by Calculated Risk on 8/20/2012 11:20:00 AM

Monday, August 20, 2012

Mortgage Cramdowns: A Missed Opportunity

Binyamin Appelbaum at the NY Times reviews some of the Obama administration's missed opportunities: Cautious Moves on Foreclosures Haunting Obama

Here is an excerpt on mortgage cramdowns:

Former Representative Jim Marshall, a centrist Georgia Democrat who lost his House seat in 2010, was a staunch advocate of the administration’s economic policies. He supported the banking bailout. He opposed a similar bailout for homeowners.Both Tanta and I urged changing the bankruptcy laws to allow mortgage cramdowns. Here was a piece from Tanta in 2007 (yes, 2007) explaining mortgage cramdowns and why they were the appropriate policy: Just Say Yes To Cram Downs (For new readers, Tanta was my former co-blogger and mortgage banker. You can read about her here).

The administration made just one mistake, he said in a recent interview: it failed to rewrite the bankruptcy code.

Congressional Democrats wanted to change the law to permit “cramdown” — a term that meant letting bankruptcy courts cut mortgage debts — to put pressure on mortgage companies to modify loans and to provide a backup plan for borrowers who could not get the help they needed.

“There was another way to deal with this, and that is what I supported: forcing the banks to deal with this,” Mr. Marshall said. “It would have been better for the economy and lots of different neighborhoods and people owning houses in those neighborhoods.”

Mr. Obama sponsored cramdown legislation as a senator, endorsed it as a presidential candidate and called on Congress to pass it in the Arizona speech.

But he also repeatedly pressed the pause button. When proponents sought to add a cramdown to the Emergency Economic Stabilization Act in September 2008, Mr. Obama, who had flown back to Washington from the campaign trail, persuaded them to postpone the “partisan” effort as an example to Republicans, who said the measure would violate existing contracts.

In February 2009, after Mr. Obama became president, the White House asked Democrats not to attach the measure to the American Recovery and Reinvestment Act, fearing it would cost votes. In March, a watered-down version finally passed the House, but the mortgage industry rallied opposition to block it in the Senate.

Some officials said the White House had tried and failed. But other officials and participants, including Mr. Marshall, said it simply was not a priority.

“There wasn’t enough political capital, time or energy,” said Mr. Barr, the former Treasury deputy.

Cramdowns in bankruptcy are still an appropriate policy, and hopefully the candidates will be asked in the debates about what policies they will pursue to help the unemployed and to address foreclosures - and be asked specifically about cramdowns.

Chicago Fed: Growth in Economic Activity below trend in July

by Calculated Risk on 8/20/2012 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity increased in July

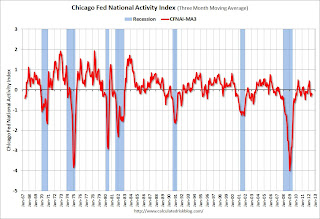

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to –0.13 in July from –0.34 in June. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased slightly from –0.18 in June to –0.21 in July—its fifth consecutive reading below zero. July’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth was below trend in July.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, August 19, 2012

Sunday Night Futures

by Calculated Risk on 8/19/2012 09:30:00 PM

My baseline scenario is for economic growth to remain sluggish but to start to increase as housing improves and the impact of state and local austerity subsides. I think QE3 remains likely, although the timing is still uncertain. My baseline also assumes that some sort of reasonable resolution to the "fiscal cliff" is found, that the European crisis doesn't take down the world economy and that President Obama is reelected.

The Asian markets are mostly green tonight, with the Nikkei up 0.5% and the Shanghai Composite up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down slightly, and the DOW futures down about 4 points.

Oil prices are moving up again with WTI futures are at $96.21 and Brent is at $114.10 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.69 per gallon.

Yesterday:

• Summary for Week Ending Aug 17th

• Schedule for Week of Aug 19th

Two more questions for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Gasoline Prices up 30 cents over last 7 weeks

by Calculated Risk on 8/19/2012 06:56:00 PM

Just filled up my car, and I paid $4.11 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.68 per gallon. That is about the current level according to Gasbuddy.com (see graph below). In California, where I live, gasoline prices are always higher than the national average. Update: Some of the recent increase in California was due to the refinery fire in Richmond

The following graph shows the recent increase in gasoline prices. Gasoline prices are down from the peak in early April, but up about 30 cents over the last seven weeks. Note: This will push up the headline CPI numbers.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Weekend:

• Summary for Week Ending Aug 17th

• Schedule for Week of Aug 19th

Report: ECB Considering setting limits on Sovereign Debt Yields

by Calculated Risk on 8/19/2012 12:15:00 PM

The European crisis will be back in the headlines soon ...

From Bloomberg: ECB May Set Yield Limits on Euro Sovereign Bonds, Spiegel Says

The European Central Bank is considering setting limits on yields of euro area sovereign debt by pledging unlimited bond purchases, Germany’s Spiegel magazine reported ...On Thursday German Chancellor Merkel and French President Hollande will meet in Berlin, and on Friday, the Spanish Government is expected to announce the details of the bank bailout. Also on Friday, Greek Prime Minister Samaras and German Chancellor Merkel will meet in Berlin with a press conference to follow.

The following week, the Jackson Hole Economic Symposium starts on Thursday, with Fed Chairman Ben Bernanke speaking on Friday, August 31st at 10 AM ET, and ECB President Mario Draghi speaking on Saturday, September 1st at 10 AM.