by Calculated Risk on 5/16/2012 08:30:00 AM

Wednesday, May 16, 2012

Housing Starts increase to 717,000 in April

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 717,000. This is 2.6 percent (±14.8%)* above the revised March estimate of 699,000 and is 29.9 percent (±15.2%) above the revised April 2011 rate of 552,000.

Single-family housing starts in April were at a rate of 492,000; this is 2.3 percent (±11.9%)* above the revised March figure of 481,000. The April rate for units in buildings with five units or more was 217,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 715,000. This is 7.0 percent (±1.0%) below the revised March rate of 769,000, but is 23.7 percent (±1.9%) above the revised April 2011 estimate of 578,000.

Single-family authorizations in April were at a rate of 475,000; this is 1.9 percent (±1.1%) above the revised March figure of 466,000. Authorizations of units in buildings with five units or more were at a rate of 217,000 in April.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 717 thousand (SAAR) in April, up 2.6% from the revised March rate of 699 thousand (SAAR). Note that March was revised up sharply from 654 thousand.

Single-family starts increased 2.3% to 492 thousand in April. March was revised up to 481 thousand from 462 thousand.

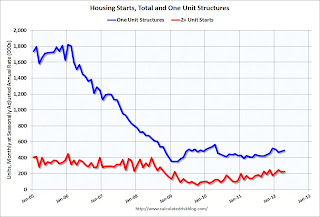

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 50% from the bottom, and single family starts are up 39% from the low.

This was above expectations of 690 thousand starts in April, and was especially strong given the upward revisions to prior months.

The housing recovery continues.

Tuesday, May 15, 2012

Look Ahead: Housing Starts, Industrial Production, Mortgage Delinquencies, FOMC Minutes

by Calculated Risk on 5/15/2012 09:16:00 PM

Wednesday will be another busy day:

• Housing starts for April will be released at 8:30 AM. Total housing starts were at 654,000 in March, on a seasonally adjusted annual rate basis (SAAR), and single-family starts were at 462,000. This was a decline from the February rate, but most of the decline was related to the volatile multi-family sector. Based on housing permits, starts probably rebounded in April. The consensus is for total housing starts to increase to 690,000 (SAAR) in April.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.5% increase in Industrial Production in April, and for Capacity Utilization to increase to 79.0% (from 78.6%).

• At 10:00 AM, the Mortgage Bankers Association (MBA) is scheduled to release the 1st Quarter 2012 National Delinquency Survey (NDS). This provides a breakdown of mortgage delinquencies by number of days delinquent, type of loan, and by state. Since the mortgage settlement was signed off on April 5th, there probably wasn't any impact on Q1 delinquencies. I'll be on the conference call at 10:30 AM and pass along any comments about the settlement, HARP, house prices, etc.

• At 2 PM, the FOMC Minutes for the meeting of April 24-25 will be released. From Goldman Sachs on things to look for:

We expect that the April FOMC minutes ... will include a discussion of possible easing options. ... The first set of options center around the Fed's balance sheet, and we think that the discussion might include the benefits of mortgage purchases, the potential for more “twisting,” and the pros and cons of sterilized asset purchases.• Also on Wednesday, the MBA will release the weekly mortgage applications survey, and the AIA will release the Architecture Billings Index for April (a leading indicator for commercial real estate).

For the monthly economic question contest:

Misc: NY Fed Manufacturing Survey, Remodeling Index

by Calculated Risk on 5/15/2012 05:49:00 PM

A couple of releases earlier this morning ...

• From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate pace

The May Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State at a moderate pace. The general business conditions index rose eleven points to 17.1. The new orders index inched up to 8.3, and the shipments index shot up eighteen points to 24.1. ... Employment index readings remained relatively healthy, suggesting that employment levels and hours worked continued to expand. ... The index for number of employees was little changed at 20.5, and the average workweek index rose six points to 12.1.This was above the consensus forecast of 10.0, up from 6.6 in April (above zero is expansion).

• From BuildFax:

Residential remodels authorized by building permits in the United States in March were at a seasonally-adjusted annual rate of 2,781,000. This is 1 percent below the revised February rate of 2,811,000 and is 10 percent above the March 2011 estimate of 2,522,000.Even with the decline in March, the remodeling in is up 10% year-over-year.

"Overall, March 2012 had lower remodeling activity than February, which saw significantly greater-than-expected activity, likely due to the unseasonably warm winter weather," said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census. The BFRI is seasonally-adjusted using the X12 procedure.

Lawler: Update Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/15/2012 03:12:00 PM

CR Note: Last week I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler sent me the updated table below for several other distressed areas. For all of these areas, the share of distressed sales is down from April 2011 - and for the areas that break out short sales, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

In five of the seven cities that break out short sales, there are now more short sales than foreclosure sales!

Economist Tom Lawler also wrote today: Plunge in Foreclosures Pushes Up REO Prices/Down REO Price Discounts

ForeclosureRadar released its April Foreclosure Report, which covers foreclosure activity in Arizona, California, Nevada, Oregon, and Washington. According to the report, foreclosure starts fell sharply in April in all five states, and completed foreclosure sales declined in all five states, with sizable drops from March in all states save for Washington. And in Arizona, California, and Nevada, record high percentages (44.6%, 41,1%, and 50.7%) of completed foreclosure sales were sold to third parties, rather than becoming bank REO. In its write-up, FR lamented that “we are seeing unprecedented government intervention into the foreclosure process leaving underwater homeowners in limbo, while stealing opportunity from investors and first time buyers." In discussing the “stolen opportunities,” FR noted that “In both Arizona and Nevada winning bids on the courthouse steps on average equal the current estimated value of those properties,” and that “(i)n California the discount between market value and winning bid have on average declined to 12.3 percent” – substantially lower than a year ago. According to FR, “(t)his leaves investors who intend to resell their purchases with record low profits after eviction, repairs, and closing costs.”

An increasing number of investors, of course, are buying REO with plans to rent the properties out, which has not only intensified demand but has reduced the supply of homes offered for sale.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |

| Orlando | 29.4% | 25.4% | 25.5% | 40.2% | 54.9% | 65.6% |

| Northeast Florida | 38.1% | 50.3% | ||||

| Hampton Roads | 31.0% | 35.0% | ||||

Key Measures of Inflation in April

by Calculated Risk on 5/15/2012 11:52:00 AM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in April on a seasonally adjusted basis ... The gasoline index fell 2.6 percent in April and accounted for most of the decline in energy, though the indexes for natural gas and fuel oil decreased as well. ... The index for all items less food and energy rose 0.2 percent in April, the same increase as in March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was flat at 0.0% (0.4% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.3%, and core CPI rose 2.3%. Core PCE is for March and increased 2.0% year-over-year.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.