by Calculated Risk on 9/07/2012 08:03:00 PM

Friday, September 07, 2012

Bank Failure #41 in 2012: First Commercial Bank, Bloomington, Minnesota

Autumn leaves yellow and fall

As do Mid-West Banks

by Soylent Green is People

From the FDIC: Republic Bank & Trust Company, Louisville, Kentucky, Assumes All of the Deposits of First Commercial Bank, Bloomington, Minnesota

As of June 30, 2012, First Commercial Bank had approximately $215.9 million in total assets and $206.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $63.9 million. ... First Commercial Bank is the 41st FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota.It is Friday!

Earlier on employment:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

AAR: Rail Traffic "mixed" in August, Building related commodities were up

by Calculated Risk on 9/07/2012 05:32:00 PM

Once again rail traffic was "mixed". However building related commodities were up such as lumber and crushed stone, gravel, sand. Lumber was up 21% from August 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Weekly Rail Traffic for August

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in August 2012 totaled 1,461,680, down 1.4 percent compared with August 2011. Intermodal traffic in August 2012 totaled 1,230,992 containers and trailers, up 51,145 units or 4.3 percent compared with August 2011. The August 2012 average weekly intermodal volume of 246,198 units is the second highest average for any August on record.

...

“U.S rail traffic in August was pretty much same song, different verse,” said AAR Senior Vice President John T. Gray. “Weakness in coal carloadings was largely but not entirely offset by increases in carloads of petroleum and petroleum products, autos, lumber, and several other commodities, with intermodal showing continued strength.”

Click on graph for larger image.

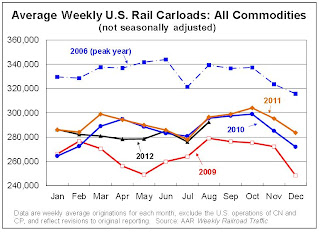

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

On a non-seasonally adjusted basis, U.S. rail carload traffic fell 1.4% (21,050 carloads) in August 2012 from August 2011. Carloads totaled 1,461,680 for the month, an average of 292,336 per week, which is the highest weekly average since November 2011. It was the seventh straight year-over-year monthly decline.The second graph is for intermodal traffic (using intermodal or shipping containers):

Commodities with carload gains on U.S. railroads in August 2012 included petroleum and petroleum products (up 18,007 carloads, or 49.0%); motor vehicle and parts (up 8,966 carloads, or 13.0%); and crushed stone, sand, and gravel (up 6,905 carloads, or 7.3%). Carloads of lumber and wood products were up 21.3% (2,877 carloads) in August 2012; carloads of grain were up 1.7%.

Coal continues to suffer, with U.S. carloadings down 7.3% (48,493 carloads) in August 2012 from August 2011

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now near peak levels.

U.S. intermodal traffic rose 4.3% (51,145 containers and trailers) in August 2012 over August 2011 on a non-seasonally adjusted basis, totaling 1,230,992 units for the month. The weekly average in August 2012 was 246,198, the second highest for an August in history.The top months for intermodal are usually in the fall, and it looks like intermodal traffic will be at or near record levels this year.

This is more evidence of sluggish growth - and of residential investment making a positive contribution.

Earlier on employment:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Market Update

by Calculated Risk on 9/07/2012 04:05:00 PM

Click on graph for larger image.

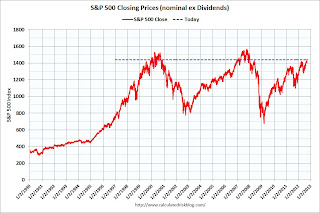

I haven't posted these graphs in a couple of months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in December 1999; almost 13 years ago.

The second graph (click on graph for larger image) is from Doug Short shows the S&P 500 since the 2007 high ...

Earlier:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

LPS: House Price Index increased 0.7% in June

by Calculated Risk on 9/07/2012 02:00:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses June closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic) and the LPS index is seasonally adjusted.

From LPS: U.S. Home Prices Up 0.7 Percent for the Month; Up 0.9 Percent for the Past Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on June 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS index increased 0.7% in June (seasonally adjusted) and is up 4.0% this year, and up 0.9% year-over-year.

The LPS HPI is off 23.5% from the peak in June 2006.

Earlier:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Employment: Another Weak Report (more graphs)

by Calculated Risk on 9/07/2012 10:26:00 AM

The economy has added 1.11 million jobs over the first eight months of the year (1.21 million private sector jobs). At this pace, the economy would add around 1.8 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

Government payrolls declined another 7 thousand in August, bringing government job losses to 93,000 for 2012 through August (61,000 state and local jobs losses so far in 2012, and 32,000 fewer Federal jobs).

Some numbers: There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.7%.

The change in payroll employment for July was revised down from +163,000 to +141,000, and June was revised down from +64,000 to +45,000, for a total revision of minus 41,000 over those two months.

The average workweek was unchanged at 34.4 hours, and average hourly earnings declined slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.4 hours in August. ... In August, average hourly earnings for all employees on private nonfarm payrolls edged down by 1 cent to $23.52. Over the past 12 months, average hourly earnings rose by 1.7 percent." This is sluggish earnings growth.

There are a total of 12.5 million Americans unemployed and 5.0 million have been unemployed for more than 6 months.

This was another weak employment report, especially with the downward revisions and slight decline in hourly earnings. Here are a few more graph ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.6% in August (this was up slightly in August.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 8.0 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decrease in August to 8.03 millon from 8.25 million in August.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased in August to 14.7%, down from 15.0% in July.

Unemployed over 26 Weeks

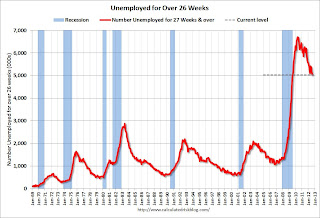

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.03 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.18 million in July. This is generally trending down and is at the lowest level since 2009. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

So far in 2012 - through August - state and local government have lost 61,000 jobs (10,000 jobs were added in August). In the first eight months of 2011, state and local governments lost 168,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed, but they haven't stopped.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is losing workers too (43,000 over the last 12 months, although 3,000 added in August). I think state and local government employment losses might slow further over the next several months.

Overall this was another weak report.