by Calculated Risk on 9/07/2012 08:30:00 AM

Friday, September 07, 2012

August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 96,000 in August, and the unemployment rate edged down to 8.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in food services and drinking places, in professional and technical services, and in health care.

...

Both the civilian labor force (154.6 million) and the labor force participation rate (63.5 percent) declined in August. The employment-population ratio, at 58.3 percent, was little changed.

...

The change in total nonfarm payroll employment for June was revised from +64,000 to +45,000, and the change for July was revised from +163,000 to +141,000.

Click on graph for larger image.

Click on graph for larger image.This was another weak month, especially with the downward revisions to the June and July reports.

This was below expectations of 125,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.3% in August (black line). This is a new low for the year, and just above the cycle low.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another weak report. (expected was 125,000). I'll have much more later ...

Thursday, September 06, 2012

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/06/2012 08:14:00 PM

At 8:30 AM ET on Friday, the employment report for August will be released. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July. The consensus is for the unemployment rate to be unchanged at 8.3%.

Some previews:

From Tim Duy at EconomistsView: Fed Watch: Quick Employment Report Preview

From me: Employment Situation Preview

From Nelson Schwartz at the NY Times Economix: Betting on Job Growth

[C]hief United States economist at Morgan Stanley, Vincent Reinhart, raised his prediction for Friday’s government report to 125,000 total nonfarm payroll jobs from an earlier estimate of 100,000.From the WSJ Real Time Economics: Jobs Gain of 200,000 Still Isn’t Enough

TrimTabs Investment Research, usually a Sad Sack when it comes to job estimates, said its calculations of tax-withholding data show August payrolls increased by a hefty 185,000.And two more questions for the September economic contest:

A Draghi Kind of Day

by Calculated Risk on 9/06/2012 04:15:00 PM

First, Tim Duy models a few employment indicators Fed Watch: Quick Employment Report Preview

The model forecasts a nonfarm payroll gain of 198k for August. To be sure, the standard error of 88k is large in terms of payroll forecasts; I wouldn't be surprised by anything between 110k and 290k. That said, the current consensus is 125k with a range of 70k to 177k, which seems low to me.And a few articles on the ECB:

From the NY Times: Central Bank to Snap Up Debt, Saying, ‘Euro Is Irreversible’

Mario Draghi, the E.C.B. president, overcame objections by Germany and won nearly unanimous support from the bank’s board for a program of buying government bonds that would effectively spread responsibility for repaying national debts to the euro zone countries as a group.From the WSJ: ECB Unveils Bond-Buying Program

The E.C.B. will buy bonds on open markets, without setting any limits, of countries that ask for help, which Spain is expected to do. The E.C.B. said it would act only after countries agreed on conditions with the euro zone rescue fund, which will be known as the European Stability Mechanism. The E.S.M. would buy bonds directly from governments, taking responsibility for imposing the conditions, while the E.C.B. would intervene in secondary markets.

The bank and its president, Mr. Draghi, have had the quiet support of all European leaders in taking this latest bold action ... Crucially, support for Mr. Draghi includes Berlin and the German chancellor, Angela Merkel.

From the Financial Times: Draghi outlines bond buying plan

And some in-depth analysis at Alphaville including OMT! and Seniority, the SMP, and the OMT

Here are the full ‘technical features’, which Mario Draghi read out at Thursday’s press conference. Three big things stick out:Much more at Alphaville.

- The ECB will apparently make a ‘legal act’ to confirm that its bond holdings under “Outright Monetary Transactions” are pari passu, not senior. ...

- The ECB will relax collateral requirements ... That’s a big, big move for Spanish banks in particular ...

- Conditionality. A slight chink? The ECB could buy bonds under an EFSF-ESM precautionary credit line for a sovereign, short of a maximal full bailout. Here’s the EFSF’s guidelines on the conditions of precautionary credit lines, for example.

Employment Situation Preview

by Calculated Risk on 9/06/2012 12:42:00 PM

In July, the BLS reported there were 163,000 payroll jobs added. This followed three weak months: 68,000 payroll jobs were added in April, 87,000 in May, and 64,000 in June. Some of the spring weakness might have been "payback" for the mild weather earlier in the year, so it might help to look at the average per month. So far this year, the economy has added 151,000 payroll jobs per month (161,000 private sector per month).

Also, there is a strong possibility that the seasonal factors are a little distorted by the deep recession and financial crisis - this is the third year in a row we've some late spring weakness. In 2010, payrolls picked up in October following a weak period (looking at the data ex-Census), in 2011, payrolls picked up in September. If there is a seasonal distortion, the next four months will probably see some increase too.

Bloomberg is showing the consensus is for an increase of 125,000 payroll jobs in August, and for the unemployment rate to remain unchanged at 8.3%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 201,000 private sector payroll jobs in August. This is the strongest ADP report since March, and this would seem to suggest that the consensus for the increase in total payroll employment is too low. However the ADP report hasn't been very useful in predicting the BLS report for any one month.

• The ISM manufacturing employment index decreased in August to 51.6%, down from 52.0% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 12,000 in August.

The ISM non-manufacturing (service) employment index increased in August to 53.8%, up from 49.3% in July. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased about 160,000 in August.

Added together, the ISM reports suggests about 148,000 jobs added in August.

• Initial weekly unemployment claims averaged about 371,000 in August, up from the 366,000 average for July - but below the 382,000 average for April, May and June. This was about the same level as in the January, February and March period when the BLS reported an average of 226,000 payroll jobs added per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 374,000; down from 388,000 during the reference week in July.

• The final July Reuters / University of Michigan consumer sentiment index increased to 74.3, up from the July reading of 72.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This level still suggests a weak labor market.

• The small business index from Intuit showed 30,000 payroll jobs added, down from 45,000 in July.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Rate at 8.1% in August

U.S. unemployment, as measured by Gallup without seasonal adjustment, is 8.1% for the month of August, down slightly from 8.3% measured in mid-August and 8.2% for the month of July. Gallup's seasonally adjusted unemployment rate for August is also 8.1%, a slight uptick from 8.0% at the end of July.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that economic activity picked up a little in August, and that would seem to suggest a stronger than consensus employment report. Also it is possible that there have been some seasonal factor distortions.

The ISM manufacturing reports suggest a gain of around 148,000 payroll jobs, and the ADP report (private only), also suggests the consensus is too low. Initial weekly unemployment claims were near the low for the year during August.

A negative is the weak small business numbers from Intuit.

Overall it seems like the August report will be somewhat stronger than expected.

ISM Non-Manufacturing Index increases in August

by Calculated Risk on 9/06/2012 10:00:00 AM

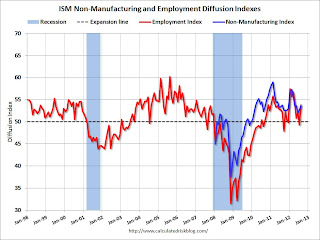

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 32nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.7 percent in August, 1.1 percentage points higher than the 52.6 percent registered in July. This indicates continued growth this month at a slighter faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.6 percent, which is 1.6 percentage points lower than the 57.2 percent reported in July, reflecting growth for the 37th consecutive month. The New Orders Index decreased by 0.6 percentage point to 53.7 percent. The Employment Index increased by 4.5 percentage points to 53.8 percent, indicating growth in employment after one month of contraction. The Prices Index increased 9.4 percentage points to 64.3 percent, indicating substantially higher month-over-month prices when compared to July. According to the NMI™, 10 non-manufacturing industries reported growth in August. Respondents' comments continue to be mixed, and for the most part reflect uncertainty about business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.