by Calculated Risk on 7/19/2012 10:00:00 AM

Thursday, July 19, 2012

Existing Home Sales in June: 4.37 million SAAR, 6.6 months of supply

The NAR reports: June Existing-Home Prices Rise Again, Sales Down with Constrained Supply

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 5.4 percent to a seasonally adjusted annual rate of 4.37 million in June from an upwardly revised 4.62 million in May, but are 4.5 percent higher than the 4.18 million-unit level in June 2011.

...

Total housing inventory at the end June fell another 3.2 percent to 2.39 million existing homes available for sale, which represents a 6.6-month supply at the current sales pace, up from a 6.4-month supply in May. Listed inventory is 24.4 percent below a year ago when there was a 9.1-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2012 (4.37 million SAAR) were 5.4% lower than last month, and were 4.5% above the June 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.39 million in June from the downwardly revised 2.47 million in May (revised down from 2.49 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory declined to 2.39 million in June from the downwardly revised 2.47 million in May (revised down from 2.49 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.Months of supply increased to 6.6 months in June.

This was below expectations of sales of 4.65 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Weekly Initial Unemployment Claims increase to 386,000

by Calculated Risk on 7/19/2012 08:37:00 AM

The DOL reports:

In the week ending July 14, the advance figure for seasonally adjusted initial claims was 386,000, an increase of 34,000 from the previous week's revised figure of 352,000. The 4-week moving average was 375,500, a decrease of 1,500 from the previous week's revised average of 377,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 375,500.

The sharp decline last week due to onetime factors, and some increase was expected.

And here is a long term graph of weekly claims:

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.Wednesday, July 18, 2012

Thursday: Existing Home Sales, Philly Fed, Unemployment Claims

by Calculated Risk on 7/18/2012 09:31:00 PM

Existing home sales for June is the key release on Thursday. Most of the focus will be on sales, but the key numbers are inventory and months-of-supply.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.65 million on seasonally adjusted annual rate (SAAR) basis, up from 4.55 million in May.

• Also at 10:00 AM, Philly Fed Survey for July will be released. This survey really surprised to the downside in June, and the consensus is for a reading of -8.0, up from -16.6 last month (below zero indicates contraction).

• Also at 10:00 AM, the Conference Board Leading Indicators for June will be released. The consensus is for a 0.1% decrease in this index.

Earlier:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

• Starts and Completions: Multi-family and Single Family

• August 1st QE3 Departure Date?

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 7/18/2012 05:12:00 PM

Halfway through 2012, single family starts are on pace for over 500 thousand this year, and total starts are on pace for about 730 thousand. That is above the forecasts for most analysts (however Lawler and the NAHB were close).

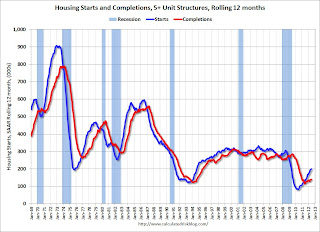

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

For the fifth consecutive month, the rolling 12 month total for starts has been above completions - that usually only happens after housing has bottomed.

Earlier on housing starts:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "largely positive"

by Calculated Risk on 7/18/2012 02:00:00 PM

Reports from most of the twelve Federal Reserve Districts indicated that overall economic activity continued to expand at a modest to moderate pace in June and early July.This is a downgrade from the previous beige book that reported "moderate" growth.

And on real estate:

Reports on residential housing markets remained largely positive. Sales were characterized as improving in Philadelphia, New York, Richmond, Chicago, St. Louis, and Minneapolis, while home sales increased in Boston, Cleveland, Atlanta, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco."Prepared at the Federal Reserve Bank of Atlanta and based on information collected before July 9, 2012."

...

Most Districts reported declines in home inventories. Homes prices have begun to stabilize in some markets and price increases were noted in select markets. Boston and Atlanta noted that appraisals were coming in below market prices.

...

Rental markets continued to strengthen by most accounts.

...

Recent activity in commercial real estate markets has been mixed. Modest improvements were noted in Boston, Atlanta, and St. Louis and demand strengthened in the San Francisco District. Softer conditions were reported in the New York and Richmond Districts, while demand held steady in the Philadelphia and Dallas Districts. Nonresidential construction activity varied as well.

More sluggish growth, but still "modest to moderate". And a few positive comments on residential real estate ...