by Calculated Risk on 8/22/2012 10:00:00 AM

Wednesday, August 22, 2012

Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply

Note: The NAR had release issues this morning.

From the WSJ: Home Resales Jump

Existing-home sales increased 2.3% in July from a month earlier to a seasonally adjusted annual rate of 4.47 million, the National Association of Realtors said Wednesday. The month's sales were 10.4% above the same month a year earlier.

The sales pace for June was unrevised at 4.37 million per year.

The median sales price in July, meanwhile, was $187,300, up 9.4% from the same month a year earlier and the strongest year-over year gain since January 2006.

At the end of July, meanwhile, the inventory of previously owned homes listed for sale rose 1.3% to 2.4 million. That represented a 6.4 month supply at the current sales pace

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2012 (4.47 million SAAR) were 2.3% higher than last month, and were 10.4% above the July 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.4 million in July from 2.39 million in June. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

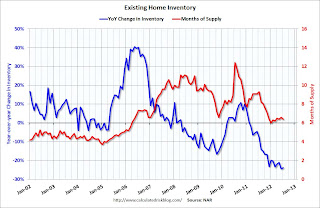

According to the NAR, inventory increased to 2.4 million in July from 2.39 million in June. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.Months of supply decreased to 6.4 months in July.

This was slightly below expectations of sales of 4.50 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

MBA: Mortgage Refinance Activity declines as Rates Increase

by Calculated Risk on 8/22/2012 07:01:00 AM

From the MBA: Refinance Applications Decline as Rates Increase

The Refinance Index decreased 9 percent from the previous week to the lowest level since early July. The seasonally adjusted Purchase Index increased 0.9 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.86 percent from 3.76 percent, with points decreasing to 0.42 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

Note: Yesterday Zillow reported "The 30-year fixed mortgage rate on Zillow(R) Mortgage Marketplace is currently 3.5 percent, up eight basis points from 3.42 percent at this same time last week."

The second graph shows the refinance index.

The second graph shows the refinance index.The refinance activity has declined for three straight weeks as mortgage rates have moved higher. This is still a fairly high level of activity.

Tuesday, August 21, 2012

Wednesday: July Existing Home Sales, FOMC Minutes

by Calculated Risk on 8/21/2012 09:07:00 PM

Europe is coming back from vacation, from the WSJ: Europe Pressures Intensify

After a summer lull, Greece is again Ms. Merkel's biggest headache.Merkel and Samaras will meet on Friday with a press conference following ... The following week ECB President Mario Draghi will speak at the Jackson Hole Economic Symposium on Saturday, Sept 1st at 10 AM.

The Greek government, struggling with depression-like conditions that have pushed the economy to the brink, is likely to need many billions of euros of additional aid to avoid bankruptcy.

... The chancellor is set to meet with French President François Hollande on Thursday and Greek Prime Minister Antonis Samaras on Friday, meetings the chancellor's aides say will help determine Berlin's course.

... The chancellor isn't likely to reach a decision for several weeks, German officials said. In part, they said, she is waiting for two developments that could expand or constrain her options: Germany's constitutional court is due to rule on Sept. 12 on whether the euro zone can launch its permanent bailout fund, and inspectors from the European Union and the IMF are due to report on the size of Greece's finance shortfall. The latter could take until October, some euro-zone officials say.

On Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for July is scheduled for release by the National Association of Realtors (NAR). The consensus is for sales of 4.50 million on seasonally adjusted annual rate (SAAR) basis. Sales in June 2012 were 4.37 million SAAR.

• At 2:00 PM, the FOMC Minutes for the meeting of July 31-August 1, 2012 will be released. Once again the minutes will be closely scrutinized for hints about QE3.

Another question for the monthly economic prediction contest:

• During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate) will be released.

FHFA: New Short Sale Guidelines for Fannie and Freddie

by Calculated Risk on 8/21/2012 05:10:00 PM

From the FHFA: New Standard Short Sale Guidelines for Fannie Mae and Freddie Mac

The Federal Housing Finance Agency (FHFA) today announced that Fannie Mae and Freddie Mac are issuing new, clear guidelines to their mortgage servicers that will align and consolidate existing short sales programs into one standard short sale program. The streamlined program rules will enable lenders and servicers to quickly and easily qualify eligible borrowers for a short sale.A few details:

The new guidelines, which go into effect Nov. 1, 2012, will permit a homeowner with a Fannie Mae or Freddie Mac mortgage to sell their home in a short sale even if they are current on their mortgage if they have an eligible hardship. Servicers will be able to expedite processing a short sale for borrowers with hardships such as death of a borrower or co-borrower, divorce, disability, or relocation for a job without any additional approval from Fannie Mae or Freddie Mac.

“These new guidelines demonstrate FHFA’s and Fannie Mae’s and Freddie Mac’s commitment to enhancing and streamlining processes to avoid foreclosure and stabilize communities,” said FHFA Acting Director Edward J. DeMarco. “The new standard short sale program will also provide relief to those underwater borrowers who need to relocate more than 50 miles for a job.”

Fannie Mae and Freddie Mac will waive the right to pursue deficiency judgments in exchange for a financial contribution when a borrower has sufficient income or assets to make cash contributions or sign promissory notes: Servicers will evaluate borrowers for additional capacity to cover the shortfall between the outstanding loan balance and the property sales price as part of approving the short sale.Short sales are already more common than foreclosures in many areas, and these new guidelines will probably lead to an even higher percentage of short sales next year (compared to foreclosures).

Offer special treatment for military personnel with Permanent Change of Station (PCS) orders: Service members who are being relocated will be automatically eligible for short sales, even if they are current on their existing mortgages, and will be under no obligation to contribute funds to cover the shortfall between the outstanding loan balance and the sales price on their homes.

Fannie Mae and Freddie Mac will offer up to $6,000 to second lien holders to expedite a short sale. Previously, second lien holders could slow down the short sale process by negotiating for higher amounts.

More from Fannie Mae: Fannie Mae Announces New Short Sale Guidelines

Under the new guidelines, servicers will be permitted to approve a short sale for borrowers who have certain hardships but have not yet gone into default. Those hardships include the death of a borrower or co-borrower, divorce or legal separation, illness or disability or a distant employment transfer. In addition, Fannie Mae is significantly reducing the documentation required to complete a short sale, including requiring no documentation of a borrower’s hardship 90 days or more delinquent and have a credit score lower than 620. This will remove barriers for those homeowners who are most in danger of foreclosure and increase servicer efficiency in completing a short sale.

Fannie Mae will also limit subordinate-lien payments to $6,000. Previously, subordinate lien holders often attempted to negotiate higher payments. The servicer will be able to offer the maximum payment of $6,000 in order to facilitate the transaction. By setting a standard payout amount and a limit for every transaction, Fannie Mae is removing the guess work and standardizing the transaction to help accelerate the short sale process.

... Fannie Mae completed 38,717 short sales through the first six months of 2012 and 70,025 in full year 2011.

Mortgage Delinquencies by State: Range and Current

by Calculated Risk on 8/21/2012 01:06:00 PM

Two weeks ago I posted a graph of mortgage delinquencies by state. This raised a question of how the current delinquency rate compares to before the crisis - and also a comparison to the peak of the delinquency crisis in each state.

The following graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

Click on graph for larger image.

Click on graph for larger image.

Many states have seen declines, and several states have seen significant declines in the serious delinquency rate including Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey and New York are judicial states. Florida is a judicial states - and has the highest serious deliquency rate - but Florida has seen some improvement.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

Although some states have seen significant declines in delinquency rates, all states are still above the Q1 2007 levels - and some states have seen little progress.