by Calculated Risk on 6/15/2012 03:01:00 PM

Friday, June 15, 2012

LA area Port Traffic: Imports down YoY, Exports mostly unchanged in May

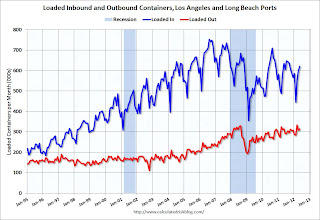

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for May. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is down about 0.2%, and outbound traffic is unchanged compared to April.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of May, loaded outbound traffic was down 2.4% compared to May 2011, and loaded inbound traffic was unchanged compared to May 2011.

For the month of May, loaded outbound traffic was down 2.4% compared to May 2011, and loaded inbound traffic was unchanged compared to May 2011.

This suggests imports from Asia might be down a little in May, and exports mostly unchanged. (Note: the dollar value of oil imports will be down in May too, so the trade deficit should decline).

State Unemployment Rates little changed in May

by Calculated Risk on 6/15/2012 11:47:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in May. Eighteen states recorded unemployment rate increases, 14 states and the District of Columbia posted rate decreases, and 18 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 11.6 percent in May [down from 11.7% in April]. Rhode Island and California posted the next highest rates, 11.0 and 10.8 percent, respectively [down from 11.2% and 10.9%]. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 3.9 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

It appears some of the "sand states", with the largest housing bubbles, are starting to see faster declines in the unemployment rate (Arizona, Florida, California and Nevada).

Consumer Sentiment declines in June to 74.1

by Calculated Risk on 6/15/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for June declined to 74.1, down from the May reading of 79.3.

This was below the consensus forecast of 77.5 and the lowest level this year. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

Industrial Production down in May, Capacity Utilization declined

by Calculated Risk on 6/15/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in May after having gained 1.0 percent in April. A decrease of 0.4 percent for manufacturing production in May partially reversed a large increase in April. Outside of manufacturing, the output of mines advanced 0.9 percent in May, while the output of utilities rose 0.8 percent. At 97.3 percent of its 2007 average, total industrial production in May was 4.7 percent above its year-earlier level. Capacity utilization for total industry declined 0.2 percentage point to 79.0 percent, a rate 1.3 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.0% is still 1.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined in May to 97.3. This is 16.6% above the recession low, but still 3.4% below the pre-recession peak.

The consensus was for no change in Industrial Production in April, and for no change in Capacity Utilization at 79.2%. This was below expectations.

NY Fed: Regional manufacturing activity "expanded slightly" in June Survey

by Calculated Risk on 6/15/2012 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The June Empire State Manufacturing Survey indicates that manufacturing activity expanded slightly over the month. The general business conditions index fell fifteen points, but remained positive at 2.3. The new orders index declined six points to 2.2, and the shipments index fell a steep nineteen points to 4.8. Price indexes were markedly lower, with the prices paid index falling eighteen points to 19.6 and the prices received index dropping eleven points to 1.0. Employment indexes also retreated, though they still indicated a small increase in employment levels and a slightly longer average workweek.The employment index declined to 12.4 from 20.5.

This is the first regional manufacturing survey released for June, and this was well below the consensus forecast of 13.8.