by Calculated Risk on 2/10/2012 12:30:00 PM

Friday, February 10, 2012

Bernanke: "Housing Markets in Transition"

Here is the transcript of Fed Chairman Ben Bernanke's speech at the National Association of Homebuilders International Builders' Show, Orlando, Florida: "Housing Markets in Transition". The speech is being streamed live at www.nahb.org/Bernanke

Excerpt:

One way to understand conditions in the housing market is to focus on the balance of supply and demand. For the past few years, the actual and potential supply of single-family homes has greatly exceeded the effective demand. The elevated number of homes that are currently vacant instead of owner occupied reflects the imbalance. According to the most recent estimate, about 1-3/4 million homes are currently unoccupied and for sale. While this figure has declined slightly during the past few years, it is nonetheless up dramatically from the first half of the 2000s, when readings of about 1-1/4 million vacant homes were the norm. Of course, housing conditions vary by region, and vacancy rates in some locations are substantially higher than the national average....

Moreover, a very large number of additional homes are poised to come on the owner-occupied market. In each of the past few years, roughly 2 million homes have entered the foreclosure process, and many of these homes have been put up for sale, crowding out much of the need for new building. Looking ahead, the relatively high rate of foreclosures is likely to continue for a while, putting additional homes on the market and dislocating families and disrupting communities in the process.

At the same time, a number of factors are constraining demand. Household formation has been down, particularly among young adults. High unemployment and uncertain job prospects may have reduced the willingness of some households to commit to homeownership. Availability of mortgage credit is an important constraint, to which I will return later. Additionally, housing may no longer be viewed as the secure investment it once was thought to be, given uncertainty about future home prices and the economy more generally.

Not surprisingly, the large imbalance of supply and demand has been reflected in a drop in home values of historic proportions. ...

To recap, the housing sector continues to suffer from serious imbalances--a marked excess supply for owner-occupied housing accompanied by a stronger rental markets. The narrative of the housing market over the next several years will revolve around the resolution of those imbalances.

Consumer Sentiment declines in February to 72.5

by Calculated Risk on 2/10/2012 09:55:00 AM

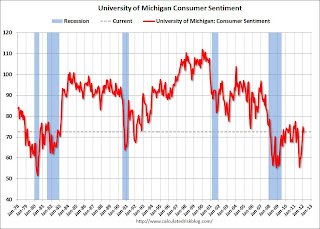

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for February declined to 72.5, down from the January reading of 75.0.

Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer. This was below the consensus forecast of a decline to 74.3.

Trade Deficit increased in December to $48.8 Billion

by Calculated Risk on 2/10/2012 08:50:00 AM

The Department of Commerce reports:

[T]otal December exports of $178.8 billion and imports of $227.6 billion resulted in a goods and services deficit of $48.8 billion, up from $47.1 billion in November, revised. December exports were $1.2 billion more than November exports of $177.5 billion. December imports were $3.0 billion more than November imports of $224.6 billion.The trade deficit was slightly above the consensus forecast of $48.5 billion.

The first graph shows the monthly U.S. exports and imports in dollars through November 2011.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 9% compared to December 2010; imports are up about 11% compared to December 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $104.13 per barrel in December. The trade deficit with China declined to $23 billion, but hit an annual record in 2011.

Exports to eurozone countries increased slightly in December after declining sharply in November.

Thursday, February 09, 2012

NAHB: Bernanke speaks on Friday, Multifamily and Remodeling expected to increase in 2012

by Calculated Risk on 2/09/2012 09:41:00 PM

The NAHB 2012 International Builders’ Show is currently being held in Orlando.

On Friday, Fed Chairman Ben Bernanke will speak at 12:30 PM ET: "Housing Markets in Transition". The speech will be streamed live at www.nahb.org/Bernanke

And the NAHB is expecting continued growth in 2012 for two components of residential investment: Multifamily and remodeling.

