by Calculated Risk on 5/11/2012 02:03:00 PM

Friday, May 11, 2012

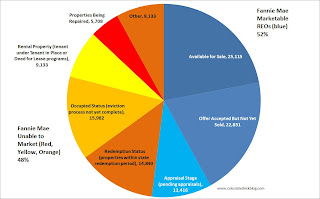

Lawler: Fannie SF REO Inventory: Total vs. “Listed/Available for Sale”

From economist Tom Lawler:

In its latest 10-Q filing Fannie Mae showed the distribution of the “status” of its SF REO inventory, including the % it was unable to “market” for various reasons. (Fannie’s SF REO inventory as of 3/31/2012 totaled 114,157 properties, down 25.5% from last March).

Of Fannie’s 114,157 SF REO properties, almost half – 54,795 – were characterized as being “unable to market” (meaning can’t be listed for sale). Another 11,416 were not yet “listed” or “available” for sale because the properties were still being appraised (so that a list price can be determined). That left just 47,946 properties that were available for sale (listed), of which 22,831 already had a purchase offer accepted but which had not yet closed escrow.

Every so often some “quack” writes a piece saying that “lots” of GSE REOs aren’t listed for sale, “proving” that the GSEs are “holding properties off the market.”

Hopefully disclosure such as these will make such quacks “duck” for cover.

Click on graph for larger image.

Click on graph for larger image.

CR Note: The Fannie table is below. Here is a pie chart showing the distribution of REO.

The "blue" categories are "marketable" (and many are in escrow).

The "orange, yellow, red" categories are not currently marketable. Some are within the state redemption period, some are rented, some are in the eviction process, some are being repaired ...

NOTE: Table below has a sub-total for "unable to market" that includes the categories below it:

| Fannie Mae SF REO Inventory by "Status," March 31, 2012 | ||

|---|---|---|

| Percent | Number (derived for categories) | |

| Available for Sale | 22% | 25,115 |

| Offer Accepted But Not Yet Sold | 20% | 22,831 |

| Appraisal Stage (pending appraisals) | 10% | 11,416 |

| Unable to Market: | 48% | 54,795 |

| Redemption Status (properties within state redemption period) | 13% | 14,840 |

| Occupied Status (eviction process not yet complete) | 14% | 15,982 |

| Rental Property (tenant under Tenant in Place or Deed for Lease programs) | 8% | 9,133 |

| Properties Being Repaired | 5% | 5,708 |

| Other | 8% | 9,133 |

| Total | 100% | 114,157 |

Las Vegas: Visitor Traffic at New High, Convention Attendance Lags

by Calculated Risk on 5/11/2012 01:01:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered.

From the Las Vegas Sun: Visitor volume continues steady climb, latest numbers show

Las Vegas visitor volume continued to climb in March despite a drop in convention attendance, the Las Vegas Convention and Visitors Authority reported Thursday.

The LVCVA said 3.5 million tourists visited the city in March, a 3.7 percent increase over March 2011. For the first quarter, visitor volume is up 3.6 percent over last year to 9.8 million, just under the pace needed to record an unprecedented 40 million visitors.

Convention attendance was down 3.9 percent to 513,010 ... Convention attendance was down despite a 34.6 percent increase in the number of conferences and meetings held (2,302).

Click on graph for larger image.

Click on graph for larger image. It looks like visitor traffic will set a record this year, but convention attendance is still way below the pre-recession levels. This is probably giving a boost to the hotel and gambling industry.

Consumer Sentiment increases in May to 77.8

by Calculated Risk on 5/11/2012 10:00:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.

This was above the consensus forecast of 76.2 and the highest level since January 2008. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy.

PPI declines 0.2% in April, Core PPI increased 0.2%

by Calculated Risk on 5/11/2012 08:42:00 AM

From the BLS: The Producer Price Index for finished goods falls 0.2% in April; finished core rises 0.2%

The decline in the headline number was mostly due to falling energy prices.

The index for crude energy materials fell 6.8 percent in April. From January to April, prices for crude energy materials dropped 15.1 percent subsequent to a 6.6-percent advance for the 3 months ended in January. Almost three-fourths of the April monthly decline can be traced to the index for crude petroleum, which decreased 7.9 percentHowever, excluding food and energy, core PPI increased 0.2%. We will probably see a slowdown in April CPI too due to declining oil and gasoline prices in April (to be released next week).

Thursday, May 10, 2012

Look Ahead: PPI, Consumer Sentiment

by Calculated Risk on 5/10/2012 09:55:00 PM

There are two minor economic indicators scheduled for release tomorrow.

• The Producer Price Index for April at 8:30 AM ET. The consensus is for no change in producer prices (0.2% increase in core).

• And at 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index is scheduled (preliminary for May). The consensus is for sentiment to decline to 76.2 from 76.4 in April.

Here are a couple of other sources for consumer confidence, with opposite readings. First from Gallup: U.S. Economic Confidence Steady at Relatively Improved Level

U.S. economic confidence for the week ending May 6 is at -18, up slightly from the previous week and slightly better than the -20 average for the month of April.And from IBD: U.S. Consumer Confidence Weakens in May

The IBD/TIPP Economic Optimism Index declined by 0.8 points, or 1.6%, in May posting 48.5 vs. 49.3 in April.• Of course the big stories tomorrow will be JPMorgan's $2 billion blunder, and the ongoing tragedy in Greece and Europe. It seems very likely that there will be another election in Greece on June 17th, from the Athens News:

Euro zone countries are prepared to keep financing Greece until the country forms a new government, whether one emerges from Sunday's election or if new elections have to be held next month, euro zone officials said on Thursday. "I expect an announcement of new elections in Greece by Sunday at the latest," one euro zone official said. "My understanding is that a second election in Greece could be by mid-June. We have the means to support Greece through the end of June," a second euro zone official said.

"We will provide enough funds for Greece to stay afloat for as long as the political decision is clarified," the first euro zone official said.

"There is no use letting them default in the middle of things. That is what yesterday was all about - giving them enough money to stay afloat and not induce new chaos if people are not paid, but not giving them more than the bare minimum to discourage parties which say that 'we can do whatever we want and they will still save us because it is in the EU's interest.'"