by Calculated Risk on 9/17/2012 02:55:00 PM

Monday, September 17, 2012

LA area Port Traffic: Imports and Exports down YoY in August

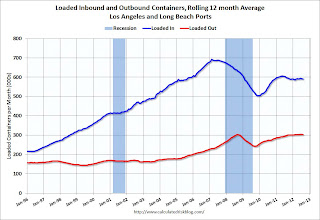

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in July.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of August, loaded outbound traffic was down 4% compared to August 2011, and loaded inbound traffic was down 1% compared to August 2011.

For the month of August, loaded outbound traffic was down 4% compared to August 2011, and loaded inbound traffic was down 1% compared to August 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase over the next couple of months, but probably not by much.

This suggests trade with Asia might be down slightly in August.

FNC: Residential Property Values increased 0.8% in July

by Calculated Risk on 9/17/2012 11:38:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and other house price indexes.

FNC released their July index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.8% in July compared to June (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.8% and 0.9% in July. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since this index is NSA, the month-to-month changes will probably turn negative later this year. However this is the first month-to-month increase for the month of July since 2006.

The year-over-year trends continued to show improvement in July, with the 100-MSA composite up 0.6% compared to July 2011. This is the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through July 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Some of the month-to-month gain is seasonal since this index is NSA. The key is the indexes are now showing a year-over-year increase in July.

The July Case-Shiller index will be released next week on Tuesday, September 25th.

NY Fed Empire State Mfg Index declines in September

by Calculated Risk on 9/17/2012 08:41:00 AM

From MarketWatch: Empire State index hits nearly two-year low

The Empire State index decreased to negative 10.4 in September from negative 5.9 in August, according to the manufacturing survey released by the New York Federal Reserve. It is the lowest reading since November 2010.The number of employees fell from 16.47 in August to 4.3 in September. This was significantly below expectations of a reading of minus 2.0.

The new-orders index worsened to negative 14.0 in September from negative 5.5 in August.

One bright spot in the report was an increase in a key barometer of future activity that asks manufacturers about expectations six months ahead. The forward-looking index rose to 27.2 in September from 15.2 in August.

The index of the number of employees fell sharply in September but remained slightly above negative territory at 4.3.

Manufacturing remains a weak spot for the US economy.

Sunday, September 16, 2012

Sunday Night Futures

by Calculated Risk on 9/16/2012 09:55:00 PM

This could slow down the QE3 mortgage transmission mechanism, from the Financial Times: QE3 hit by mortgage processing delays

“In the very near term [QE3] has virtually no transfer mechanism whatsoever to the customer,” said one executive at a leading lender, who requested anonymity. “Originators are massively backlogged in terms of origination volumes.”The Asian markets are mixed tonight, with the Shanghai down 0.3% and the Hang Seng up 0.3%.

Excerpt with permission

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down almost 5 points, and the DOW futures down 32 points.

Oil prices are moving up WTI futures are at $99.00 and Brent is at $117.44 per barrel.

On Monday:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for September. The consensus is for a reading of minus 2.0, up from minus 5.8 in August (below zero is contraction).

Yesterday:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Three more questions this week for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

QE3 and the Residential Investment Transmission Mechanism

by Calculated Risk on 9/16/2012 01:29:00 PM

From Paul Krugman: How Could QE Work?

[A]t this point it’s not at all clear that we have an overhang of excess housing capacity; we might even have a shortfall.This is similar to the argument I made last weekend:

And we’re seeing a modest housing recovery starting ...

...

This means that we actually can hope that the Fed’s new policy will boost housing as well as operating through other channels, and therefore that it can act more like conventional monetary policy in fostering recovery.

That said, I’m still skeptical about whether monetary policy alone can come close to doing enough — a skepticism shared by Ben Bernanke:

So looking at all the different channels of effect, we think it does have impact on the economy, it will have impact on the labor market but as again, the way I would describe it is a meaningful effect, a significant effect but not a panacea, not a solution for the whole issue.We still need fiscal policy. But it’s good to see the Fed doing more.

[O]ne of the key transmission channels for monetary policy is through residential investment and mortgages. The previous rounds of QE (and "twist") have lowered mortgage rates and allowed homeowners with excellent credit and income to refinance. However this channel has been limited ...Note: Krugman's comment on "overhang of excess housing" is very important. Although there isn't good timely data on household formation and the housing stock, I do think most of the excess supply has been absorbed.

As residential investment recovers, and house prices increase (or at least stabilize), this channel will probably become more effective.

Last month I summarized some of The economic impact of a slight increase in house prices. This includes mortgage lenders and appraisers becoming more confident in the mortgage and housing markets. I think that is starting to happen, and I think QE might have more traction now through the housing channel.

For another view on QE3, see Jim Hamilton's: Effects of QE3

I think the correct interpretation of QE3 is that the Fed has unambiguously signaled that it's not going to re-run the Japanese experiment to see what happens when the central bank stands by and watches wages and prices fall even while unemployment remains very high. The Fed can and will keep U.S. inflation from falling much below 2%, and that may help a little. Investors should expect that, and not a whole lot more.And for those who think commodity prices will soar, I suggest Michael Pettis' analysis of supply and demand: By 2015 hard commodity prices will have collapsed

Yesterday:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th