by Calculated Risk on 1/18/2012 10:00:00 AM

Wednesday, January 18, 2012

NAHB Builder Confidence index increases in January

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Fourth Consecutive Time in January

Builder confidence in the market for newly built, single-family homes continued to climb for a fourth consecutive month in January, rising four points to 25 on the NAHB/Wells Fargo Housing Market Index (HMI), released today. This is the highest level the index has attained since June of 2007.

...

“Builders are seeing greater interest among potential buyers as employment and consumer confidence slowly improve in a growing number of markets, and this has helped to move the confidence gauge up from near-historic lows in the first half of 2011,” noted NAHB Chief Economist David Crowe. “That said, caution remains the word of the day as many builders continue to voice concerns about potential clients being unable to qualify for an affordable mortgage, appraisals coming through below construction cost, and the continuing flow of foreclosed properties hitting the market.”

...

Each of the HMI’s three component indexes registered a fourth consecutive month of improvement in January. The component gauging current sales conditions rose three points to 25, which was its highest point since June of 2007. The component gauging sales expectations in the next six months also rose three points, to 29 -- its highest point since September 2009. And the component gauging traffic of prospective buyers rose three points to 21, its highest point since June of 2007.

The HMI also posted gains in all four regions in January, including a nine-point gain to 23 in the Northeast, a one-point gain to 24 in the Midwest, a two-point gain to 27 in the South and a five-point gain to 21 in the West.

Click on graph for larger image.

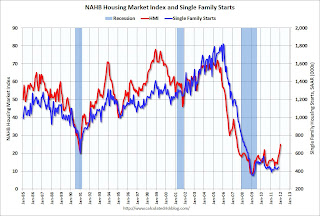

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up.

This is still very low, but this is the highest level since June 2007.

Industrial Production increased 0.4% in December, Capacity Utilization increased

by Calculated Risk on 1/18/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in December after having fallen 0.3 percent in November. For the fourth quarter as a whole, industrial production rose at an annual rate of 3.1 percent, its 10th consecutive quarterly gain. In the manufacturing sector, output advanced 0.9 percent in December with similarly sized gains for both durables and nondurables. The output of utilities fell 2.7 percent, as unseasonably warm weather reduced the demand for heating; the output of mines moved up 0.3 percent. At 95.3 percent of its 2007 average, total industrial production in December was 2.9 percent above its level of a year earlier. The capacity utilization rate for total industry rose to 78.1 percent, a rate 2.3 percentage points below its long-run (1972--2010) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is still 2.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus was for a 0.5% increase in Industrial Production in December, and for an increase to 78.1% for Capacity Utilization. This was close to consensus.

MBA: Mortgage Refinance Applications increase sharply

by Calculated Risk on 1/18/2012 08:33:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 26.4 percent from the previous week to its highest level since August 8, 2011. The seasonally adjusted Purchase Index increased 10.3 percent from one week earlier to its highest level since December 12, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

"Interest rates dropped last week due to continuing anxieties regarding the fragile economic situation in Europe," said Michael Fratantoni, MBA's Vice President of Research and Economics. Fratantoni continued, "With mortgage rates reaching new lows, refinance volume jumped and MBA's refinance index reached its highest level in the last six months. Purchase activity also increased as buyers returned to the market after the holiday season."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.06 percent from 4.11 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.40 percent from 4.34 percent

...

Click on graph for larger image.

Click on graph for larger image.The purchase index increased last week, and the 4-week average also increased. This index has mostly been sideways for the last 2 years - and even with the recent increase, this is at about the same level as in 1997.

Residential Remodeling Index declines seasonally in November

by Calculated Risk on 1/18/2012 12:23:00 AM

The BuildFax Residential Remodeling Index was at 137.9 in November, down from 147.6 in October, but up 33.5% from November 2010. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax Remodeling Index

The Residential BuildFax Remodeling Index rose 33.5% year-over-year in November--for the twenty-fifth straight month of growth--to 137.9. However, this also marked the first month-over-month drop since February, likely due to seasonal factors. Residential remodels in November were down month-over-month 9.7 points (6.6%) from the October value of 147.6, and up year-over-year 34.6 points from the November 2010 value of 103.3.

...

"Residential remodeling in 2011 grew substantially above 2010 rates and remained strong through the end of the year," said Joe Emison, Vice President of Research and Development at BuildFax. "However, we do expect to see the number of remodeling permits decrease on a month-over-month basis for the duration of the winter."

Click on graph for larger image.

Click on graph for larger image.Although the index declined in November, this is the highest level for a November since the index started in 2004, even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 33.5% from November 2010. This is the 25th consecutive month with a year-over-year increase.

Even though new home construction is still moving sideways, two other components of residential investment probably increased in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Tuesday, January 17, 2012

QOTD: Housing "markets get healthy from the bottom up"

by Calculated Risk on 1/17/2012 07:43:00 PM

From the WSJ: From Bottom Up, Signs of Housing Recovery (ht Brian)

Across Westchester, the number of buyers in contract to buy homes priced less than $500,000 at the end of 2011 rose by nearly 40% compared to a year earlier, according to a market report issued by the broker Houlihan Lawrence. Sales weakened at higher price points.The article doesn't discuss the role of investors buying, and investor buying is at record levels in California and other bubble states.

Analysts have noted a similar pattern in New Jersey. Sales have picked up due to buyers of properties priced less than $400,000, according to data compiled by the Otteau Valuation Group. The number of such contracts signed during the fourth quarter rose by 11.3% compared to the same period a year earlier.

Analysts said housing-market recoveries often begin at the bottom.

"It is nice when you get the high end of the market doing well," said Chris Meyers, chief operating officer of Houlihan Lawrence, the largest residential brokerage in Westchester, "but in our experience the strong markets get healthy from the bottom up."

Also the article doesn't mention the higher conforming loan limits from Fannie and Freddie in Westchester. But there is some truth to the quote "markets get healthy from the bottom up".