by Calculated Risk on 9/11/2012 02:12:00 PM

Tuesday, September 11, 2012

QE Timeline Update

By request, here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• August 31, 2012: Fed Chairman Ben Bernanke hints at QE3: Analysis: Bernanke Clears the way for QE3 in September

This graph show the S&P 500 and the Fed actions. Click on graph for larger image.

Las Vegas August Real Estate: Sales decline, Inventory down sharply year-over-year

by Calculated Risk on 9/11/2012 12:34:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

From the GLVAR: GLVAR August 2012 Housing Statistics

According to GLVAR, the total number of local homes, condominiums and townhomes sold in August was 3,688. That’s up from 3,572 in July but down from the near-record 4,693 total sales in August 2011.A few key points:

...

For the second straight month, the total number of homes listed for sale on GLVAR’s Multiple Listing Service bounced back a bit, with a total of 17,047 single-family homes listed for sale at the end of the month. That’s up 0.6 percent from 16,944 single-family homes listed for sale at the end of July, but still down 23.9 percent from one year ago.

[T]he number of available homes listed for sale without any sort of pending or contingent offer fell from the previous month and year. By the end of August, GLVAR reported 3,981 single-family homes listed without any sort of offer. That’s down 7.3 percent from 4,293 such homes listed in July and down 64.4 percent from one year ago.

...

Meanwhile, 43.7 percent of all existing local homes sold during August were short sales. That’s up from 40 percent in July and the highest short sale percentage GLVAR has ever recorded.

Continuing a trend of declining foreclosure sales in recent months, bank-owned homes accounted for 16.9 percent of all existing home sales in August, down from 20.7 percent in July.

• Even with the slight increase in inventory in August, inventory is still down sharply from a year ago (down 64.4 percent year-over-year for single family homes without contingent offers).

• The decline in sales from the record levels in 2011 (even more sales than during the bubble!) is because of the decline in foreclosures. Some of the recent decline in foreclosures is due to new foreclosure rules in Nevada, but there is also a shift to short sales.

• Short sales are more than double foreclosures now. The GLVAR reported 43.7 percent of sales were short sales, and only 16.9% foreclosures. We've seen a shift from foreclosures to short sales in most areas (not just in areas with new foreclosure laws).

• The percent distressed sales was extremely high at 60.6% in August (short sales and foreclosures), down slightly from 60.7% in July.

• There is a push to complete short sales, from the article:

[H]omeowners are pushing to short-sell their homes by the end of the year, when the Mortgage Forgiveness Debt Relief Act is set to expire unless Congress acts to extend it. If Congress does not extend this law by Dec. 31, she said any amount of money a bank writes off in agreeing to sell a home as part of a short sale will become taxable income when sellers pay their income taxes.

BLS: Job Openings "little changed" in July

by Calculated Risk on 9/11/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.7 million job openings on the last business day of July, little changed from June, the U.S. Bureau of Labor Statistics reported today.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in July was up from 2.4 million at the end of the recession in June 2009.

...

In July, the quits rate was unchanged for total nonfarm, total private, and government. The number of quits was 2.2 million in July, up from 1.8 million at the end of the recession in June 2009. ... Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

Quits increased slightly in July, and quits are up about 8% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Trade Deficit at $42.0 Billion in July

by Calculated Risk on 9/11/2012 08:30:00 AM

The Department of Commerce reported:

[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion.June was revised down from $42.9 billion. The trade deficit was below the consensus forecast of $44.3 billion.

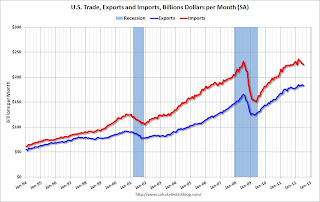

The first graph shows the monthly U.S. exports and imports in dollars through July 2012.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in July. Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

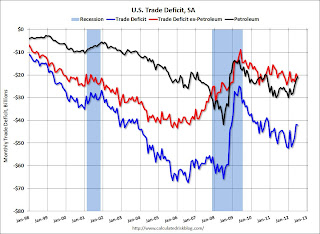

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $93.83 in July, down from $100.13 per barrel in June, and the lowest level since early 2011. Import oil prices will probably start increasing again in August. The trade deficit with China increased to $29.4 billion in July, up from $27.0 billion in July 2011. Once again most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $10.2 billion in July, up from $7.7 billion in July 2011.

Monday, September 10, 2012

Tuesday: Trade Deficit, Job Openings

by Calculated Risk on 9/10/2012 09:11:00 PM

A couple of interesting stories ...

From the NY Times: Chinese Leader’s Absence Stokes Rumor Mills

Over the past week, the new leader, Xi Jinping, has missed at least three scheduled meetings with foreign dignitaries, including Secretary of State Hillary Rodham Clinton last Wednesday and the prime minister of Denmark on Monday. So far officials have declined to provide an explanation for his absences.I heard he was spotted standing in line waiting for the iPhone 5!

That set off furious speculation on the Internet that the 59-year-old Mr. Xi’s health, either physical or political, has taken a turn for the worse. Some diplomats say they have heard that Mr. Xi suffered a pulled muscle while swimming or playing soccer. One media report, since retracted, had it that Mr. Xi was hurt in an auto accident when a military official tried to injure or kill him in a revenge plot. A well-connected political analyst in Beijing said in an interview that Mr. Xi might have had a mild heart attack.

Whatever the actual reason, Mr. Xi’s unexplained absences are conspicuous on the eve of what is supposed to be China’s once-in-a-decade transfer of power.

And on Apple, from Catherine Rampell at the NY Times Economix: How the iPhone 5 Could Bolster the G.D.P.

Michael Feroli, the chief United States economist at JPMorgan Chase, did a back-of-the-envelope calculation and estimated that the upcoming release of what is expected to be the iPhone 5 could add one-quarter to one-half of a percentage point to the annualized growth rate of America’s gross domestic product next quarter.• At 8:30 AM, the Trade Balance report for July will be released. The consensus is for the U.S. trade deficit to increase to $44.3 billion in July, up from from $42.9 billion in June. Export activity to Europe will be closely watched due to economic weakness.

• At 10:00 AM, the BLS will released the Job Openings and Labor Turnover Survey for July from the BLS. This survey has been showing an increase in job openings; in June openings were up about 16% year-over-year compared to June 2011.

Another question for the September economic contest: