by Calculated Risk on 8/23/2012 08:30:00 AM

Thursday, August 23, 2012

Weekly Initial Unemployment Claims increase to 372,000

The DOL reports:

In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000. The 4-week moving average was 368,000, an increase of 3,750 from the previous week's revised average of 364,250.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,000.

This was above the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

And here is a long term graph of weekly claims:The 4-week average post-bubble low is 363,000; this week the average was at 368,000.

Wednesday, August 22, 2012

Thursday: New Home Sales, Weekly Unemployment Claims

by Calculated Risk on 8/22/2012 08:41:00 PM

From Jon Hilsenrath and Kristina Peterson at the WSJ: Fed Moving Closer to Action

The Federal Reserve sent its strongest signal yet that it is preparing new steps to bolster the economic recovery, saying measures would be needed fairly soon unless growth substantially and convincingly picks up.Here is Tim Duy's take: It's All About The Data

Lots of possibilities at this point. If you were looking for additional asset purchases at the last FOMC meeting, you were not crazy. There was obviously widespread concern about the mid-year slowdown and its implications for the stability of the Fed's forecasts. Moreover, policymakers appear to have concluded that additional asset purchases could be effective. If the data had continued to progress as it had since the July/August meeting, I would say that another round of QE was a slam-dunk. But the data has not progressed in the same direction; rather than falling short of expectations, it has tended toward upside surprises. That of course could change over the next few weeks. In short, we need to ask ourselves what will constitute a "substantial and sustainable strengthening." If Lockhart is a guide, I am thinking we have seen such a shift already. If so, I would expect that on the basis of current data the Fed would delay action until closer to the end of Operation Twist II and to see if Congress has come to any agreement on the fiscal situation in 2013. If the change in the data has not reached the threshold of "substantial and sustainable strengthening" then we would expect action. It will be interesting to see if any of the doves back off on their dreary forecasts in the coming days; such shifts in tone would be telling. Also note that there is a middle ground in the possibility of further changes to the communication strategy; something that could placate both the doves and the hawks until a clearer image of the path of the US economy emerges.On Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 366 thousand.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for August. The consensus is for a reading of 51.0, down from 51.8 in July.

• At 10:00 AM, New Home Sales for July will be released by the Census Bureau. The consensus is for an increase in sales to 362 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 350 thousand in June. Watch for upgrades to the sales rate for previous months.

• Alst at 10:00 AM, the FHFA House Price Index for June 2012 will be released. This is based on GSE repeat sales and the consensus is for a 0.6% increase in house prices.

Another question for the monthly economic prediction contest:

Europe Note: German Chancellor Merkel and French President Hollande will meet in Berlin

AIA: Architecture Billings Index Downturn Moderates as Negative Conditions Continue in July

by Calculated Risk on 8/22/2012 04:02:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Downturn Moderates as Negative Conditions Continue

The Architecture Billings Index (ABI) pointed to a slower decline in July in design activity at U.S. architecture firms. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 48.7, up considerably from the mark of 45.9 in June. This score reflects a decrease in demand for design services (any score below50 indicates a decline in billings). The new projects inquiry index was 56.3, up from mark of 54.4 the previous month.

“Even though architecture firm billings nationally were down again in July, the downturn moderated substantially,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “As long as overall economic conditions continue to show improvement, modest declines should shift over to growth in design activity over the coming months.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

Earlier on existing home sales:

• Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

FOMC Minutes: Discussion of policy tools the FOMC "might employ"

by Calculated Risk on 8/22/2012 02:00:00 PM

Update: Here is a key sentence:

"Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery"From the Fed: Minutes of the Federal Open Market Committee, July 31-August 1, 2012. Excerpt:

Participants discussed a number of policy tools that the Committee might employ if it decided to provide additional monetary accommodation to support a stronger economic recovery in a context of price stability. One of the policy options discussed was an extension of the period over which the Committee expected to maintain its target range for the federal funds rate at 0 to 1/4 percent. It was noted that such an extension might be particularly effective if done in conjunction with a statement indicating that a highly accommodative stance of monetary policy was likely to be maintained even as the recovery progressed. Given the uncertainty attending the economic outlook, a few participants questioned whether the conditionality of the forward guidance was sufficiently clear, and they suggested that the Committee should consider replacing the calendar date with guidance that was linked more directly to the economic factors that the Committee would consider in deciding to raise its target for the federal funds rate, or omit the forward guidance language entirely.This seems to suggest that "many participants" are supportive of QE3, although an alternative might be an extension of the period of exceptionally low rates.

