by Calculated Risk on 2/05/2012 03:06:00 PM

Sunday, February 05, 2012

Greek talks end without agreement, will meet again on Monday

From the Athens News: Lengthy and difficult negotiations

A five-hour meeting between prime minister Lucas Papademos and the leaders of the three parties supporting the government ended without agreement on Sunday.More from the Financial Times: Deadlock for Greek austerity talks

Pasok leader George Papandreou, main opposition New Democracy party leader Antonis Samaras and Popular Orthodox Rally (Laos) party leader George Karatzaferis failed to reach agreement with Papademos concerning the demands of the EU-IMF troika for private-sector wage cuts, further pension cuts, large-scale firing of public-sector staff and major downsizing of the public sector.

...

Main opposition New Democracy leader Antonis Samaras made no statements as he left the meeting but indicated the deadlock reached during the meeting during a brief statement to television cameras when he returned to ND's headquarters.

"For the first time, a negotiation is taking place. The country cannot stand more recession. I am fighting with every means to prevent this," he said, confirming that the negotiations will continue on Monday.

Yesterday:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

Recovery Measures

by Calculated Risk on 2/05/2012 10:13:00 AM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that several major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q4 2011. Real GDP returned to the pre-recession in Q3 2011, and Gross Domestic Income (not shown) returned to the pre-recession peak in Q2 - GDI for Q4 will be released with the 2nd estimate of GDP. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through December.

This measure was off 10.7% at the trough.

Real personal income less transfer payments is still 4.8% below the previous peak.

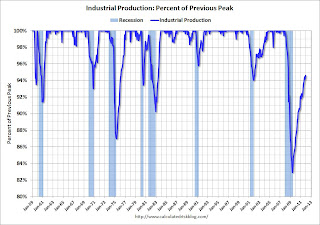

This graph is for industrial production through December.

This graph is for industrial production through December.

Industrial production was off over 17% at the trough, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 5.4% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 4.1% below the pre-recession peak.

If the economy adds 243 thousand payroll jobs per month on average (the January report), it will take another 2 years to get back to the pre-recession employment peak. And that doesn't count growth of the working age population over the last 4+ years.

Yesterday:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

Saturday, February 04, 2012

Greece: Key meeting on Sunday

by Calculated Risk on 2/04/2012 09:56:00 PM

From the Athens News: Crucial meeting of coalition partners

The crucial negotiation of the coalition political party leaders over the EC-ECB-IMF troika's ultimatums and shock measures has been set for 13:00 on Sunday.From Reuters: Euro zone loses patience with Greece

In this new meeting of the leaders of three parties backing the interim government led by Lucas Papademos which will take place on Sunday, the prime minister is expected to present them with a document detailing the rigid positions of the troika. ... [reports are] the prime minister is thinking of resigning if the three do not manage to come to an agreement.

Euro zone finance ministers told Greece on Saturday it could not go ahead with an agreed deal to restructure privately-held debt until it guaranteed it would implement reforms needed to secure a second financing package from the euro zone and the IMF.From the NY Times: Greek Talks at a Delicate Point, Official Says

The Greek finance minister, Evangelos Venizelos, said on Saturday that talks between the government and its foreign creditors on a second rescue deal were “on a razor’s edge,” adding that though progress had been made on some levels, crucial issues were unresolved.Earlier:

“Two major, interrelated issues remain unresolved — labor relations and wages in the private sector, and the fiscal measures that must be taken to ensure we are within the target for 2012,” Mr. Venizelos said after a two-hour conference call with euro zone officials. Despite the barriers, a deal must be reached in bailout talks by Sunday night, he said.

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

AAR: Rail Traffic increased 0.1 percent YoY in January

by Calculated Risk on 2/04/2012 05:47:00 PM

Earlier:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

From the Association of American Railroads (AAR): AAR Reports Gains for January Rail Traffic

The Association of American Railroads (AAR) reported that total U.S. rail carloads originated in January 2012 totaled 1,144,800, an average of 286,200 per week and up 0.1 percent over January 2011. Intermodal volume in January 2012 was 877,637 containers and trailers, up 1.7 percent over January 2011. January’s average of 219,409 intermodal units per week was the third highest ever for a January for U.S. railroads.

...

“Total rail carload traffic in January was flat compared with last year, due largely to sharp declines in coal and grain traffic,” said AAR Senior Vice President John T. Gray. “However, a number of other commodity categories — including many that have historically been much more highly correlated with GDP growth than coal and grain—saw large increases in January. That’s a sign that the underlying economy is probably stronger than you would think if you just looked at the rail traffic totals.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

On a non-seasonally adjusted basis, total U.S. rail carloads in January 2012 totaled 1,144,800, an average of 286,200 per week and up 0.1% over January 2011.Rail carload traffic collapsed in November 2008, and now, 2 1/2 years into the recovery, carload traffic is still not half way back to the pre-recession levels.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is close to the peak year in 2006.

U.S. rail intermodal volume in January 2012 was 877,637 containers and trailers, up 1.7% over January 2011. January’s average of 219,409 intermodal units per week was the third highest ever for a January for U.S. railroads.

Schedule for Week of February 5th

by Calculated Risk on 2/04/2012 01:21:00 PM

Earlier:

• Summary for Week ending February 3rd

This will be a light week for economic releases. The key economic release is the December trade balance report to be released on Friday.

Also on Friday Fed Chairman Ben Bernanke will speak to the National Association of Homebuilders: "Housing Markets in Transition".

Europe will be a focus, especially any announcements about Greece. Also the ECB holds a meeting on Thursday.

The mortgage settlement might be announced this coming week too.

No releases scheduled.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In general, the number of job openings (yellow) has been trending up, and were up about 7% year-over-year compared to November 2010.

10:00 AM: Testimony from Fed Chairman Ben Bernanke, "The Economic Outlook and the Federal Budget Situation", Before the Committee on the Budget, U.S. Senate (repeat of House testimony).

3:00 PM: Consumer Credit for December. The consensus is for a $7.0 billion increase in consumer credit.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although this does not include all the cash buyers.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 370,000 from 367,000 last week.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for December. The consensus is for a 0.5% increase in inventories.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. Imports have been mostly moving sideways for the past six months (seasonally adjusted). Exports are well above the pre-recession peak and up 10% compared to November 2010; imports are up about 13% compared to November 2010.

The consensus is for the U.S. trade deficit to increase to $48.5 billion in December, up from from $47.8 billion in November. Export activity to Europe will be closely watched.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for February.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for February. The final January Reuters / University of Michigan consumer sentiment index increased to 75.0, up from the December reading of 69.9.

The consensus is for a decrease in February to 74.3 from 75.0 in January.

12:30 PM: Speech by Fed Chairman Ben Bernanke, "Housing Markets in Transition", At the 2012 National Association of Homebuilders International Builders' Show, Orlando, Florida