by Calculated Risk on 9/13/2012 02:00:00 PM

Thursday, September 13, 2012

FOMC Projections and Bernanke Press Conference

Here are the updated projections from the FOMC meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Live Video streaming by Ustream

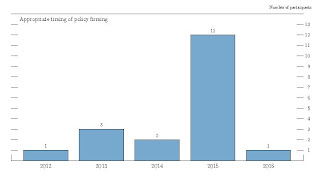

Below are the updated projections starting with when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate. I've included the chart from the June meeting to show the change.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

There was a clear shift to 2015.

Another key is very few participants think the FOMC should raise rates before 2015.

Most participants still think the Fed Funds rate will be in the current range through 2014.

The four tables below show the FOMC Sept meeting projections, and the June projections to show the change.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

GDP projections have been revised down for 2012, and revised up for 2013 and 2014.

The unemployment rate was at 8.1% in August, and the projection for 2012 is unchanged. The projection for 2014 was revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

The forecasts for overall and core inflation show the FOMC is still not concerned about inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.8 | 1.6 to 2.0 | 1.6 to 2.0 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.9 | 1.7 to 2.0 | 1.8 to 2.0 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

by Calculated Risk on 9/13/2012 12:33:00 PM

Information received since the Federal Open Market Committee met in August suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has continued to advance, but growth in business fixed investment appears to have slowed. The housing sector has shown some further signs of improvement, albeit from a depressed level. Inflation has been subdued, although the prices of some key commodities have increased recently. Longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed additional asset purchases and preferred to omit the description of the time period over which exceptionally low levels for the federal funds rate are likely to be warranted.

Weekly Initial Unemployment Claims increase to 382,000

by Calculated Risk on 9/13/2012 08:30:00 AM

The DOL reports:

In the week ending September 8, the advance figure for seasonally adjusted initial claims was 382,000, an increase of 15,000 from the previous week's revised figure of 367,000. The 4-week moving average was 375,000, an increase of 3,250 from the previous week's revised average of 371,750The previous week was revised up from 365,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

This was above the consensus forecast of 370,000.

Update via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

And here is a long term graph of weekly claims:

Mostly moving sideways this year.

Wednesday, September 12, 2012

Thursday: FOMC Meeting, Unemployment Claims

by Calculated Risk on 9/12/2012 09:47:00 PM

From Tim Duy at EconomistsView: The Wait Should be Finally Over

With respect to the meeting tomorrow, I agree with Robin Harding at the FT on this point:From Jon Hilsenrath at the WSJ: Four Things to Watch at Fed Meeting. Some excerpts:

For me, the question of what the Fed will do is far less interesting – and far less in doubt – than how the Fed will do it. This will not be a pro forma repeat of previous actions. As Mr Bernanke’s speech shows, the Fed is trying to address grave concerns about the labour market. The crucial issue is whether and how they tie any action to the state of the economy.I don't anticipate a lump sum QE announcement. I anticipate an open-ended commitment to regular purchases of securities, Treasuries and/or MBS, that can be scaled up or down in response to the economy. Wall Street may be initially disappointed by the lack of a big number, but over time I think markets will come to appreciate the greater impact offered by a regular commitment based upon economic outcomes rather than the arbitrary amounts and time lines of previous QE efforts.

As Harding says, how they tie the policy to the economy is key.

–QE STRATEGY: Many investors expect the Federal Reserve to launch a new round of bond purchases, often called quantitative easing or QE. One big question is how the Fed would structure such a program.On Thursday:

...

–WHAT TO DO WITH TWIST: Officials must decide what to do about the “Operation Twist” program if they launch a new bond-buying program. The Fed is funding the Twist purchases with money it gets by selling short-term Treasury securities.

...

–COMMUNICATION: How the Fed describes its impetus for action, and its criteria for even more in the future, could matter a lot. Is it responding to a darkening outlook? Or has it decided to take more aggressive action because its patience with slow growth and high unemployment is running out and it has a new commitment to changing that?

...

–WHETHER TO LOWER ANOTHER RATE: The Fed now pays banks 0.25% interest on reserves they keep with the central bank. The Fed could reduce the rate it pays on reserves that aren’t required of banks (known as excess reserves) a little bit to try to give banks more impetus to lend.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 365 thousand.

• Also at 8:30 AM, the Producer Price Index for August will be released. The consensus is for a 1.4% increase in producer prices (0.2% increase in core).

• At 12:30 PM, the FOMC Meeting Announcement will be released. Additional policy accommodation is very likely. The FOMC might lengthen their forward guidance for the first rate hike to mid-2015 or later, and / or also launch an open ended Large Scale Asset Purchases(LSAP) program (commonly called QE3).

• At 2:00 PM, The FOMC Forecasts will be released. These include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections. Earlier I posted a preview with the June projections for reference.

• At 2:15 PM: Fed Chairman Ben Bernanke will hold a press briefing and discuss the FOMC policy decisions.

.

FOMC Projections Preview

by Calculated Risk on 9/12/2012 07:01:00 PM

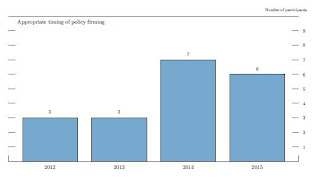

There is plenty of discussion about QE3 (will they or won't they), but another key piece of information released tomorrow is the projections of the FOMC participants. In advance of the meeting I thought I'd take a look back at the previous projections from the June meeting.

The first chart is when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate.

The key is to see if this shifts further to the right with more participants thinking the first rate increase will happen in 2015 or beyond. Many analysts expect that the FOMC will push out their forward guidance to 2015 (from 2014), and that suggests many more participants will view 2015 or beyond as appropriate.

This graph will probably be extended to 2015, and once again many participants will probably think the Fed Funds rate will be in the current range into 2015.

On the projections, GDP will probably be revised down again for 2012.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

GDP grew at a 1.8% annualized rate in the first half of 2012, and would have to increase at a 2.0% to 3.0% rate in the 2nd half to reach the previous range of projections.

The unemployment rate was at 8.1% in August. This is still in the June projection range, and the key will be to watch the projections for 2013 and 2014. Fed Chairman Ben Bernanke called unemployment a "grave concern" in his recent Jackson Hole speech.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

Overall PCE inflation has been on a 1.3% annualized pace this year through July (although this will probably increase with the increase in oil prices), and core PCE has been increasing at a 1.8% annualized pace. The core PCE rate has slowed further over the last few months. Right now inflation is tracking near the bottom of the previous FOMC projections.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

Here was the key sentence from the most recent FOMC minutes: "Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery."

There is nothing in the recent data pointing to a "substantial and sustainable strengthening in the pace of the economic recovery". So I expect QE3 to be announced tomorrow.