by Calculated Risk on 8/25/2012 08:03:00 AM

Saturday, August 25, 2012

Summary for Week ending August 24th

The key sentence of the week was from the FOMC minutes of the last meeting: “Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery.”

“Substantial and sustainable”? Not any time soon. So the question is what is the meaning of “fairly soon”, and does that mean QE3, or an extension of the exceptionally low levels of interest rates until 2015?

We might get some hints next week when Fed Chairman Ben Bernanke speaks at the Jackson Hole Economic Symposium. But “fairly soon” probably means September ... for something!

The only significant economic releases this week were housing related – July new and existing home sales - and of course both were fairly positive.

For new homes, sales increased to 372,000 on an annual rate basis in July. New home sales have averaged a 360,000 pace through July, and that means sales are on pace to increase 18% from 2011 (with coming revisions, I expect sales to be up 20%+ this year). This is from a very low level, but how many sectors are seeing a 20% year-over-year increase in 2012?

For existing home sales, the key number is inventory. Although the NAR reported inventory increased slightly in July from June, inventory is still down 23.8% compared to July 2011. Another positive is that conventional sales in many areas are up sharply from last year, offsetting the decline in distressed sales.

Another key sentence (and an old theme for this blog): As goes housing, so goes the economy. The general rule is housing leads the economy – there are exceptions like in 2001 following the popping of the stock bubble, and recently we’ve seen a recovery without housing – but the housing recovery suggests, barring a significant policy mistake in the US or Europe, the pace of the economic recovery should increase in 2013. Will it be “substantial and sustainable”? I doubt it will be "substantial" in the near term.

Here is a summary of last week in graphs:

• New Home Sales increased in July to 372,000 Annual Rate

Click on graph for larger image.

Click on graph for larger image.

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 372 thousand. This was up from a revised 359 thousand SAAR in June (revised up from 350 thousand). Sales in May were revised down.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

This was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

• Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in July 2012 (4.47 million SAAR) were 2.3% higher than last month, and were 10.4% above the July 2011 rate.

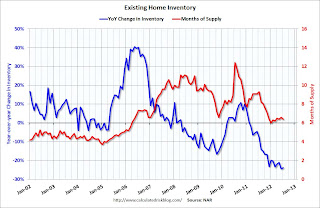

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.Months of supply decreased to 6.4 months in July.

This was slightly below expectations of sales of 4.50 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index Downturn Moderates as Negative Conditions Continue in July

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims increased to 372,000

From the DOL: "In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000."

From the DOL: "In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000."The dashed line on the graph is the current 4-week average. The 4-week average post-bubble low is 363,000; this week the average was at 368,000.

This was above the consensus forecast of 365,000.

• Other Economic Stories ...

• FOMC Minutes: Discussion of policy tools the FOMC mioght use "fairly soon"

• From the Census Bureau: Durable Goods orders increase 4.2% in July

• From Zillow: Negative Equity Falls in Second Quarter; Nearly Half of Borrowers Under 40 Remain Underwater

• From the FHFA: U.S. House Prices Rose 1.8 Percent From First Quarter to Second Quarter 2012

Friday, August 24, 2012

Zillow forecasts Case-Shiller House Price index to show small Year-over-year increase for June

by Calculated Risk on 8/24/2012 08:22:00 PM

Note: The Case-Shiller report is for June (really an average of prices in April, May and June).

Zillow Forecast: Zillow Forecast: June Case-Shiller Composite-20 Expected to Show 0.3% Increase from One Year Ago

On Tuesday, August 28th, the Case-Shiller Composite Home Price Indices for June will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 0.3 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be flat on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from May to June will be 0.9 percent for both the 20-City Composite and the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series and the June Zillow Home Value Index data, and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

This will be the first month with positive annual appreciation in the 20-City Index since September of 2010. In 2010, home prices showed increases due to the Federal home buyer credit, which artificially lifted the market. This time around the home price appreciation is organic and represents a recovering housing market. Zillow has called a home value bottom for the national real estate market with many regional markets experiencing inventory shortages and strong near-term price appreciation. While the Case-Shiller indices have been appreciating at a healthy clip for the past few months, we do expect them to moderate and likely report monthly declines towards the end of the year, largely as a function of declining overall monthly sales volume which will increase the percentage of foreclosure re-sales in the transactional mix being tracked by Case-Shiller.

For those of you interested in more recent data on the housing market, Zillow’s July 2012 data was released this week, Tuesday, August 21st and can be found here. The Zillow Home Value Index does not include foreclosure re-sales, and we expect it to increase 1.2% between June 2012 and June 2013.

If the Zillow forecast is correct, this will be a significant milestone for the Case-Shiller as year-over-year prices turn positive.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | June 2011 | 154.87 | 154.35 | 141.50 | 140.78 |

| Case-Shiller (last month) | May 2012 | 151.79 | 152.88 | 138.96 | 139.93 |

| Zillow June Forecast | YoY | 0.0% | 0.0% | 0.3% | 0.3% |

| MoM | 2.1% | 0.9% | 2.2% | 0.9% | |

| Zillow Forecasts1 | 154.9 | 154.3 | 142.0 | 141.2 | |

| Current Post Bubble Low | 146.51 | 149.21 | 134.08 | 136.49 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 5.7% | 3.4% | 5.9% | 3.4% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Lawler: Updated Distressed Home Sales Share Table

by Calculated Risk on 8/24/2012 03:59:00 PM

CR Note: Tom Lawler thanks everyone for voting his horse "Dealer" to victory in the best pet contest. My congratulations to Rosemary and Tom who are celebrating their anniversary today!

