by Calculated Risk on 8/15/2012 09:54:00 PM

Wednesday, August 15, 2012

Thursday: Housing Starts, Weekly Unemployment Claims, Philly Fed Index

First, informative reading from Bond Girl at Nemo's site: The well-known story of municipal bond defaults

And from Jim Hamilton at Econbrowser: Recent developments in oil markets

And from Tim Duy at Economist'sView: Data Dump

• At 8:30 AM ET, Housing Starts for July will be released. The consensus is for total housing starts to decrease to 750,000 (SAAR) in July, down from 760,000 in June.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand last week. Initial weekly unemployment claims have been declining recently, and the 4-week average last week was just above the post-bubble low of 363,000.

• At 10:00 AM, the Philly Fed Survey for August will be released. This has been negative the last three months with readings of -5.8, -16.6 and -12.9. The consensus is for another negative reading of -5.0 in August (above zero indicates expansion).

Another question for the monthly economic prediction contest:

Jackson Hole Economic Symposium 2012 Dates

by Calculated Risk on 8/15/2012 07:16:00 PM

The Kansas City Fed doesn't publicly release the dates of the symposium ahead of time. I'll post the schedule when it is available, but here are a few tentative details:

• Jackson Hole Economic Symposium, Thursday, August 30th through Saturday, Sept 1st.

• Fed Chairman Ben Bernanke speaks on Friday, August 31st at 10 AM ET.

• ECB President Mario Draghi speaks on Saturday, September 1st at 10 AM.

Note: Markets will be closed the following Monday for Labor Day on September 3rd.

Here are a few other more dates:

• Political conventions: Republicans August 27–30 in Tampa, and Democrats September 3–6 in Charlotte. The election is on November 6th.

• September 3rd, EU Finance Minsters Meeting.

• September 6th, Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

• September 12th at 6 AM ET, Germany's Constitutional Court is expected to rule on the new eurozone bailout fund and fiscal treaty.

• September 12th and 13th: the Federal Open Market Committee (FOMC) meets. After this meeting the FOMC will release updated Summary of Economic Projections, and Fed Chairman Ben Bernanke will hold a press conference. Major economic releases before the FOMC meeting: August 29th, second estimate of Q2 GDP, and September 7th, the August employment report. PCE price index for July will be released on August 30th.

• Mid-September: Euro-zone finance ministers' informal meetings in Nicosia.

• October 4th, Governing Council meeting of the European Central Bank in Ljubljana with a press conference to follow.

• October 8th, Finance Ministers meeting in Luxembourg.

• European Council meeting, October 18th and 19th in Brussels.

• October 23rd and 24th: the Federal Open Market Committee (FOMC) meets.

July Update: Early Look at 2013 Cost-Of-Living Adjustments indicates 1% increase

by Calculated Risk on 8/15/2012 04:38:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.3 percent over the last 12 months to an index level of 225.568 (1982-84=100). For the month, the index decreased 0.2 percent prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was last year (2011), at 223.233, we only have to compare to last year. Note: The last few years we needed to compare to Q3 2008 since that was the previous highest Q3 average.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2011 average. If the current level holds, COLA would be around 1.0% for next year (the current 225.568 divided by the Q3 2011 level of 223.233). With the recent increases in oil and gasoline prices, CPI-W might increase some in August and September, and COLA might be closer to 1.5%.

This is early - we need the data for August and September - but it appears COLA will be slightly positive next year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2011 yet, but wages probably didn't increase much from 2010. If wages increased the same as last year, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $112,500 from the current $110,100.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

WSJ: Articles on Shadow Inventory

by Calculated Risk on 8/15/2012 02:38:00 PM

Two articles on shadow inventory ...

Yesterday morning from Nick Timiraos at the WSJ: Shadow Inventory: It’s Not as Scary as It Looks

While the shadow is very large, one often-overlooked fact is that the shadow isn’t nearly as large as it was two years ago.And today from Timiraos at the WSJ: Shadow Inventory: Monitor Banks’ Speed, Not Just Volume

...

Barclays Capital estimates that at the end of May there were around 1.8 million mortgages in the foreclosure process and another 1.45 million where borrowers have missed at least three payments. That puts the total number of properties that could be repossessed and resold by banks at around 3.25 million mortgages.

...

But it is down from a peak of 4.25 million in February 2010.

...

[Housing analyst Ivy Zelman] published an in-depth research note earlier with the title: “Shining a bright light on the shadow: Why what’s lurking doesn’t concern us.” In it, she explains how it’s more important to focus on the pace at which foreclosures are being liquidated, and not the absolute number.

“Just like the Wizard of Oz, shadow inventory is not very intimidating once you pull back the curtain,” the report said.

“If you don’t understand the shadow inventory, it’s very ominous and concerning,” says Ivy Zelman, chief executive of Zelman & Associates. “But if you understand the flows and how it is brought to market” it looks less intimidating, she says.I discussed some of this yesterday in House Prices and a Foreclosure Supply Shock

...

Nationally, Barclays estimates that the number of bank-owned properties will decline a bit more this year, before accelerating next year to a peak of around 575,000 in early 2014.

...

Meanwhile, as the shadow inventory has dropped over the past year and as banks and states have slowed down the process, demand has picked up. That’s especially the case for foreclosed properties at low price points ...

Key Measures show slowing inflation in July

by Calculated Risk on 8/15/2012 12:10:00 PM

Note: This is the last inflation report before the September FOMC meeting (the August report will be released September 14th and the FOMC meeting is Sept 12th and 13th).

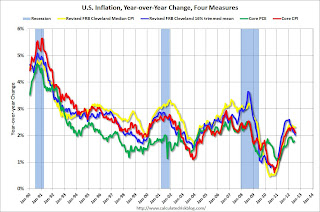

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat at 0.0% (0.6% annualized rate) in July. The CPI less food and energy increased 0.1% (1.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.0%, and core CPI rose 2.1%. Core PCE is for June and increased 1.8% year-over-year.

These measures suggest inflation is now at the Fed's target of 2% on a year-over-year basis and it appears the inflation rate is slowing. On a monthly basis (annualized), two of these measure were well below the Fed's target; trimmed-mean CPI was at 1.3%, Core CPI at 1.1% - although median CPI was at 2.5% and and Core PCE for June was at 2.5%. Based on initial data - and comparing to the increase in August 2011 - it is very likely that the August report will show a further decline in the year-over-year inflation rate.