by Calculated Risk on 8/30/2012 09:02:00 AM

Thursday, August 30, 2012

Personal Income increased 0.3% in July, Spending increased 0.4%

The BEA released the Personal Income and Outlays report for July:

Personal income increased $42.3 billion, or 0.3 percent, and disposable personal income (DPI) increased $39.9 billion, or 0.3 percent, in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $46.0 billion, or 0.4 percent. In June, personal income increased $46.1 billion, or 0.3 percent, DPI increased $37.4 billion, or 0.3 percent, and PCE increased $3.5 billion, or less than 0.1 percent, based on revised estimates.The following graph shows real Personal Consumption Expenditures (PCE) through July (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in July, in contrast to a decrease of 0.1 percent in June. ... The PCE price index increased less than 0.1 percent in July, compared to an increase of 0.1 percent in June. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared to an increase of 0.2 percent.

...

Personal saving -- DPI less personal outlays -- was $506.3 billion in July, compared with $516.2 billion in June. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 4.2 percent in July, compared with 4.3 percent in June.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

A key point is the PCE price index has only increased 1.3% over the last year, and core PCE is up only 1.6%. The PCE price index - and core PCE - hardly increased in July.

Weekly Initial Unemployment Claims at 374,000

by Calculated Risk on 8/30/2012 08:30:00 AM

The DOL reports:

In the week ending August 25, the advance figure for seasonally adjusted initial claims was 374,000, unchanged from the previous week's revised figure of 374,000. The 4-week moving average was 370,250, an increase of 1,500 from the previous week's revised average of 368,750.The previous week was revised up from 372,000, so this was an increase from the reported level a week ago.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 370,250.

This was above the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

Wednesday, August 29, 2012

Thursday: Personal Income for July, Weekly Unemployment Claims

by Calculated Risk on 8/29/2012 09:51:00 PM

A few excerpts from Michelle Meyer at Merrill Lynch: Home is where the heart is

The turn in home prices, although modest at the start, will help to boost consumer confidence. Simply believing that prices have stopped falling should provide a sense of relief to households. It will also allow households to have greater mobility, generating a more efficient labor market and greater churn in the housing stock.I made a similar argument a few weeks ago: The economic impact of a slight increase in house prices.

...

While the housing market is far from normal, the bottoming in home prices marks an important shift for the economy. Home-price appreciation will slowly start to support household balance sheets and improve confidence, creating a positive feedback loop with the credit market and broader economy. It is gradual and fragile, but we believe it has finally begun.

On Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 372 thousand.

• Also at 8:30 AM, the BEA will release the Personal Income and Outlays report for July. The consensus is for a 0.3% increase in personal income in July, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for August will be released. The consensus is for an a reading of 5, unchanged from 5 in July (above zero is expansion). This is the last of the regional surveys for August, and all of them have been weak.

A question for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

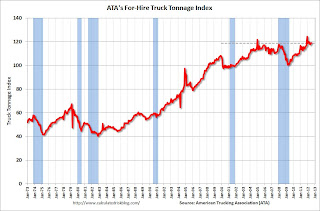

ATA Trucking index unchanged in July

by Calculated Risk on 8/29/2012 04:44:00 PM

From ATA: ATA Truck Tonnage was Unchanged in July

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index was unchanged in July after increasing 1.1% in June. (June’s gain was slightly smaller than the 1.2% increase ATA reported on July 25.) In July, the SA index stayed at 118.8 (2000=100). Compared with July 2011, the SA index was 4.1% higher, which was the largest year-over-year gain since February 2012. Year-to-date, compared with the same period last year, tonnage was up 3.7%.Note from ATA:

...

“July’s reading reflects an economy that has lost some steam, but hasn’t stalled,” ATA Chief Economist Bob Costello said. “Certainly there has been some better economic news recently, but I continue to believe we will see some deceleration in tonnage during the second half of the year, if for nothing else but very tough comparisons on a robust August through December period in 2011.” ... Costello kept his tonnage outlook for 2012 to the 3% to 3.5% range as reported last month.

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 3.7% year-over-year - but has been moving mostly sideways in 2012.

Fed's Beige Book: Economic activity increased "gradually", Residential real estate shows "signs of improvement"

by Calculated Risk on 8/29/2012 02:07:00 PM

Reports from the twelve Federal Reserve Districts suggest economic activity continued to expand gradually in July and early August across most regions and sectors. Six Districts indicated the local economy continued to expand at a modest pace and another three cited moderate growth; among the latter, Chicago noted that the pace of growth had slowed from the prior period.This is a downgrade from the previous beige book that reported "modest to moderate" growth.

And on real estate:

Housing markets across most Districts exhibited signs of improvement, with sales and construction continuing to increase. Dallas reported significant levels of buyer traffic, Richmond noted strong pending sales, and Minneapolis and St. Louis mentioned increases in building permits. New York, Philadelphia, and Chicago indicated improvements as well, but characterized the progress as slow and modest. Declines in inventory levels were reported in Boston, New York, Philadelphia, Atlanta, Dallas, and San Francisco; these declining inventories put some upward pressure on prices according to Boston, Atlanta, and Dallas. A reduction in the stock of distressed properties was mentioned in New York, Richmond, and San Francisco. In Philadelphia and Kansas City, the possibility of shadow inventory entering the market remains a concern. In general, outlooks were positive, with continued increases in activity expected, although the projected gains were more modest in Boston, Cleveland, and Kansas City."Prepared at the Federal Reserve Bank of Boston and based on information collected on or before August 20, 2012."

Commercial real estate market conditions held steady or improved in nearly all Districts in recent weeks.

Another downgrade ... from "moderate growth" two reports ago, to "modest to moderate" in the last report ... and now "expand gradually". On the positive side, there were more positive comments about residential real estate.