by Calculated Risk on 5/01/2012 08:37:00 AM

Tuesday, May 01, 2012

Chrysler: U.S. April sales increased 20% year-over-year

From Retuers: Chrysler April US Sales Jump 20 Percent

Chrysler Group's U.S. new-vehicle sales rose 20 percent last month, marking the best April performance in four yearsThe key number for the economy is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. Once all the reports are released, I'll post a graph of the estimated total April light vehicle sales (SAAR) - usually around 4 PM ET.

...

The U.S. automaker said it expects the April annual selling rate for the industry to finish at 14.6 million vehicles. That would be stronger than the 14.4 million 41 analysts surveyed by Thomson Reuters had forecast and would also top the March rate of 14.4 million.

The consensus is for an increase to 14.4 million SAAR, from 14.3 million in March.

I'll add the reports from the other major auto companies as updates to this post.

Monday, April 30, 2012

Contest Questions and April Winner

by Calculated Risk on 4/30/2012 09:59:00 PM

For the question contest in April, the leaders were:

1) Bill (Calculated Risk)

2) Liye Ma

3) (4 way tie) Billy Forney (Finished 2nd in March)

3) Eggert Ólafsson

3) Makesh Pravin

3) Rik Osmer

Congratulations to all.

For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login. Contestants receive 1 point for each correct answer. At the end of each month, I list the leaders in a post on the blog.

Here are the questions for this week (2 on Tuesday, 1 on Thursday, 2 on Friday):

Restaurant Performance Index increases in March

by Calculated Risk on 4/30/2012 07:04:00 PM

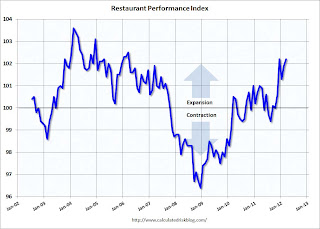

From the National Restaurant Association: Restaurant Performance Index Closes Out Q1 at Post-Recession High

Driven by solid same-store sales and traffic results and an increasingly bullish outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) matched its post-recession high in March. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.2 in March, up 0.3 percent from February and equaling its post-recession high that was previously reached in December 2011.

“The first quarter finished strong with a solid majority of restaurant operators reporting higher same-store sales and customer traffic levels in March,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are solidly optimistic about sales growth and the economy in the months ahead, which propelled the Expectations component of the RPI to its highest level in 15 months.”

“Bolstered by improving sales and traffic results, restaurant operators’ outlook for capital spending reached its highest level in more than four years,” Riehle added. “This will have positive implications throughout the supply chain of the restaurant industry.”

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.2 in March, up from 101.9 in February (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and the index was fairly strong in March.

Fannie Mae and Freddie Mac Serious Delinquency rates declined in March

by Calculated Risk on 4/30/2012 04:47:00 PM

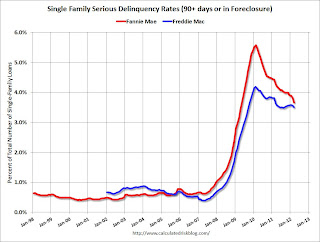

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in March to 3.67%, down from 3.82% in February. The serious delinquency rate is down from 4.44% in March 2011, and is at the lowest level since April 2009. Some of the decline over the last two months is seasonal.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined to 3.51% in March, down from 3.57% in February. Freddie's rate is down from 3.63% in Feburary 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year or so.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Note: LPS reported the serious delinquency rate (including in foreclosore) was about 7.5% in March. That includes the Fannie and Freddie loans with serious delinquency rates at less than half the industry average. This is also a reminder of how bad the non-Fannie/Freddie loans are performing.

Fed: On net, Domestic Banks eased their lending standards and experienced stronger demand over the last 3 months

by Calculated Risk on 4/30/2012 02:27:00 PM

From the Federal Reserve: The April 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices

Overall, in the April survey, modest net fractions of domestic banks generally reported having eased their lending standards and having experienced stronger demand over the past three months. ... However, moderate to large net fractions of domestic banks eased many terms on C&I loans to firms of all sizes, with most indicating that they had done so in response to more aggressive competition from other banks or nonbank lenders. Domestic banks also reported an increase in demand from firms of all sizes.

...

Regarding loans to households, standards on prime residential mortgage loans and home equity lines of credit (HELOCs) were about unchanged. However, the April survey indicated a moderate strengthening in demand for prime residential mortgage loans. With respect to consumer loans, moderate net fractions of banks reported that they had eased standards on most types of these loans over the past three months. In addition, demand for all types of consumer loans increased somewhat, on net, with demand for auto loans showing the largest increase.

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards from the previous quarterly for commercial real estate (CRE). Lenders are now easing standards a little for CRE. A little easing doesn't mean standards are "loose", just not as tight as over the last several years.

The second graph shows the change in demand for CRE loans.

The second graph shows the change in demand for CRE loans. Increasing demand and some easing in standards - this is another indicator suggesting the drag from non-residential investment will probably end mid-year.