by Calculated Risk on 5/19/2012 08:27:00 AM

Saturday, May 19, 2012

Summary for Week of May 18th

The headlines last week were once again mostly about Europe and Greece, especially the possibility of Greece exiting the euro (aka "Grexit") after the next election on June 17th. The outcome of the election is uncertain, although most Greeks and European policymakers would like Greece to stay in the euro. One thing is certain, Greece will be in the headlines for at least another month.

Most of the US economic data was at or above expectations last week. An exception was the Philly Fed manufacturing survey, but that was partially offset by faster expansion in the Empire State survey.

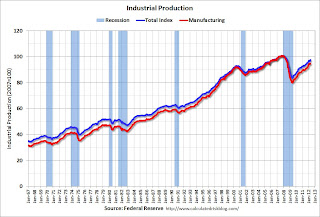

Housing starts were solid as the slow housing recovery continues. Industrial production and capacity utilization increased, and the mortgage deliquencies are trending down.

The US economy remains sluggish. However, excluding Europe (and other international issues), the outlook would be improving. Two key questions are: what will happen in Greece and Europe? and how will that impact the US economy? I'll try to add some thoughts soon, but even with the problems in Europe, a recession in the US seems unlikely this year.

Here is a summary in graphs:

• Housing Starts increased to 717,000 in April

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 717 thousand (SAAR) in April, up 2.6% from the revised March rate of 699 thousand (SAAR). Note that March was revised up sharply from 654 thousand to 699 thousand..

Single-family starts increased 2.3% to 492 thousand in April. March was revised up to 481 thousand from 462 thousand.

Total starts are up 50% from the bottom, and single family starts are up 39% from the low.

This was above expectations of 690 thousand starts in April, and was especially strong given the upward revisions to prior months.

• Retail Sales increased 0.1% in April

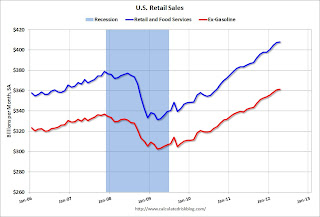

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. Ex-autos, retail sales also increased 0.1% in April.

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. Ex-autos, retail sales also increased 0.1% in April.Sales for March was revised down to a 0.7% increase from 0.8%, and February was revised down to 1.0% from 1.1%.

This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted)

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto.

• Industrial Production up in April, Capacity Utilization increases

This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 79.2% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 97.4. March was revised down (so the month-to-month increase was greater than expected), and February was revised up.

The consensus was for a 0.5% increase in Industrial Production in April, and for an increase to 79.0% (from 78.7%) for Capacity Utilization. This was above expectations.

• MBA: Mortgage Delinquencies decline in Q1

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (14.31% in foreclosure), New Jersey (8.37%), Illinois (7.46%), Nevada (the only non-judicial state in the top 10 at 6.47%), and New York (6.17%).

As Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education noted, the biggest problem is the number of loans in the foreclosure process. This is primarily a problem in states with a judicial foreclosure process. States like California and Arizona are now below the national average of percent of loans in the foreclosure process.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent decreased to 3.13% from 3.22% in Q4. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.21% in Q1, from 1.25% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.06% from 3.11% in Q4 2011. This is the lowest level since 2008, but still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process increased slightly to 4.39% from 4.38%.

• Regional manufacturing activity mixed in May Surveys

From the Philly Fed: May 2012 Business Outlook Survey

Firms responding to the May Business Outlook Survey indicated that manufacturing growth fell back from the pace of recent months. The survey’s broad indicators for general activity fell into negative territory for the first time in eight months. Indicators for new orders and employment also suggested slight declines from April.

From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate pace

From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate paceThe May Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State at a moderate pace. The general business conditions index rose eleven points to 17.1.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The NY and Philly Fed surveys went in opposite directions this month. The NY Fed survey showed stronger expansion; the Philly Fed survey indicated contraction. The average of the Empire State and Philly Fed surveys declined in May, and is at the lowest level this year.

