by Calculated Risk on 6/20/2012 10:42:00 PM

Wednesday, June 20, 2012

Look Ahead: Existing Home Sales

Existing home sales for May is the key economic release on Thursday. And somewhat related, here is an interesting article on construction in Phoenix, from Bloomberg: Arizona’s Homebuilding Revival Sparks Bidding Wars for Workers (ht Brian)

After being decimated by the housing crash, Arizona’s builders are now scrounging for workers as demand for new homes climbs. Building permits are at an almost three-year high, creating a scarcity of framers, roofers and masons, many of whom moved elsewhere when work dried up. ...On Thursday:

Construction jobs, which also include commercial and government projects, increased 9.3 percent in May from a year earlier to 120,300, the biggest gain of any industry in the state, according to Arizona’s Office of Employment and Population Statistics. ...

“The industry is so wound down that it’s hard to flip the switch on and build as many homes as there is demand right now,” said Ben Sage, director of the Arizona region for Metrostudy, a Houston-based firm that tracks new construction. “The subcontractors are scrambling for workers.”

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 383 thousand from 386 thousand last week.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for June. The consensus is for a reading of 53.8, down slightly from 53.9 in May.

• At 10:00 AM, the NAR is scheduled to release existing home sales for May. The consensus is for sales of 4.57 million on seasonally adjusted annual rate (SAAR) basis. Housing economist Tom Lawler is forecasting the NAR will report sales of 4.66 million in May.

• Also at 10:00 AM, the Philly Fed manufacturing survey for June (consensus 0.5), the FHFA house price index for April, and the Conference Board Leading Indicators for May (consensus no change) will be released.

Bernanke Paves the Way for QE3 on August 1st

by Calculated Risk on 6/20/2012 06:20:00 PM

At the January press conference, Fed Chairman Ben Bernanke hinted at further accommodation (QE3) based on incoming data. Then the January and February employment reports were above expectations, and inflation also picked up a little due to the surge in oil and gasoline prices.

In April, based on the stronger data, the FOMC participants revised up their projections for GDP and inflation, and revised down their projections for the unemployment rate - and QE3 was put on hold.

Compare the current projections released today (below) not just with the April projections, but with the January projections. GDP is below the projections in January, and inflation is also below the January projection.

Only the unemployment rate is slightly improved from the January projections - and then only for 2012 - 2013 and 2014 are now worse. As Tim Duy wrote, the projections are "shocking".

[T]his is a significant downward revision to the forecast for not just this year, but next year as well. Moreover, they expect no meaningful progress on the unemployment rate and the PCE inflation forecast remains centered well below 2%.In the press conference today, Bernanke made it clear that further accommodation is very likely if employment indicators don't improve soon. He also pointed out that the Fed can't do any more "twisting" because of the lack of short duration securities.

And that strongly suggests QE3 following the two day meeting ending August 1st.

Also the FOMC statement was changed to "The Committee is prepared to take further action as appropriate ..." from "The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate ...". A little more aggressive.

One of the reasons I thought QE3 was unlikely today was the lack of foreshadowing from the Fed. Now the markets are prepared - and unless employment indicators pick up significantly, QE3 seems very likely. (Note: There is only one employment report between now and the next FOMC meeting - the June report on July 6th. Otherwise the Fed will rely on weekly unemployment claims and other indicators).

It is possible the Fed will wait until September (depending on incoming data), but right now I think QE3 will arrive on August 1st.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

| April 2012 Projections | 2.4 to 2.9 | 2.7 to 3.1 | 3.1 to 3.6 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

| April 2012 Projections | 7.8 to 8.0 | 7.3 to 7.7 | 6.7 to 7.4 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

| April 2012 Projections | 1.9 to 2.0 | 1.6 to 2.0 | 1.7 to 2.0 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

Census: Number of Shared Households increased 2.25 million from 2007 to 2010

by Calculated Risk on 6/20/2012 04:25:00 PM

From the Census Bureau: Sharing a Household: Household Composition and Economic Well-Being: 2007–2010

In spring 2007, there were 19.7 million shared households. By spring 2010, the number of shared households had increased by 11.4 percent, while all households increased by only 1.3 percentAccording to the report, there were 22.0 million shared households in spring 2010.

