by Calculated Risk on 9/13/2012 08:49:00 PM

Thursday, September 13, 2012

Friday: Retail Sales, Industrial Production, CPI

First, Tom Lawler has been discussing the rental demand for single family homes. He sent me this article today: Phoenix-area rental homes a red-hot commodity

In the Valley’s most popular communities, desperate renters are submitting applications for multiple single-family homes to secure a place to live. ... The unprecedented demand for rentals is fueled by former homeowners whose houses were foreclosed on or sold in short sales and now need a place to live. Some of them can no longer qualify to buy a home. For others, the housing bubble sullied the aura of owning a home.On Friday:

With the trend showing no sign of slowing, more investors than ever are buying homes to rent. Popular areas such as central and north Phoenix, south Scottsdale, Glendale, central Tempe, Chandler and Gilbert are hot spots for rentals.

Multiple indicators show demand for rentals has never been higher:

More rental contracts were signed in June and July than in any other months in the past decade, according to the Arizona Regional Multiple Listing Service.

The percentage of single-family homes purchased to be rented out hit a record 32 percent in July, more than triple the typical rate, said Mike Orr, a real-estate analyst at Arizona State University.

In July, the average rental home was empty for only 38 days, tied for the shortest period in 12 years, Orr said.

The vacancy rate for big apartment complexes recently hit an almost six-year low as of June 30, according to commercial broker Marcus & Millichap.

“It’s a crazy rental market right now,” said Liza Asbury of Realty One Group. “There are multiple offers for properties. If it (the home) is nice, it is definitely going fast.”

• At 8:30 AM ET, the Consumer Price Index for August will be released. The consensus is for CPI to increase 0.6% in August and for core CPI to increase 0.2%.

• Also at 8:30 AM, Retail Sales for August will be released. The consensus is for retail sales to increase 0.8% in August, and for retail sales ex-autos to increase 0.7%.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is that Industrial Production declined 0.1% in August, and that Capacity Utilization declined to 79.2%.

• At 9:55 AM, the Reuters/University of Michigan's Consumer sentiment index will be released (preliminary for September). The consensus is for sentiment to decrease to 74.0 from 73.5 in August.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales report for July (Business inventories) will be released. The consensus is for 0.5% increase in inventories.

Two more questions for the September economic prediction contest:

Analysis: Bernanke Delivered

by Calculated Risk on 9/13/2012 04:45:00 PM

The FOMC delivered everything I expected - and more. This was a very strong move and I suspect many analysts are underestimating the potential positive impact on the economy.

However, as Fed Chairman said, monetary policy is "not a panacea". I do think this will help, but this will not solve the unemployment problem.

Here are a few key points:

• Forward guidance is a critical part of Fed policy (see Michael Woodford's paper presented at Jackson Hole). The FOMC didn't go as far as targeting nominal GDP, but they took two key steps today: 1) they extended the forward guidance until mid-2015, and 2) the FOMC made it clear that "a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens". "AFTER the economic recovery strengthens" is key.

• This easing was not based on new economic weakness. From the FOMC statement: "economic activity has continued to expand at a moderate pace in recent months". This easing was intended to help increase the pace of recovery.

• Another key change was the FOMC tied this easing directly to the labor market: "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability."

• I think this will be more effective than most analysts expect. As I noted last weekend, housing is usually a key transmission channel for monetary policy, and now that residential investment has started to recover - and house price have stabilized, or even started to increase, this channel will probably become more effective.

I also liked that Bernanke addressed three concerns that have been raised about monetary policy. Note: The replay of the press conference is available here.

The first "concern" was that some people are confusing fiscal and monetary policy. Monetary policy is NOT spending (see Bernanke's comments at 7:00).

The other two are legitimate concerns - that the Fed policies can hurt savers, and that there is a risk of inflation down the road. I agree with Bernanke that a stronger economy will lead to better returns for savers, and that inflation is not an immediate concern.

FOMC Projections and Bernanke Press Conference

by Calculated Risk on 9/13/2012 02:00:00 PM

Here are the updated projections from the FOMC meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Live Video streaming by Ustream

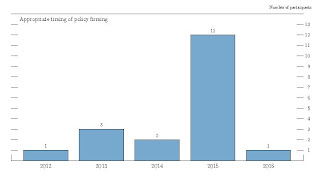

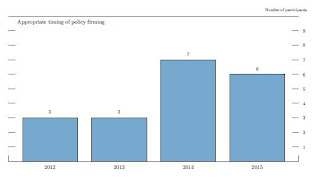

Below are the updated projections starting with when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate. I've included the chart from the June meeting to show the change.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

There was a clear shift to 2015.

Another key is very few participants think the FOMC should raise rates before 2015.

Most participants still think the Fed Funds rate will be in the current range through 2014.

The four tables below show the FOMC Sept meeting projections, and the June projections to show the change.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

GDP projections have been revised down for 2012, and revised up for 2013 and 2014.

The unemployment rate was at 8.1% in August, and the projection for 2012 is unchanged. The projection for 2014 was revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

The forecasts for overall and core inflation show the FOMC is still not concerned about inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.8 | 1.6 to 2.0 | 1.6 to 2.0 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.9 | 1.7 to 2.0 | 1.8 to 2.0 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

by Calculated Risk on 9/13/2012 12:33:00 PM

Information received since the Federal Open Market Committee met in August suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has continued to advance, but growth in business fixed investment appears to have slowed. The housing sector has shown some further signs of improvement, albeit from a depressed level. Inflation has been subdued, although the prices of some key commodities have increased recently. Longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed additional asset purchases and preferred to omit the description of the time period over which exceptionally low levels for the federal funds rate are likely to be warranted.

Weekly Initial Unemployment Claims increase to 382,000

by Calculated Risk on 9/13/2012 08:30:00 AM

The DOL reports:

In the week ending September 8, the advance figure for seasonally adjusted initial claims was 382,000, an increase of 15,000 from the previous week's revised figure of 367,000. The 4-week moving average was 375,000, an increase of 3,250 from the previous week's revised average of 371,750The previous week was revised up from 365,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

This was above the consensus forecast of 370,000.

Update via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

And here is a long term graph of weekly claims:

Mostly moving sideways this year.