by Calculated Risk on 8/30/2012 09:10:00 PM

Thursday, August 30, 2012

Friday: Bernanke, Bernanke, Bernanke

The focus on Friday will be Fed Chairman Ben Bernanke's speech at the Jackson Hole Economic Symposium.

Earlier this week, ECB President Mario Draghi cancelled his speech on Saturday. Here is an update on Europe, from the Financial Times: Brussels pushes for wide ECB powers

The European Central Bank would be given sweeping authority over all 6,000 eurozone banks under a plan being drawn up by the European Commission ... The plan, agreed at a meeting this week between top aides to José Manuel Barroso, commission president, and Michel Barnier, the EU’s senior financial regulator, would strip existing national supervisors of almost all authority to shut down or restructure their countries’ failing banks, giving those powers to Frankfurt.Europe will be back on the front pages next week.

Excerpt with permission.

On Friday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for August will be released. The consensus is for a decrease to 53.0, down from 53.7 in July.

• At 9:55 AM ET, the final Reuter's/University of Michigan's Consumer sentiment index for August will be released. The consensus is for a reading of 73.5, down from the preliminary August reading of 73.6, and up from the July reading of 72.3.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July will be released. The consensus is for a 0.9% increase in orders.

• Also at 10:00 AM, Fed Chairman Ben Bernanke will speak at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, "Monetary Policy Since the Crisis"

Lawler: On the relationship between pending home sales and closed sales

by Calculated Risk on 8/30/2012 06:55:00 PM

Yesterday the National Association of Realtors reported that its “National” Pending Home Sales Index increased by 2.4% on a seasonally adjusted basis in July to its highest level since April 2010.

The NAR’s PHSI did not signal the “dip” in June/July closed existing home sales, for reasons that are difficult to discern. It’s not easy to figure out “fallout” rates from the PHSI for several reasons: first, the PHSI is an index number with 2001 “activity” equal to 100, making numerical comparisons to the NAR’s existing home sales estimate difficult, especially since there is a “discontinuity” in the NAR’s existing home sales methodology in 2007; and second, the NAR’s PHSI is based on a sample size not much more than half that used to estimate existing home sales. To really delve into the relationship between pending sales and closed sales, one needs to get local data—which unfortunately isn’t available to the public in that many places.

Click on graph for larger image.

Click on graph for larger image.

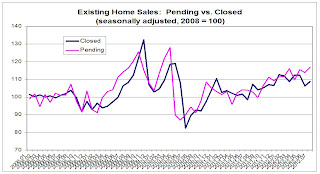

CR Note: This graph from Tom Lawler shows Pending and Closed home sales since January 2008. For this graph, Tom Lawler set both series to 100 in 2008.

More from Lawler: For fun, however, I looked at pending sales vs. closed sales data reported by MRIS for the mid-Atlantic region. While I have limited historical data, that data suggests that (1) contract fallout over the past two and a half years is up considerably from earlier periods; and (2) that increased fallout coincided with a significant increase in the share of pending sales that were “contingent. Other MRIS data/analyses suggests that a rise in the share of pending contracts that are short-sales, which (1) take much longer time to close; and (2) which have very high contract fall-out rates, has significantly impacted the relationship between pending sales and closed sales.

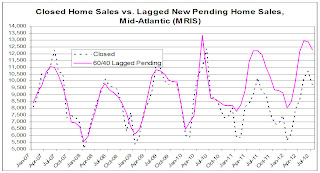

Here is a chart showing closed home sales by MRIS for the mid-Atlantic region compared to lagged new pending contracts, using a weighting of 60% for the previous month and 40% for two months earlier.

Here is a chart showing closed home sales by MRIS for the mid-Atlantic region compared to lagged new pending contracts, using a weighting of 60% for the previous month and 40% for two months earlier.

This chart suggests that over the last two years the number of closed home sales has been significantly lower than one would have expected based on the past relationship between past new pending sales and closed sales. While not shown here, a more “sophisticated” look at leads and lags suggests that the reason is not simply delayed closings, but is mainly contract fallout.

CR Note: It appears short sales are distorting the relationship between pending and closed sales, and the "pending home sales" report should currently be taken with an extra grain of salt.

WSJ: Bernanke Jackson Hole Speech Preview

by Calculated Risk on 8/30/2012 03:51:00 PM

Fed Chairman Ben Bernanke is scheduled to speak on Friday at 10 AM ET at the Jackson Hole Economic Symposium.

From Jon Hilsenrath at the WSJ: Bernanke's Dilemma Over His Legacy

[W]hen the chairman speaks Friday morning at the central bank's annual retreat here, he must once again address whether there is more the Fed can do to get the economy going and whether it is worth taking chances on controversial new programs. All along he has argued these efforts are worth it and appears likely to stick to that line in his speech.I'd like to think that Bernanke isn't thinking about his legacy, but that he is focused on what is best for the economy. So far the inflation critics have been wrong, and high inflation still seems very unlikely with a depressed economy, and significant resource slack.