Most of the adults sharing a household were related:

In both 2007 and 2010, additional adults were more likely to live with relatives than with nonrelatives. In 2010, additional adults related to the householder accounted for 81.8 percent of all additional adults. ... additional adults related to the householder rose by 2.4 million ... Additional adults not related to the householder, i.e., roomates, housemates, or boarders, increased by 910,000 between 2007 and 2010.About 1.2 million were adult children of the householder (823 thousand were in the 25 to 34 age bracket). These are the people that we discussed as "moving into their parent's basement". Other relatives moving in included parents, siblings, adult grandchildren (190 thousand), and others.

Definition from Census:

This report classifies a shared household as a household which includes at least one “additional adult,” a person aged 18 or older who is not enrolled in school and who is neither the householder, the spouse, nor the cohabiting partner of the householder.A large number of these adults will eventually move out of their parent's (grandparent's) homes. The recent surge in rental demand suggests that many of these people are already moving out. This will be demand for housing units, although mostly for rental units.

FOMC Projections and Bernanke Press Conference

by Calculated Risk on 6/20/2012 02:00:00 PM

Here are the updated projections from the FOMC meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Live Video streaming by Ustream

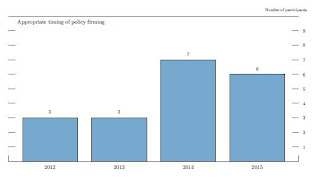

Below are the update projections starting with when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate. I've included the chart from the April meeting to show the change.

Click on graph for larger image.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

There was a shift to 2015 with two additional participants.

A key is the same number of participants think the FOMC should raise rates before 2014.

Most participants still think the Fed Funds rate will be in the current range into 2014.

On the projections, GDP was revised down, unemployment rate up, and inflation down.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

| April 2012 Projections | 2.4 to 2.9 | 2.7 to 3.1 | 3.1 to 3.6 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

GDP projections have been revised down for 2012, and revised down for 2013 and 2014.

The unemployment rate increased to 8.2% in April, and the projection for 2012 has been revised up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

| April 2012 Projections | 7.8 to 8.0 | 7.3 to 7.7 | 6.7 to 7.4 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

The forecasts for overall and core inflation were revised down to reflect the recent decrease in inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

| April 2012 Projections | 1.9 to 2.0 | 1.6 to 2.0 | 1.7 to 2.0 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

| April 2012 Projections | 1.8 to 2.0 | 1.7 to 2.0 | 1.8 to 2.0 |

| January 2012 Projections | 1.5 to 1.8 | 1.5 to 2.0 | 1.6 to 2.0 |

FOMC Statement: Continue Twist through end of Year

by Calculated Risk on 6/20/2012 12:30:00 PM

Information received since the Federal Open Market Committee met in April suggests that the economy has been expanding moderately this year. However, growth in employment has slowed in recent months, and the unemployment rate remains elevated. Business fixed investment has continued to advance. Household spending appears to be rising at a somewhat slower pace than earlier in the year. Despite some signs of improvement, the housing sector remains depressed. Inflation has declined, mainly reflecting lower prices of crude oil and gasoline, and longer-term inflation expectations have remained stable.At 2:00 PM, the FOMC Forecasts will be released, and at 2:15 PM, Fed Chairman Ben Bernanke will hold a press briefing.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects economic growth to remain moderate over coming quarters and then to pick up very gradually. Consequently, the Committee anticipates that the unemployment rate will decline only slowly toward levels that it judges to be consistent with its dual mandate. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee anticipates that inflation over the medium term will run at or below the rate that it judges most consistent with its dual mandate.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities. Specifically, the Committee intends to purchase Treasury securities with remaining maturities of 6 years to 30 years at the current pace and to sell or redeem an equal amount of Treasury securities with remaining maturities of approximately 3 years or less. This continuation of the maturity extension program should put downward pressure on longer-term interest rates and help to make broader financial conditions more accommodative. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. The Committee is prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed continuation of the maturity extension program.

Here is the previous FOMC Statement for comparison.