• Weekly Initial Unemployment Claims at 370,000

The DOL reports:

The DOL reports:In the week ending May 12, the advance figure for seasonally adjusted initial claims was 370,000, unchanged from the previous week's revised figure of 370,000. The 4-week moving average was 375,000, a decrease of 4,750 from the previous week's revised average of 379,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 375,000.

The 4-week average has declined for two consecutive weeks. The average has been between 363,000 and 384,000 all year.

This was above the consensus of 365,000.

• AIA: Architecture Billings Index indicates contraction in April

From AIA: Architecture Billings Index Reverts to Negative Territory

From AIA: Architecture Billings Index Reverts to Negative TerritoryAfter five months of positive readings, the Architecture Billings Index (ABI) has fallen into negative terrain. ... The American Institute of Architects (AIA) reported the April ABI score was 48.4, following a mark of 50.4 in March.This graph shows the Architecture Billings Index since 1996. The index was at 48.4 in April. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This is just one month - and as Baker noted, this might be payback for the mild weather earlier in the year - but this suggests CRE investment will stay weak all year (it will be some time before investment in offices and malls increases).

• Key Measures of Inflation in April

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.This graph shows the year-over-year change for core CPI, core PCE, median CPI and the trimmed-mean CPI. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.3%, and core CPI rose 2.3%. Core PCE is for March and increased 2.0% year-over-year.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was flat at 0.0% (0.4% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

• Other Economic Stories ...

• NAHB Builder Confidence increases in May, Highest since May 2007

• Lawler: Early Read on Existing Home Sales in April

• Greece: Election is June 17th

• Hotels: RevPAR increases 4.5% compared to same week in 2011

• State Unemployment Rates decline in 37 states in April

Friday, May 18, 2012

Van Rompuy Statement: "Stay the course" in Europe, "Pro-growth agenda" in June

by Calculated Risk on 5/18/2012 09:13:00 PM

Remarks from Herman Van Rompuy, President of the European Council prior to the G8 summit:

This G8 summit comes at a time of significant challenges to the world economy, and for Europe in particular. As far as Europe is concerned, my message is straightforward: we are determined to stay the course. We will pursue our comprehensive strategy to decrease deficit and debts, and to return to growth and job creation, based on structural reforms, investments and trade. The European Council will discuss a pro-active growth agenda on the dinner on May 23 and we will finalize it on the European Council on 28-29 of June. In that respect it should not be forgotten that in aggregate terms growth in the Euro area is positive and picking up, while our external balances with the rest of the global economy are in equilibrium.The long awaited "growth agenda" will finalized in late June. Most likely too little, too late.

Recently, we have raised our firewalls and increased our contribution to the International Monetary Fund; we have also strengthened economic governance, recapitalised banks and provided ample bank liquidity through the European Central Bank. This week, finance ministers of the EU also made further significant progress in putting into European law the international Basel 3 agreements. We will do whatever is needed to guarantee the financial stability of the euro zone.

In parallel, most EU countries are engaged in very ambitious reforms to ensure debt sustainability, raise productivity and improve competitiveness. This is particularly the case in Spain - where the Government has embarked on a set of comprehensive reforms - and in Italy, as also positively recognized by the IMF after its consultation with Rome this week. I am confident they will succeed.

As regards Greece, I do not hide my concern about the current political uncertainty. Greece is a member of the EU and the Euro zone and this membership implies solidarity and responsibility. The Euro zone has shown considerable solidarity, supplying nearly € 150bn in loans to Greece so far. Alongside this support the EU is developing a huge effort to help reviving the Greek economic potential.

We do not question Greece's sense of responsibility and are hopeful that the next Greek government will act in accordance with the country's engagement and its European future. Continued reform is the best guarantee for the Greek economy and for a future of the Greek people in the euro area.

