by Calculated Risk on 9/12/2012 02:59:00 PM

Wednesday, September 12, 2012

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in August

CR Note: Yesterday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). There has been a clear shift to fewer distressed sales in Sacramento.

Economist Tom Lawler has been digging up similar data, and he sent me the following table today for several more distressed areas. For all of these areas the share of distressed sales is down from August 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis) and the share of foreclosure sales are down - and down significantly in some areas.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Aug | 11-Aug | 12-Aug | 11-Aug | 12-Aug | 11-Aug | |

| Las Vegas | 43.7% | 21.7% | 16.9% | 50.2% | 60.6% | 71.9% |

| Reno | 38.0% | 30.0% | 13.0% | 31.0% | 51.0% | 61.0% |

| Phoenix | 29.4% | 25.2% | 14.0% | 41.5% | 43.4% | 66.7% |

| Sacramento | 35.4% | 23.6% | 16.6% | 38.4% | 52.0% | 62.0% |

| Minneapolis | 10.8% | 11.6% | 26.0% | 33.4% | 36.8% | 45.0% |

| Mid-Atlantic (MRIS) | 11.8% | 11.2% | 8.7% | 14.7% | 20.6% | 25.9% |

| Hampton Roads VA | 24.4% | 29.3% | ||||

| Charlotte | 13.6% | 19.0% | ||||

| Memphis | 28.7% | 31.5% | ||||

| Birmingham AL | 27.8% | 30.3% | ||||

Shiller on House Prices

by Calculated Risk on 9/12/2012 12:39:00 PM

An interview with Professor Robert Shiller on NPR: The Housing Market: Have We Finally Hit Bottom? A brief excerpt:

Neil Conan, Host, NPR: And in the spring you were on the fence as those first reports came in giving three months of generally positive data. Do you think we're coming off the bottom?Robert Shiller makes a few key points:

Robert Shiller, economist, Yale University: Well, we definitely have positive data. The question is how strong is it, and will this fizzle - this rally fizzle or not? And I don't know the answer to that. But I point out that this is the fourth time we've had a rally since the crisis ended. It's coming in the summertime, right? Well, that's the normal time of strength in the market.

So if you look at the data, it doesn't jump out at you that we've reached the turning point. Now, we may have, but I think that seasonality seems to be getting stronger, and that's another contender.

CONAN: So how long do you think you would want to wait before you saw enough numbers to make a decision?

SHILLER: Well, I used to forecast home prices, and I thought a year - once you have a year - this is what I used to think, and whether it's still true, but ... But once you have a year of solid price increases, you are probably off to the races for some years. So yeah, but we're not into it that long yet.

CONAN: And there's other factors, because of all those foreclosures, because of all those mortgages underwater, a lot of people fear that there's a big backlog of housing stock that you're going to have to work through before you can start going again.

SHILLER: Right, there's a lot of people who are thinking, you know, if the prices would just come up a little bit, I'd sell.

• There is a seasonal pattern for house prices, and the seasonality has been much stronger in recent years. The reason is foreclosures and short sales happen all year, but there is a seasonal pattern for conventional sales. So distressed sales push down prices more than normal in the winter. Some of the recent increase in house prices was due to seasonal factors, and - as I noted last month - we should expect the NSA indexes to show month-over-month declines later this year. But the key will be to watch the year-over-year change.

• I've argued before that we will not really know if house prices have bottomed until at least a year after it happens (I think prices bottomed early this year). Robert Shiller makes the same argument: "once you have a year of solid price increases, you are probably off to the races for some years". I don't think prices will be "off to the races" because ...

• As Shiller notes, there are probably quite a few people waiting for a better market and somewhat higher prices: "there's a lot of people who are thinking, you know, if the prices would just come up a little bit, I'd sell". That is one reason why prices will probably not be "off to the races". Also there are still quite a few distressed sales in the pipeline - and that will keep prices from rising quickly.

Here is the radio interview:

CoreLogic: Negative Equity Decreases in Q2 2012

by Calculated Risk on 9/12/2012 09:31:00 AM

From CoreLogic: CORELOGIC® Reports Number of Residential Properties in Negative Equity Decreases Again in Second Quarter of 2012

CoreLogic ... today released new analysis showing that 10.8 million, or 22.3 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2012. This is down from 11.4 million properties, or 23.7 percent, at the end of the first quarter of 2012. An additional 2.3 million borrowers possessed less than 5 percent equity in their home, referred to as near-negative equity, at the end of the second quarter. Approximately 600,000 borrowers reached a state of positive equity at the end of the second quarter of 2012, adding to the more than 700,000 borrowers that moved into positive equity in the first quarter of this year.