Participants also exchanged views on the likely benefits and costs of a new large-scale asset purchase program. Many participants expected that such a program could provide additional support for the economic recovery both by putting downward pressure on longer-term interest rates and by contributing to easier financial conditions more broadly. In addition, some participants noted that a new program might boost business and consumer confidence and reinforce the Committee's commitment to making sustained progress toward its mandated objectives. Participants also discussed the merits of purchases of Treasury securities relative to agency MBS. However, others questioned the possible efficacy of such a program under present circumstances, and a couple suggested that the effects on economic activity might be transitory. In reviewing the costs that such a program might entail, some participants expressed concerns about the effects of additional asset purchases on trading conditions in markets related to Treasury securities and agency MBS, but others agreed with the staff's analysis showing substantial capacity for additional purchases without disrupting market functioning. Several worried that additional purchases might alter the process of normalizing the Federal Reserve's balance sheet when the time came to begin removing accommodation. A few participants were concerned that an extended period of accommodation or an additional large-scale asset purchase program could increase the risks to financial stability or lead to a rise in longer-term inflation expectations. Many participants indicated that any new purchase program should be sufficiently flexible to allow adjustments, as needed, in response to economic developments or to changes in the Committee's assessment of the efficacy and costs of the program.

Some participants commented on other possible tools for adding policy accommodation, including a reduction in the interest rate paid on required and excess reserve balances. While a couple of participants favored such a reduction, several others raised concerns about possible adverse effects on money markets. It was noted that the ECB's recent cut in its deposit rate to zero provided an opportunity to learn more about the possible consequences for market functioning of such a move. In light of the Bank of England's Funding for Lending Scheme, a couple of participants expressed interest in exploring possible programs aimed at encouraging bank lending to households and firms, although the importance of institutional differences between the two countries was noted.

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 8/22/2012 11:42:00 AM

The NAR had some issues with the report this morning. Here is the press release: Existing-Home Sales Improve in July, Prices Continue to Rise

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.3 percent to a seasonally adjusted annual rate of 4.47 million in July from 4.37 million in June, and are 10.4 percent above the 4.05 million-unit pace in July 2011.Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So existing home sales are close to "normal" now, however, of course, "normal" would have very few distressed sales - so in that sense the market is a long ways from "normal". But no one should expect existing home sales to go back to 6 or 7 million per year. Instead the key to returning to "normal" is more conventional sales and fewer distressed sales.

...

Total housing inventory at the end July increased 1.3 percent to 2.40 million existing homes available for sale, which represents a 6.4-month supply at the current sales pace, down from a 6.5-month supply in June. Listed inventory is 23.8 percent below a year ago when there was a 9.3-month supply.

...

Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 24 percent of July sales (12 percent were foreclosures and 12 percent were short sales), down from 25 percent in June and 29 percent in July 2011.

...

Given population and demographic demand, [Lawrence Yun, NAR chief economist] said existing-home sales could be in a normal range of 5 to 5.5 million if all conditions were optimal. “Sales may reach 5 million next year, but it will require more sensible lending standards and stronger job creation to push beyond that,” he said.

As I've noted before, what matters the most in the NAR's existing home sales report is inventory; and what matters the most in the new home sales report tomorrow is sales. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory increased to 2.40 million units in July, up slightly from June. This is down 23.8% from July 2011, and down 13% from the inventory level in July 2005 (mid-2005 was when inventory started increasing sharply). This is the same level for inventory as in July 2004.

Clearly inventory will be below the comparable month in 2005 for the rest of the year and will probably track close to the level in 2004. It looks like inventory peaked this year in April.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

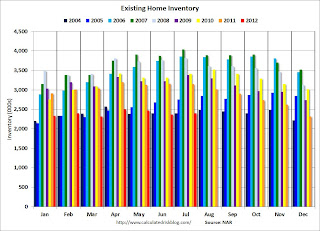

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.This year (dark red for 2012) inventory is at the lowest level for the month of July since 2004, and inventory is below the level in July 2005 (not counting contingent sales). However inventory is still elevated using months-of-supply, but I expect months-of-supply to be below 6 later this year.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for 2008, 2010 and 2011. Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for 2008, 2010 and 2011. Sales are well below the bubble years of 2005 and 2006.Earlier:

• Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply99

• Existing Home Sales graphs