by Calculated Risk on 7/15/2012 04:13:00 PM

Sunday, July 15, 2012

Gasoline Prices: "Comparative stability"

From Reuters: Gasoline prices fall more, but slide may be over: survey

The Lundberg Survey said the national average price of self-serve, regular gas was $3.41 on July 13, down from $3.478 on June 22, and from $3.615 a year ago.Oil prices have rebounded some. Brent is back up to $102.62 per barrel (after falling to $89 per barrel on June 25th), and WTI is up to $87.10.

...

Gasoline prices have fallen 14 percent from a recent peak of $3.967 a gallon set on April 6.

Trilby Lundberg ...said prices may soon enter a period of "comparative stability,"...

Professor Hamilton recently presented a calculator from Political Calculations that estimates the cost of gasoline based on Brent oil prices. Currently this suggests a price of around $3.40 per gallon - about the current price.

The following graph shows the decline in gasoline prices. Gasoline prices are down significantly from the peak in early April, but up a few cents over the last two weeks.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week Ending July 13th

• Schedule for Week of July 15th

Fed's Lockhart on Monetary Policy

by Calculated Risk on 7/15/2012 10:28:00 AM

On Friday afternoon, one of the undecided FOMC members, Atlanta Fed President Dennis Lockhart appeared to move closer to voting for QE3 now. Back in June, Lockhart said he viewed the current "policy stance as appropriate". But, based on incoming data, his views are changing.

From Lockhart on Friday: The Debate Over Further Monetary Action. Excerpt:

The question that the members of the FOMC confront is whether there is more that can be done to address the related challenges of slower GDP growth and tepid job creation. So, to wind up, let me give you my take on the key questions underlying a decision to bring on more monetary stimulus.Although Lockhart weighed both sides of each issue in his speech, he concludes: 1) the risks of QE3 are "manageable", 2) QE3 will be modestly effective, and 3) his earlier forecast is becoming "untenable" and that means he will support more accommodation if the recent weak data continues.

I think the output gap—the amount of slack in the economy—is neither as sizeable as the high-end estimates, nor is it zero. ... I do not think a compelling case has yet been made that structural adjustment has played a dominant role in slowing growth and progress against unemployment.

On the risk associated with the balance sheet: in my judgment, some further use of the balance sheet to promote continued recovery and/or financial stability brings with it manageable risks. I think reversal of the cumulative balance sheet scale and maturity structure can be accomplished in an orderly manner. But the step of additional balance sheet expansion should be undertaken very judiciously. Such a step would take us further into uncharted territory.

On the likely effectiveness of further monetary stimulus—a policy that would necessarily be brought to bear at least in part through credit channels—I think we should have modest expectations about what further action can accomplish. I do not think this means monetary policy is impotent or has reached its limit. But I don't see more quantitative easing or similar policy action as a miracle cure, especially absent fixes in policy areas outside the central bank's purview.

So, as one policymaker, here's my situation: my support for the current stance of policy rests on a forecast that sees a step-up of output and employment growth by year-end and into 2013. If the economy continues on the track indicated by the most recent incoming data and information, that forecast will become untenable, as will the policy premises underlying it.

Next up will be Fed Chairman Ben Bernanke's Semiannual Monetary Policy Report to the Congress on Tuesday and Wednesday. QE3 is coming. It is just a question of when.

Saturday, July 14, 2012

NY Times: Possible Criminal Charges in LIBOR Scandal

by Calculated Risk on 7/14/2012 09:40:00 PM

From the NY Times DealBook: U.S. Is Building Criminal Cases in Rate-Fixing

The [Justice Department]’s criminal division is building cases against several financial institutions and their employees, including traders at Barclays ... The prospect of criminal cases is expected to rattle the banking world and provide a new impetus for financial institutions to settle with the authorities. The Justice Department investigation comes on top of private investor lawsuits and a sweeping regulatory inquiry led by the Commodity Futures Trading Commission.The questionable reliability of LIBOR was widely discussed in early 2008 - and iwe are finally seeing fines and possibly criminal charges.

The multiyear investigation has ensnared more than 10 big banks in the United States and abroad. With the prospects of criminal action, several firms, including at least two European institutions, are scrambling to arrange deals ...

