states, and remained stable in 13 states, for a one-month diffusion index of 26. Over the past three months, the indexes increased in 28 states, decreased in 16 states, and remained stable in six states, for a three-month diffusion index of 24.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

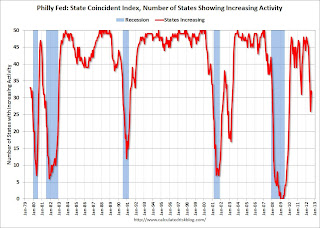

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In August, 32 states had increasing activity, up from 26 in July. The last four months have been weak following eight months of widespread growth geographically.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. And the map was all green just earlier this year.

Now there are a number of red states again.

Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio

House Price Comments, Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 9/25/2012 11:08:00 AM

Case-Shiller reported the second consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in July suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

On a Not Seasonally Adjusted (NSA) basis, the Case-Shiller 10-City composite is up 7.4% from the post-bubble low earlier this year, and the 20-City is up 7.8% from the post-bubble low. That is a significant increase, and even when NSA prices start to decline month-over-month in the September or October reports, I expect that house prices will remain above the recent low.

On a seasonally adjusted (SA) basis, prices are up 3.7% and 4.0% from the March lows for the 10-city and 20-city composite indexes.

However, no one should expect the strong price increases to continue. The Case-Shiller Composite 20 index NSA was up 1.6% from June to July. However a large portion of that increase was seasonal. On a Seasonally Adjusted (SA) basis, the Composite 20 index was up 0.4%. That is a 5% annualized rate - and that will probably not continue. I suspect much of the increase over the last few months was a "bounce off the bottom" and prices increases over the next year or two will probably be more gradual.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to July 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

Case-Shiller: House Prices increased 1.2% year-over-year in July

by Calculated Risk on 9/25/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Increase Again in July 2012 According to the S&P/Case-Shiller Home Price Indices

Data through July 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed average home prices increased by 1.5% for the 10-City Composite and by 1.6% for the 20-City Composite in July versus June 2012. For the third consecutive month, all 20 cities and both Composites recorded positive monthly changes. It would have been a fourth had prices not fallen by 0.6% in Detroit back in April.

The 10- and 20-City Composites posted annual returns of +0.6% and +1.2% in July 2012, up from their unchanged and +0.6% annual rates posted for June 2012. Fifteen of the 20 MSAs and both Composites posted better annual returns in July as compared to June 2012.

...

“Home prices increased again in July,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “All 20 cities and both Composites were up on the month for the third time in a row. Even better, 16 of the 20 cities and both Composites rose over the last year. Atlanta remains the weakest city but managed to cut the annual loss to just under 10%.

“Among the cities, Miami and Phoenix are both well off their bottoms with positive monthly gains since the end of 2011. Many of the markets we follow have seen some decent recovery from their respective lows – San Francisco up 20.4%, Detroit up 19.7%, Phoenix up 17.0% and Minneapolis up 16.5%, to name the top few. These were some of the markets that were hit the hardest when the housing bubble burst in 2006.

Click on graph for larger image.

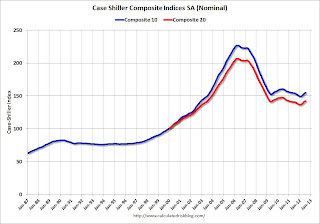

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and up 0.4% in July (SA). The Composite 10 is up 3.7% from the post bubble low set in March (SA).

The Composite 20 index is off 31.2% from the peak, and up 0.4% (SA) in July. The Composite 20 is up 4.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.6% compared to July 2011.

The Composite 20 SA is up 1.2% compared to July 2011. This was the second year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 5.9% from the peak. Note that the red column (cumulative decline through July 2012) is above previous declines for all cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 5.9% from the peak. Note that the red column (cumulative decline through July 2012) is above previous declines for all cities.This was at the consensus forecast and the recent change to a year-over-year increase is significant. I'll have more on prices later.

Monday, September 24, 2012

Tuesday: House Prices

by Calculated Risk on 9/24/2012 09:27:00 PM

On Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for July will be released. The consensus is for a 1.2% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 1.6% year-over-year, and for prices to increase 1.0% month-to-month seasonally adjusted.

• At 10:00 AM, the FHFA House Price Index for July 2012 will be released. The consensus is for a 0.8% increase in house prices.

• Also at 10:00 AM, the Conference Board's consumer confidence index for September will be released. The consensus is for an increase to 64.8 from 60.6 last month.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for September will be released. The consensus is for an increase to -4 for this survey from -9 in August (below zero is contraction).

A question for the September economic prediction contest: