by Calculated Risk on 5/31/2012 11:27:00 AM

Thursday, May 31, 2012

NY Fed: Consumer Deleveraging Continued in Q1, but Student Loan Debt Continued to Grow

From the NY Fed: New York Fed Quarterly Report Shows Student Loan Debt Continues to Grow

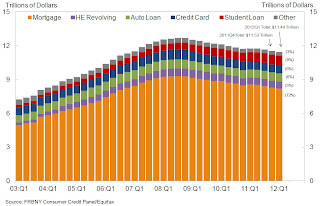

In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York today announced that student loan debt reported on consumer credit reports reached $904 billion in the first quarter of 2012, a $30 billion increase from the previous quarter. In addition, consumer deleveraging continued to advance as overall indebtedness declined to $11.44 trillion, about $100 billion (0.9 percent) less than in the fourth quarter of 2011. Since the peak in household debt in the third quarter of 2008, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.Here is the Q1 report: Quarterly Report on Household Debt and Credit

Mortgage balances shown on consumer credit reports fell again ($81 billion or 1.0%) during the quarter; home equity lines of credit (HELOC) balances fell by $15 billion (2.4%). Household mortgage and HELOC indebtedness are now 11.9% and 14.3%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances stood at $2.64 trillion at the close of the quarter. Student loan indebtedness, the largest component of household debt other than mortgages, rose 3.4% in the quarter, to $904 billion.Here are two graphs:

...

About 291,000 individuals had a foreclosure notation added to their credit reports between December 31 and March 31, about the same as in 2011Q4, but 20.8% below the 2011Q1 level.

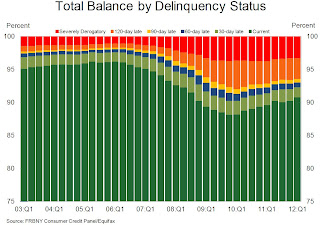

Total household delinquency rates continued their downward trend in 2012Q1. As of March 31, 9.3% of outstanding debt was in some stage of delinquency, compared to 9.8% on December 31, 2011.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q1. This was mostly due to a decline in mortgage debt.

However student debt is still increasing. From the NY Fed:

Over the one year period ending March 31, 2012, student loan balances rose $64 billion. Over the same period, all other forms of household debt (mortgages, HELOCs, auto loans and credit card balances) fell a combined $383 billion.

Since the peak in household debt in 2008Q3, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached. From the NY Fed:

About $1.06 trillion of consumer debt is currently delinquent, with $796 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

Chicago PMI declines to 52.7

by Calculated Risk on 5/31/2012 09:55:00 AM

Chicago PMI: The overall index declined to 52.7 in May, down from 56.2 in April. This was below consensus expectations of 56.1 and indicates slower growth in May. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the May Chicago Business Barometer decreased for a third consecutive month to its lowest level since September 2009. The short term trend of the Chicago Business Barometer, and all seven Business Activity indexes, declined in May. Among the Business Activity measures, only the Supplier Delivery index expanded faster while Order Backlogs and Inventories contracted.New orders declined to 52.7 from 57.4, and employment decreased to 57.0 from 58.7.

...

• PRODUCTION and NEW ORDERS lowest since September 2009;

• PRICES PAID lowest since September 2010;

• EMPLOYMENT rate of growth slowed

This is another weak reading, and suggests a decline in the ISM PMI to be released tomorrow.

Weekly Initial Unemployment Claims increase to 383,000

by Calculated Risk on 5/31/2012 08:38:00 AM

Note: The BEA reported that the second estimate of Q1 real GDP growth was 1.9%, lower than the advance estimate of 2.2% and at the consesnus expectation. Real Gross Domestic Income (GDI) was reported at 2.7% annual rate.

The DOL reports:

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750.The previous week was revised up from 370,000 to 373,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,500.

The average has been between 363,000 and 384,000 all year.

And here is a long term graph of weekly claims:

This was above the consensus forecast of 370,000.

ADP: Private Employment increased 133,000 in May

by Calculated Risk on 5/31/2012 08:11:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 133,000 from April to May on a seasonally adjusted basis. The estimated gain from March to April was revised down modestly, from the initial estimate of 119,000 to a revised estimate of 113,000.This was below the consensus forecast of an increase of 154,000 private sector jobs in May. The BLS reports on Friday, and the consensus is for an increase of 150,000 payroll jobs in May, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 132,000 in May, after rising a revised 119,000 in April. Employment in the private, goods-producing sector increased 1,000 in May. Manufacturing employment dropped 2,000 jobs, the second consecutive monthly decline.

Note: ADP hasn't been very useful in predicting the BLS report, but this suggests a somewhat weaker than consensus report.

Wednesday, May 30, 2012

Look Ahead: GDP, ADP Employment, Weekly Unemployment Claims, Chicago PMI

by Calculated Risk on 5/30/2012 09:16:00 PM

There are a number of US economic indicators to be released over the next two days, and that may take some of the focus off of Europe (probably not). For Thursday:

• At 8:15 AM ET, the ADP employment report is scheduled for release. This report is for private payrolls only (no government). The consensus is for 154,000 payroll jobs added in May, up from the 119,000 reported last month.

• At 8:30 AM ET, the second estimate of Q1 GDP will be released by the BEA. The consensus is that real GDP increased 1.9% annualized in Q1, slower than the advance estimate of 2.2%. The BEA will also release Q1 Gross Domestice Income (GDI).

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 370 thousand.

• At 9:45 AM, the Chicago Purchasing Managers Index for May will be released. The consensus is for a decrease to 56.1, down slightly from 56.2 in April.

• At 11:00 AM, the New York Fed will release the Q1 2012 Report on Household Debt and Credit (filled with data!)

For the monthly economic question contest (one more questions for May):