I'm not sure what Van Rompuy means by "aggregate growth in the Euro area is positive and picking up". According to Eurostat, "GDP remained stable in both the euro area1 (EA17) and the EU271 during the first quarter of 2012, compared with the previous quarter". Flat line isn't growth.

Although Van Rompuy expressed "concern" about Greece, he also said the EU will "do whatever is needed to guarantee the financial stability of the euro zone". It is important to remember that these guys are committed to the euro - and they will not give up easily.

Bank Failure #24 in 2012: Alabama Trust Bank

by Calculated Risk on 5/18/2012 06:26:00 PM

Torpedoed in sea of debt

Sunk by crimson tide

by Soylent Green is People

From the FDIC: Southern States Bank, Anniston, Alabama, Assumes All of the Deposits of Alabama Trust Bank, National Association, Sylacauga, Alabama

As of March 31, 2012, Alabama Trust Bank, National Association had approximately $51.6 million in total assets and $45.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.9 million. ... Alabama Trust Bank, National Association is the 24th FDIC-insured institution to fail in the nation this year, and the first in Alabama.It may be small, but it still counts. It's Friday, Friday ...

Grexit Update

by Calculated Risk on 5/18/2012 01:46:00 PM

The Greek election is still a month away ...

From the WSJ: EU Official: Greek Exit Plans Discussed

The European Commission and the European Central Bank are drawing up plans should Greece abandon the euro, Trade Commissioner Karel De Gucht said in an interview published Friday, the first time a senior European Union official has acknowledged such preparations.Here are some comments from analysts at Nomura:

The ECB and the commission are "working on emergency scenarios in case Greece doesn't make it," Mr. De Gucht said in an interview with the Flemish newspaper De Standaard.

...

European Economics Commissioner Olli Rehn quickly countered Mr. De Gucht's comments about the contingency plans, saying: "We are not working on the scenario of a Greek exit. We are working on the basis of a scenario of Greece staying in."

• We expect the ECB to cut the refi rate to 0.50% in July with risks skewed towards less and later; a policy error in our view.And some other commentary:

• We assume that the eurozone crisis will escalate and further increase pressure on the ECB: ultimately we expect QE.

• Based on current political trends, a Greek euro-area exit looks probable rather than possible following the 17 June election.

From Paul Krugman at the NY Times: Apocalypse Fairly Soon

Right now, Greece is experiencing what’s being called a “bank jog” — a somewhat slow-motion bank run, as more and more depositors pull out their cash in anticipation of a possible Greek exit from the euro. Europe’s central bank is, in effect, financing this bank run by lending Greece the necessary euros; if and (probably) when the central bank decides it can lend no more, Greece will be forced to abandon the euro and issue its own currency again.From Tim Duy at Fed Watch: Closer to Colliding

This demonstration that the euro is, in fact, reversible would lead, in turn, to runs on Spanish and Italian banks. Once again the European Central Bank would have to choose whether to provide open-ended financing; if it were to say no, the euro as a whole would blow up.

Yet financing isn’t enough.

Can the Troika cave to Greece while remaining credible with other troubled economies? I doubt it - which I think increases the risk that the core of Europe will believe it necessary to create a moral hazard example out of Greece.From Michael Pettis: Europe’s depressing prospects

Of course, this worked so well with Lehman Brothers. We will just foget about that little detail for the moment.

State Unemployment Rates decline in 37 states in April

by Calculated Risk on 5/18/2012 10:33:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in April. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, five states posted rate increases, and eight states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-eight states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase and one had no change.

...

Nevada continued to record the highest unemployment rate among the states, 11.7 percent in April [down from 12.0 in March]. Rhode Island and California posted the next highest rates, 11.2 and 10.9 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 3.9 percent, and South Dakota, 4.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

The states with the largest decrease in the unemployment rate are Michigan, Alabama, Tennessee, South Carolina, Ohio and Oregon. The states with the smallest improvement are New Jersey and New York.