Beyond big issues of the moment—such as whether the Fed will launch a new bond-buying program—a broader question looms in Jackson Hole about Mr. Bernanke's legacy. Long after his term as chairman ends in 17 months, will he be remembered as the Fed chief who did too little to combat high unemployment or the one who did too much and unleashed inflation and financial instability with the actions he took? Critics make both arguments.

More from Hilsenrath:

The Fed signaled strongly in the minutes of its August 1 policy meeting that in September it is likely to offer new assurances that interest rates will stay low beyond 2014 and that it is seriously considering more bond purchases. One issue Mr. Bernanke might clear up on Friday: Whether U.S. economic data since that meeting—some of it modestly stronger—has changed his outlook.Bernanke will not announce a new program at Jackson Hole. The most he will do is argue the Fed can do more and still has tools that will be effective - and he will probably say that help from fiscal authorities to provide more stimulus in the short term, and a credible long term plan to reduce the deficit, would be very helpful (good luck).

Goldman Sachs chief U.S. economist Jan Hatzius estimates that a $500 billion bond-buying program would boost growth by 0.2 percentage points for a year and bring down the unemployment rate by 0.1 percentage point.

I think the key will be how he describes the economy and his view of growth prospects.

Forecasts: Light Vehicle Sales expected to increase in August

by Calculated Risk on 8/30/2012 02:29:00 PM

In addition to the decent personal income and outlays report for July released this morning, and solid retailer results for August, it appears auto (and light truck) sales increased in August.

TrueCar is forecasting: August 2012 New Car Sales Expected to Be Up 17 Percent

For August 2012, new light vehicle sales in the U.S. (including fleet) is expected to be 1,255,392 units, up 17.2 percent from August 2011 and up 8.9 percent from July 2012 (on an unadjusted basis)Edmunds.com is forecasting: August Car Sales Offer a Pleasant Summer Surprise for the Auto Industry

...

The August 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.2 million new car sales, up from 12.1 million in August 2011 and up from 14.1 million in July 2012

Edmunds.com ... forecasts that 1,287,603 new cars will be sold in August for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.5 million light vehicles. If the numbers hold, August will be the second best month of 2012 in terms of SAAR and the third best month in terms of unit sales.The cash-for-clunkers spike was at a SAAR of 14.546, and the Edmunds forecast is close. Note: There was one more selling day in August 2012 than in August 2011. Light vehicle sales for August will be released on Tuesday, Sept 4th.

“Sales showed signs of flattening out in the first couple months of summer, so August’s sales figures will come as a nice surprise for everyone in the auto industry,” says Edmunds.com Senior analyst Jessica Caldwell.

...

Edmunds.com estimates that August’s projected sales will be an 11.7 percent increase from July 2012, and a 20.1 percent increase (unadjusted for number of selling days) from August 2011. Retail SAAR will come in at 12.0 million vehicles in August, with fleet transactions accounting for 17.0 percent of total sales. An estimated 3.1 million used cars will be sold in August, for a SAAR of 36.9 million (compared to 3.2 million – or a SAAR of 36.3 million – used car sales in July).

This doesn't suggest "a substantial and sustainable strengthening in the pace of the economic recovery" (from the FOMC minutes), but it does suggest some pickup in Q3.

Kansas City Fed: "Moderate" growth in Regional Manufacturing Activity in August

by Calculated Risk on 8/30/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Improved Moderately

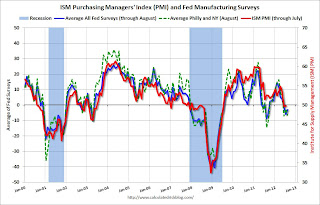

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity improved moderately, and producers’ optimism continued to edge higher.This was below expectations of a 5 reading for the composite index. However the regional manufacturing surveys were mostly weak in August. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factory activity in our region grew slightly faster this month, in spite of the ongoing drought having a negative effect on producers of agricultural equipment” said Wilkerson. “Firms also expected production to accelerate in coming months.”

...

Growth in Tenth District manufacturing activity improved moderately in August, and producers’ optimism continued to edge higher. Price indexes were relatively stable, although the share of producers planning to raise prices increased further. Several respondents said the ongoing drought has negatively affected their business, mainly through higher input costs and slower sales for agricultural-related products.

The month-over-month composite index was 8 in August, up from 5 in July and 3 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index climbed from 2 to 7, and the shipments, new orders, and order backlog indexes all moved back into positive territory. The new orders for export index inched higher but remained below zero, while the employment index dipped slightly from 6 to 2.

Most future factory indexes improved further after rebounding last month. The future composite index edged up from 13 to 16, and future production and shipments indexes increased notably after no change last month. The future order backlog index jumped from 3 to 14, while the employment index remained unchanged.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The ISM index for August will be released Tuesday, Sept 4th, and these surveys suggest another weak reading.