by Calculated Risk on 6/13/2012 11:51:00 AM

Wednesday, June 13, 2012

Redfin: House prices increased 2.2% Year-over-year in May

Another house price index, this one is based on price per sq ft ...

From Redfin: May Real Estate Prices Increase 2.2% as Inventory Continues to Fall

Redfin today released a new 19-market analysis of May home prices, sales volume and inventory levels. The Redfin Real-Time Price Tracker ... showed an annual price gain of 2.2% and a monthly gain of 2.7%. Inventory levels were down 23.5% compared to last year, and down 1.7% compared to last month. Sales volume was up 7.4% over this time last year, and pending sales were up even more, by 10.7%.There is limited historical data for this index. In 2011, sales were fairly weak in the May through July period, and a 7.4% increase in year-over-year sales would be less than the 10% year-over-year increase in April.

“We expected real estate to soften in May along with the larger economy, but we actually saw home prices continue to increase,” said Redfin CEO Glenn Kelman. “This trend seems likely to hold at least through mid-summer. Redfin’s business saw a stronger-than-expected rebound from Memorial Day weekend: with rates low and rents high more new home-buyers were touring homes last weekend, and more are now writing offers. The limit on sales volume is inventory. Not enough sellers have stepped in to provide the liquidity that once came from banks with foreclosures to sell.”

“The 2011 decline in inventory was seasonal and largely expected,” said Tim Ellis, Redfin’s real estate analyst. “But once the trend continued into the outset of 2012′s home-buying cycle, inventory shocks resulted in the first sharp price increases for many areas in five years.”

The reported 23.5% decrease in inventory is similar to other sources and is a key driver for the small year-over-year price increase.

Retail Sales decline 0.2% in May

by Calculated Risk on 6/13/2012 08:46:00 AM

On a monthly basis, retail sales were down 0.2% from April to May (seasonally adjusted), and sales were up 5.3% from May 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $404.6 billion, a decrease of 0.2 percent from the previous month, but 5.3 percent above May 2011.Ex-autos, retail sales declined 0.4% in May.

Click on graph for larger image.

Click on graph for larger image.Sales for April was revised down to a 0.2% decrease from a 0.1% increase.

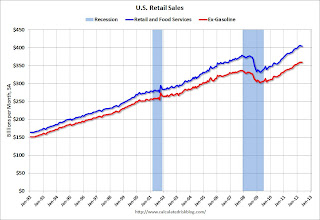

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.1% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.9% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.9% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.9% on a YoY basis (5.3% for all retail sales). Retail sales ex-gasoline decreased 0.1% in May.

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto.

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto. MBA: Mortgage Applications Reach Highest Level Since 2009

by Calculated Risk on 6/13/2012 07:00:00 AM

From the MBA: Mortgage Applications Reach Highest Level Since 2009 in Latest MBA Weekly Survey

The Refinance Index increased over 19 percent from the previous week to the highest index level since April 2009. The seasonally adjusted Purchase Index increased around 13 percent from one week earlier.

“Mortgage application volume increased sharply last week. The increase was accentuated due to the comparison to the week including Memorial Day, but the level of refinance and total market activity is the highest since the spring of 2009,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “Refinance volume increased as borrowers were able to lock in at mortgage rates below 4 percent, and purchase application volume was its highest level in over six months. HARP volume has been steady in recent weeks at about 28 percent of refinance applications.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.88 percent from 3.87 percent, with points decreasing to 0.43 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak, but appears to be moving up recently.

Refinance activity continues to increase as mortgage rates are near the record low set the previous week.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.According to the MBA, HARP volume was still at 28% of all refinance activity, so HARP activity is increasing at the same rate as overall refinance activity.

Tuesday, June 12, 2012

Look Ahead: Retail Sales

by Calculated Risk on 6/12/2012 09:45:00 PM

Over in Europe, eurozone industrial production will be released. The consensus is for a 1% decline.

As a reminder, the Greek election is this coming Sunday, and currently polls show no clear winner.

From Bloomberg: Greek Bank Deposit Outflows Said to Have Risen Before Elections

Daily withdrawals have increased to the upper end of a 100 million-euro ($125 million) to 500 million-euro range this month, one banker said, asking not to be identified because the figures aren't public. A second banker said the drawdown may have exceeded 700 million euros yesterday.• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record or near record low mortgage rates and a sharp increase in refinance activity.

• At 8:30 AM, Retail sales for May will be released. The consensus is for retail sales to decrease 0.2% in May, and for retail sales ex-autos to decrease 0.1%.

• Also at 8:30 AM, the Producer Price Index for May. The consensus is for a 0.6% decrease in producer prices due to the decline in oil prices (0.2% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales for April will be released (Business inventories). The consensus is for 0.3% increase in inventories.

JPMorgan Provides example of "Orderly Liquidation" after a catastrophic loss

by Calculated Risk on 6/12/2012 08:08:00 PM

From the Financial Times: JPMorgan plan for ‘catastrophic’ event

[T]he presentation given at a Harvard Law School event is also an unusually frank acknowledgement that there are limits to the capital buffers of even healthy banks.Here is the presentation: Orderly Liquidation of a Failed SIFI (systemically important financial institutions).

In the doomsday scenario set out by [Gregory Baer, deputy general counsel], a $50bn loss would trigger “a run on the bank” - with $375bn of funding, including bank deposits, draining away.

The government would then step in and mark down the bank’s assets, leading to an additional $150bn loss. Shareholders would be wiped out but senior creditors would be transferred to a new bridge company that allows “critical activities [to] continue to operate smoothly”.

excerpt with permission

This provides a "Hypothetical, illustrative example of the orderly liquidation of JPMorgan Chase". This is a pretty catastrophic event: "For illustrative purposes, we describe the impact of a catastrophic, idiosyncratic event causing a $200B loss and $550B of liquidity outflows – leading to Orderly Liquidation Authority being invoked to resolve JPMC"