by Calculated Risk on 6/28/2012 05:00:00 PM

Thursday, June 28, 2012

Europe: Growth Pact Update

There is a little news from the European summit meeting:

Herman Van Rompuy, President of the European Council did tweet:

With the #GrowthCompact we will boost the financing of the economy by mobilising around EUR 120 bn for immediate growth measures.This is the plan that was discussed last week.

Rompuy also wrote:

A EUR 10 bn increase of the EIB capital will increase the bank's overall lending capacity by EUR 60 bn. This money must flow across Europe.Earlier Angela Merkel cancelled a planned press conference.

The Financial Times is live blogging the European summit: EU summit: Live blog

Van Rompuy says no agreement yet on growth pact because they haven’t finished discussing all the chapters yet. He would not confirm it was being blocked by either Mario Monti or David Cameron; it was simply unfinished. He said two countries were most concerned to see agreement on both long and short term together – he didn’t name them, but Germany and Italy are the most likely suspects. Both inclined to say no agreement until it is all agreed.Meanwhile Bloomberg is reporting there is agreement: EU Leaders Agree 120 Billion-Euro Pact to Promote Growth, Jobs

excerpt with permission

A QE Timeline

by Calculated Risk on 6/28/2012 02:04:00 PM

By request, here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

This graph show the S&P 500 and the Fed actions.

Click on graph for larger image.

Kansas City Fed: Growth in Regional Manufacturing Activity Slowed in June

by Calculated Risk on 6/28/2012 11:03:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Eased Further Activity Slowed

Growth in Tenth District manufacturing activity slowed in June, and expectations eased as producers grew more uncertain.. ...The regional manufacturing surveys were mostly weaker in June, especially the Philly Fed index.

The month-over-month composite index was 3 in June, down from 9 in May and equal to 3 in April ... The production index eased from 17 to 12, and the new orders index fell back into negative territory after rising slightly last month. Order backlogs continued to ease. The employment index moved lower but remained positive, while the new orders for exports index decreased.

Price indexes moderated for the second straight month, including an actual decline in monthly selling prices. The month-over-month finished goods price index dropped from 0 to -4, its lowest level since mid-2010, and the raw materials price index also decreased.

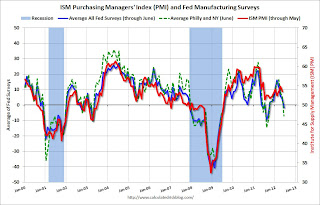

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

The ISM index for June will be released Monday, July 2nd, and these surveys suggest some decrease from the 53.5 reading in May.

Weekly Initial Unemployment Claims mostly unchanged

by Calculated Risk on 6/28/2012 08:30:00 AM

The DOL reports:

In the week ending June 23, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 6,000 from the previous week's revised figure of 392,000. The 4-week moving average was 386,750, a decrease of 750 from the previous week's revised average of 387,500.The previous week was revised up from 387,000 to 392,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined slightly to 386,750.

This is just off the high for the year.

And here is a long term graph of weekly claims:

This was near the consensus forecast of 385,000 and suggests some renewed weakness in the labor market.

This was near the consensus forecast of 385,000 and suggests some renewed weakness in the labor market.Wednesday, June 27, 2012

Tomorrow: Unemployment Claims, Q1 GDP (third estimate)

by Calculated Risk on 6/27/2012 10:30:00 PM

The focus tomorrow will be on the start of the two day European summit in Brussels, and also on the SCOTUS ruling on the health care law. The ruling on the Affordable Care Act is expected a little after 10 AM ET. (the SCOTUSblog is a good resource).

On Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 385 thousand from 387 thousand last week.

• Also at 8:30 AM, the third estimate of Q1 GDP will be released. The consensus is that real GDP increased 1.9% annualized in Q1; no change from the 2nd estimate.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for June will be released this is the last of the regional Fed surveys for June, and three out of four have been below expectations. The consensus is for a decrease to 4 from 9 in May (above zero is expansion).