by Calculated Risk on 7/03/2012 08:50:00 PM

Tuesday, July 03, 2012

House Prices: Goldman sort of Calls the Bottom

Goldman Sachs put out a research note today: House Prices Finding a Bottom. This isn't a strong call, and is only a slight upward revision to their previous forecast. As they note, there are many factors adding to the "noise" in the house price indexes (distressed sales, foreclosure moratorium, recent warm weather), and a 0.2% increase in prices over the next year isn't much.

A few brief excerpts:

[O]ur model projects a nominal house price gain of 0.2% from 2012Q1 to 2013Q1 and another 1.4% from 2012Q1 to 2013Q1. Taken literally, this would imply that the bottom in nominal house prices is now behind us.

While the recent house price news is encouraging, we would not yet sound the "all clear" for the housing market or the broader economy. First, the instability in the seasonal factors over the past few years is a potential source of noise in the recent house price indicators, and also in our model. ... In addition, the seasonal factors can be also distorted by one-off items ... All of these complications ... adds to the uncertainty as to whether the better recent numbers indicate a true turnaround in the US housing market.

Second, even if the market is gradually turning, as our model implies, the difference between a slightly declining and a slightly increasing national average for home prices is minor, especially given the wide variation between stronger and weaker markets. Our broad view remains that national home prices will remain close to flat over the next 1-2 years, or at a minimum that the recovery will remain very "U-shaped."

U.S. Light Vehicle Sales at 14.1 million annual rate in June

by Calculated Risk on 7/03/2012 03:52:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.08 million SAAR in June. That is up 22% from June 2011, and up 2.6% from the sales rate last month (13.73 million SAAR in May 2012).

This was above the consensus forecast of 13.9 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 14.08 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

June was the weakest month this year, and the year-over-year increase was large because of the impact of the tsunami and related supply chain issues in May 2011.

Sales have averaged a 14.28 million annual sales rate through the first half of 2012, up sharply from the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Sales will probably increase some more, but most of the recovery from the depth of the recession has already happened.

Manufacturing vs. Housing

by Calculated Risk on 7/03/2012 01:28:00 PM

Note on Auto Sales: I should have an estimate for the June Seasonally Adjusted Annual Rate (SAAR) around 4 PM ET.

A note on manufacturing vs. housing: The ISM manufacturing index dropped below 50 for the first time since July 2009 (below 50 indicates contraction). And the JPMorgan Global Manufacturing PMI also fell below 50.

Meanwhile, in the US, housing is picking up. Housing starts have been increasing, residential construction spending is up 17% from the recent low, and new home sales have averaged 353 thousand on an annual rate basis over the first 5 months of 2012, after averaging under 300 thousand for the previous 18 months.

If someone looked at just manufacturing, they might think the US is near a recession. And if they just looked at housing, they'd think the economy is recovering. Which is it?

First, the decline in the ISM index was partially driven by exports (no surprise given the problems in Europe and slowdown in China). The ISM export index declined to 47.5 in June from 53.5 in May, the lowest level since early 2009. However some of this export weakness will probably be offset by lower oil and gasoline prices.

Second, the current ISM reading of 49.7 isn't all that weak. Goldman Sachs analysts noted yesterday: "A reading such as this has historically been associated with just under 2% real GDP growth--very near our current second-quarter tracking estimate of 1.6%."

Third, housing is usually a better leading indicator for the US economy than manufacturing. Historically housing leads the economy both into and out of recessions (not out of the recession this time because of the excess supply in 2009). Manufacturing is more coincident. So the ISM index suggests some weakness now - mostly abroad - whereas housing suggests an ongoing sluggish recovery.

Who ya gonna call? Housing.

FHFA: "Robust" Market Reponse to Bulk REO Pilot Program

by Calculated Risk on 7/03/2012 11:54:00 AM

From the FHFA: FHFA Announces Next Steps in REO Pilot Program

The Federal Housing Finance Agency (FHFA) today announced that the winning bidders in a real estate owned (REO) pilot initiative have been chosen and transactions are expected to close early in the third quarter. Market response has been robust with strong qualified bidder interest.This transaction will close soon, but will this program be expanded? I'm trying to find out ...

“FHFA undertook this initiative to help stabilize communities and home values in areas hard-hit by the foreclosure crisis,” said Edward J. DeMarco, Acting Director of FHFA. “As conservator of Fannie Mae and Freddie Mac, we believe this pilot program will assist us in achieving our objectives and help to maximize the benefit to taxpayers. We are pleased with the response from the market and look forward to closing transactions in the near future.”

FHFA launched the pilot program in late February, and in the second quarter bids were solicited from qualified investors to purchase approximately 2,500 single-family Fannie Mae foreclosed properties. Fannie Mae offered for sale pools of properties in geographically concentrated locations across the United States.

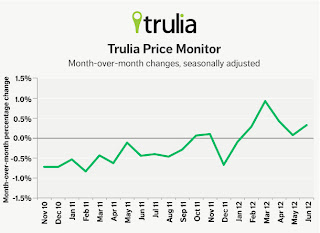

Trulia: Asking House Prices increased in June

by Calculated Risk on 7/03/2012 10:15:00 AM

Press Release: Rent increases outpace home prices rises, reports Trulia

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor ... Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through June 30, 2012.More from Jed Kolko, Trulia Chief Economist: Rising Home Prices Can’t Keep Up with Rent Increases

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 0.3 percent in June month over month (M-o-M), seasonally adjusted. With the exception of nearly flat prices in May, prices rose in four of the past five months. Asking prices in June rose nationally 0.8 percent quarter over quarter (Q-o-Q), seasonally adjusted. Year-over-year (Y-o-Y) asking prices rose by 0.3 percent; excluding foreclosures, asking prices rose Y-o-Y by 1.7 percent. Nationally, 44 out of the 100 largest metros had Y-o-Y price increases, and 84 out of the 100 largest metros had Q-o-Q price increases, seasonally adjusted.

However, seven of the 10 metros with the largest increase in asking prices also have a high share of homes in foreclosure, including Phoenix, the Florida metros, and Detroit and its suburbs. These coming foreclosures threaten to reduce or reverse recent price gains in those markets. In contrast, Denver, San Jose, Pittsburgh, Little Rock, Austin and Colorado Springs all had price gains of more than 4 percent with a moderate or low share of homes in foreclosure.

According to Trulia, rents are increasing even faster than house prices.

On rents from Bloomberg: Manhattan First-Time Apartment Buyers Grab Deals in Slow Market (ht Mike In Long Island)

“Rents are just so high right now that for a lot of people it doesn’t make sense” to continue leasing, said Sofia Song, vice president of research at StreetEasy. “A lot of people are saying, ‘You know what? For this amount of money I can probably buy something.’”Of course Manhattan is its own world, but it does appear rents are increasing in many communities.

Click on graph for larger image.

Click on graph for larger image.This graph shows the change in asking house prices in June, adjusted for the mix and seasonal factors. Although these are just asking prices, this suggests prices have continued to increase through June, and that seasonally adjusted closing prices will continue to increase through July and August on the repeat sales indexes.