According to people briefed on the matter, the Swiss bank UBS is among the next targets for regulatory action. ...

in April 2008, a senior enforcement official at the Commodity Futures Trading Commission, Vincent McGonagle, opened an investigation. ... At first the case stalled as the agency waited months to receive millions of pages of documents when Barclays pushed back ... By the fall of 2009, the trading commission received a trove of information, providing a broad view into the wrongdoing.

Earlier:

• Summary for Week Ending July 13th

• Schedule for Week of July 15th

Unofficial Problem Bank list declines to 912 Institutions

by Calculated Risk on 7/14/2012 05:05:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 13, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

We will have to wait until next week for the OCC to release its enforcement actions through mid-June 2012. As such, it was a quiet week for the Unofficial Problem Bank List with two removals and one addition. The changes leave the list with 912 institutions with assets of $352.9 billion. A year ago, the list held 995 institutions with assets of $416.2 billion.Earlier:

The addition is The Bank of Southern Connecticut, New Haven, CT ($134 million Ticker: SSE). The removals include an action termination against Tower Bank & Trust Company, Fort Wayne, IN ($651 million Ticker: TOFC) and the failed Glasgow Savings Bank, Glasgow, MO ($25 million).

The FDIC estimated the failure cost of Glasgow Savings Bank at $100 thousand or 0.4 percent of its assets. That is the lowest cost failure in this crisis without the winning bidder paying a deposit premium or receiving a loss share agreement. With such a small cost, it is surprising the bank could not recapitalize itself or shrink to increase its capital ratios.

Authorities are still searching for Aubrey Lee Price, the director that embezzled at least $17 million from Montgomery Bank & Trust, which failed last week. The FBI has placed Price on the Most Wanted List and offered a $20 thousand reward for information that leads to his arrest. Stories are starting to surface about the investors he bilked including this woman that lost her life savings. This should serve as a lesson to never place all of your savings with one institution or financial advisor.

Missing banker accused of fraud in Sarasota

Investor: Missing bank director Aubrey Lee Price stole my life savings

• Summary for Week Ending July 13th

• Schedule for Week of July 15th

Schedule for Week of July 15th

by Calculated Risk on 7/14/2012 12:45:00 PM

Earlier:

• Summary for Week Ending July 13th

This will be a very busy week for economic data. Key reports include retail sales, housing starts, and existing home sales for June.

For manufacturing, the Fed will release the June Industrial Production and Capacity Utilization, and two regional surveys will be released for July (the first look at manufacturing in July).

On prices, CPI will be released on Tuesday.

Investors will focus on Fed Chairman Ben Bernanke's testimony on Tuesday and Wednesday for hints about QE3.

8:30 AM ET: Retail Sales for June.

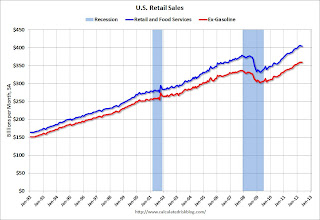

8:30 AM ET: Retail Sales for June. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 22.1% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.2% in June, and for retail sales ex-autos to increase 0.l%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. The consensus is for a reading of 4.5, up from 2.3 in June (above zero is expansion).

10:00 AM: Manufacturing and Trade: Inventories and Sales for May (Business inventories). The consensus is for 0.3% increase in inventories.

8:30 AM: Consumer Price Index for June. The consensus is for headline CPI to be unchanged in June. The consensus is for core CPI to increase 0.2%.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 30, up slightly from 29 in June. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. Total housing starts were at 708 thousand (SAAR) in May, down 4.8% from the revised April rate of 744 thousand (SAAR). Note that April was revised up from 717 thousand. March was revised up too.

The consensus is for total housing starts to increase to 745,000 (SAAR) in June from 708,000 in May.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for signs of a slowdown.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.65 million on seasonally adjusted annual rate (SAAR) basis, up from 4.55 million in May.

A key will be inventory and months-of-supply.

10:00 AM: Philly Fed Survey for July. The consensus is for a reading of -8.0, up from -16.6 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for June. The consensus is for a 0.1% decrease in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for June 2012