Economist Tom Lawler sent me the table below for several more distressed areas. For almost of these areas (except Rhode Island), the share of distressed sales is down from July 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis, and Lee County, FL) and the share of foreclosure sales are down. In most areas, short sales are higher than foreclosures, and for some areas like Phoenix, Reno and Las Vegas, short sales are now double the rate of foreclosures.

From Lawler: For the combined markets below showing the “total” distressed share of home sales, total home sales in July were up 8.7% from last July, but “non-distressed” sales were up by over 30%!

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-July | 11-July | 12-July | 11-July | 12-July | 11-July | |

| Las Vegas | 40.0% | 20.2% | 20.7% | 50.2% | 60.7% | 70.4% |

| Reno | 38.0% | 28.0% | 15.0% | 37.0% | 53.0% | 65.0% |

| Phoenix | 29.5% | 23.6% | 14.6% | 43.1% | 44.1% | 66.7% |

| Sacramento | 32.0% | 22.3% | 22.4% | 39.0% | 54.4% | 61.3% |

| Minneapolis | 9.3% | 11.0% | 24.8% | 34.4% | 34.1% | 45.4% |

| Mid-Atlantic (MRIS) | 11.3% | 10.2% | 8.7% | 15.1% | 20.0% | 25.2% |

| Orlando | 28.2% | 29.4% | 23.7% | 28.2% | 51.9% | 57.6% |

| California (DQ) | 19.0% | 17.3% | 22.0% | 34.5% | 41.0% | 51.8% |

| Lee County, FL | 17.3% | 18.8% | 15.9% | 30.6% | 33.2% | 49.4% |

| Hampton Roads VA | 29.1% | 30.3% | ||||

| Northeast Florida | 39.0% | 44.1% | ||||

| Sarasota | 32.4% | 38.0% | ||||

| Chicago | 36.1% | 36.7% | ||||

| Rhode Island | 24.8% | 20.3% | ||||

| Miami-Dade | 47.0% | 52.0% | ||||

| Memphis | 26.7% | 31.9% | ||||

| Birmingham AL | 27.2% | 28.4% | ||||

| Houston | 16.3% | 19.6% | ||||

Merkel and Samaras Press Conference

by Calculated Risk on 8/24/2012 01:29:00 PM

From the Athens News: Merkel lays down the law

“We expect Greece to deliver all that has been promised,” Merkel declared. In remarks that were unusually sharp for a joint news conference, she stressed that Berlin has heard words in the past but now expects deeds.Here is a transcript in Greek from the Greek government.

The tough talk contrasted sharply with the head of state honours and diplomatic smiles with which Samaras was received on his first official visit, complete with red carpet and band.

Merkel said that Samaras’ visit is a sign of the “very close ties” between the two countries, only to add later that each side had lost credibility in the eyes of the other and that trust must be regained.

“Our aim is for Greece to remain in the eurozone, despite all the problems that exist,” Merkel said, noting that the euro is more than a currency, that it is the embodiment of European unification.

Moreover, Merkel noted the tremendous sacrifices that the Greek people have made over the last years, underlining that the weaker classes have borne the brunt of austerity and that those who profited during previous years of prosperity have not done their part.

The remark was a thinly veiled barb against the handling of austerity measures by successive Greek governments, which have done nothing to combat rampant tax evasion among the higher income brackets, opting instead for repeated horizontal wage and pension cuts.

...

For his part, Samaras pledged that his government will pursue reforms on a strict timetable and that he is determined to “bring results”.

“I am certain that the troika report will signal that the new coalition government will deliver,” he said.

“We are eliminating two deficits at once – the country’s budget deficit and the credibility deficit,” he said.

But the prime minister underlined that “a revival of the economy and growth is of crucial importance to meet our obligations soon”.

And a google translation.

BLS: Displaced Workers Summary

by Calculated Risk on 8/24/2012 10:13:00 AM

This is an interesting biennial survey that tracks people who lost jobs that they had held for 3+ years ...

From the BLS: Displaced Workers Summary

From January 2009 through December 2011, 6.1 million workers were displaced from jobs they had held for at least 3 years, the U.S. Bureau of Labor Statistics reported today. This was down from 6.9 million for the survey period covering January 2007 to December 2009. In January 2012, 56 percent of workers displaced from 2009-11 were reemployed, up by 7 percentage points from the prior survey in January 2010.Some improvement for the previous survey (that included 2008). But, as of January 2012, only 56 percent of these workers had found new employment. And about 1/3 of those who were reemployed, took 20%+ pay cuts. From the survey:

Of the 3.0 million displaced workers who lost full-time wage and salary jobs during the 2009-11 period and were reemployed, 2.4 million had full-time wage and salary jobs in January 2012. Of these reemployed full-time workers who reported earnings on their lost job, 46 percent were earning as much or more in January 2012 as they did at their lost job. About one-third reported earnings losses of 20 percent or more.