Together, negative equity and near-negative equity mortgages accounted for 27.0 percent of all residential properties with a mortgage nationwide in the second quarter, down from 28.5 percent at the end of the first quarter in 2012. Nationally, negative equity decreased from $691 billion at the end of the first quarter in 2012 to $689 billion at the end of the second quarter, a decrease of $2 billion driven in large part by an improvement in house price levels.

“The level of negative equity continues to improve with more than 1.3 million housholds regaining a positive equity position since the beginning of the year,” said Mark Fleming, chief economist for CoreLogic. “Surging home prices this spring and summer, lower levels of inventory, and declining REO sale shares are all contributing to the nascent housing recovery and declining negative equity.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 59 percent, followed by Florida (43 percent), Arizona (40 percent), Georgia (36 percent) and Michigan (33 percent). These top five states combined account for 34.1 percent of the total amount of negative equity in the U.S."

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.More from CoreLogic: "As of Q2 2012, there were 1.8 million borrowers who were only 5 percent underwater. If home prices continue increasing over the next year, these borrowers could move out of a negative equity position."

This is some improvement, but there are still 10.8 million residential properties with negative equity.

MBA: Mortgage Applications increase, might be distorted by Holiday adjustment

by Calculated Risk on 9/12/2012 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The adjusted Refinance Index increased 12 percent from the previous week. The seasonally adjusted Purchase Index increased 8 percent from one week earlier.

The holiday adjusted numbers may overstate the level of refinance applications because some lenders who rely primarily on the internet/consumer direct channel for originations saw little if any decline in applications for Labor Day as compared with the drops for lenders relying on retail offices, perhaps because borrowers had additional time over the Labor Day weekend to complete online refinance applications.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.75 percent from 3.78 percent, with points increasing to 0.44 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

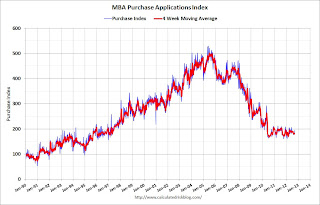

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years.

Wednesday: iPhone 5

by Calculated Risk on 9/12/2012 12:01:00 AM

On QE3 from Binyman Appelbaum at the NY Times: Economic Stimulus as the Election Nears? It’s Been Done Before

In September 1992, the Federal Reserve culminated a long-running effort to stimulate the sluggish economy by cutting its benchmark interest rate to 3 percent, the lowest level it had reached in almost three decades.Monetary policy impacts the economy with a lag, and it is too late to have an impact before the election - so politics shouldn't be a consideration.

The cut was avidly sought by the administration of President George H. W. Bush, but it was not enough to change the course of the presidential election. Years later, Mr. Bush told an interviewer that the Fed’s chairman, Alan Greenspan, had cost him a second term by failing to act more quickly and more forcefully.

...

Experts say Fed officials are sensitive to the danger of a political reaction. But Randall S. Kroszner, a Fed governor from 2006 to 2009, said the Fed’s current chairman, Ben S. Bernanke, has concluded that the best defense of the Fed’s independence is to demonstrate its value by reaching decisions on the economic merits, then offering clear explanations to politicians and the public. “Any decision the Fed will make will make someone unhappy, but what you want out of an independent agency is a careful deliberative process,” said Mr. Kroszner, a professor of economics at the University of Chicago Booth School of Business.

“Providing as much substantive economic explanation as possible for the actions that the Fed is taking, that’s the best way to maintain the Fed’s independence,” he added.

The iPhone 5 is almost an economic event, from the WSJ: Expectancy Builds Up For Apple's New iPhone

The next iPhone, which has been referred to internally by the code name N41, has been in the works for more than a year, a person familiar with the matter said. Apple is expected to tweak the smartphone's shape with a slightly larger screen and a different shell, and it will work with wireless carriers' fastest LTE networks and run new mobile software. That software, iOS 6, includes improvements to voice-activated assistant Siri, a new digital-coupon-and-passes service called Passbook, and new call-blocking features, among several others.On Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, Import and Export Prices for August will be released. The consensus is a for a 1.5% increase in import prices.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.4% increase in inventories.