From the NAHB Multifamily Industry Stages Strong Recovery but Still Limited by Credit Constraints, Says NAHB

The apartment sector is a bright spot in the overall housing market leading the industry’s path to recovery. ... “[W]e are forecasting construction of 208,000 multifamily residences in 2012 ...” said Sharon Dworkin Bell, NAHB senior vice president for multifamily and 50+ housing.There were 167,400 5+ unit starts in 2011, and only 130,500 completions. 2012 will be another strong year. Economist Tom Lawler is forecasting 225,000 multifamily starts this year.

From the NAHB today: NAHB Foresees Measured Growth in Residential Remodeling

The residential remodeling market will continue to experience measured growth in 2012 after the Remodeling Market Index (RMI) rose to a five year-high at the end of 2011, according to panelists at a press conference held today at the National Association of Home Builders (NAHB) International Builders' Show (IBS) in Orlando, Fla.

...

“Spending on improvements to owner-occupied housing is nearly equal to that of new residential construction,” said Paul Emrath, NAHB’s vice president for survey and housing policy research. “NAHB predicts that residential remodeling will rise 8.9 percent in 2012.”

Mortgage Settlement and Negative Equity

by Calculated Risk on 2/09/2012 05:24:00 PM

I don't think the mortgage servicer settlement alone will have a huge impact on housing or the economy, but I do think the settlement will lead to an increase in the number of modifications, and also an increase in the pace of completed foreclosures.

I've seen several people argue the settlement is too small to have much of an impact on housing. They compare the size of the settlement to overall negative equity. As an example from the Financial Times:

The trouble is that the $32bn is small relative to estimates of a $700bn gap between house values and underwater mortgages: it is just 5 per cent of that total.Note: the $700 billion estimate comes from CoreLogic's Q3 negative equity report.

If we compare the principal reductions to total negative equity, it does seem like a drop in the bucket. However if we think of it terms of a reduction in the number of loans that are 90+ days delinquent and in the foreclosure process, this could be significant.

The FHFA estimates approximately 1 million borrowers will be offered principal reduction modifications, although that estimate may be a little high. Perhaps 500 thousand is a better estimate, and some of them would have received modifications anyway - but the overall number of principal reduction modifications will probably increase by several hundred thousand with the settlement.

Currently, according to LPS, there are 1.79 million loans 90+ days, and 2.07 million in the foreclosure process - or about 3.86 million total seriously delinquent. A few hundred thousand extra modifications would reduce the number of seriously delinquent loans, maybe by 10% (of course some will then re-default).

Also, since there are about 10.7 million borrowers with negative equity, this suggests around 7 million borrowers with negative equity are not seriously delinquent. And that brings us to HARP ...

With the new HARP automated refinancing program coming in March, the borrowers with negative equity and GSE loans will be able to refinance into lower rate mortgages. There borrowers are already current, and if they get a lower mortgage rate (with a faster amortization schedule), they will probably stay current. Not all borrowers with negative equity will eventually default - most won't - and one of the keys to HARP is the shorter amortization schedule that will reduce negative equity fairly quickly. From the FHFA last year:

An important element of these changes is the encouragement, through elimination of certain risk-based fees, for borrowers to utilize HARP to refinance into shorter-term mortgages. Borrowers who owe more on their house than the house is worth will be able to reduce the balance owed much faster if they take advantage of today’s low interest rates by shortening the term of their mortgage.So I expect the number of borrowers with negative equity to decline fairly quickly over the next several years. This will be combination of modifications, foreclosures and refinancing programs.

Another question is: Will the mortgage settlement lead to a flood of foreclosures? It does appear the number of completed foreclosures will increase following this settlement - especially in some judicial states with large backlogs - so there will probably be more REOs (lender Real Estate Owned) for sale. Some of the REO might be sold in bulk as rentals (REO-to-rental program), and the Fed will probably issue guidance to allow servicers to rent REO in heavily impacted areas. It isn't clear how many more REOs will be on the market, but I don't expect a flood of REO as happened in late 2008 and early 2009.