by Calculated Risk on 1/14/2012 12:19:00 AM

Saturday, January 14, 2012

Record Home Sales in Las Vegas in 2011

From the Las Vegas Review-Journal: Las Vegas home sales set record

A total of 48,186 single-family homes and condos were sold in Las Vegas last year, topping the previous record of 46,879 set in 2009, the Greater Las Vegas Association of Realtors reported ... Roughly half of all sales were cash-only transactions, while 46.8 percent were real estate-owned, or bank-owned properties returning to the market after foreclosure. Another 26.6 percent were short sales, or lender-approved sales for less than the principal mortgage balance.

... new-home sales plummeted from nearly 39,000 in 2006 to fewer than 4,000 in 2011, the lowest level since Home Builders Research began tracking the market in 1988.

Click on graph for larger image.

Click on graph for larger image.This graph shows the sales per year. The are more sales now than during the peak of the bubble! However new home sales are at record lows because of all the vacant housing units and distressed sales.

Also - as the article mentions - prices are still falling. According to Case-Shiller, prices in Las Vegas have fallen about 14% since June 2009, so those people who bought in 2009 have lost money (although many paid cash, so they don't have "negative equity").

Friday, January 13, 2012

Mortgage Settlement Update

by Calculated Risk on 1/13/2012 07:43:00 PM

From Bloomberg: Attorneys General Discuss Mortgage Probes as Bank Talks Drag On

About a dozen state attorneys general met this week to discuss their mortgage investigations and how they might work together as settlement talks with banks over foreclosures drag on, three people familiar with the matter said.This is new:

The group, which met in Washington, included New York Attorney General Eric Schneiderman, California's Kamala Harris and Martha Coakley of Massachusetts ...

Over the weekend, the Justice Department contacted four smaller mortgage servicers, including U.S. Bancorp, PNC Financial Services Group Inc. and HSBC Finance Corp., with the goal of including them in any future settlement agreement. The overture was a first step meant to get reaction from the smaller banks.More on the meeting from the Financial Times: State prosecutors confer over US mortgages probes. It doesn't sound like a deal is close.

Europe Update

by Calculated Risk on 1/13/2012 04:54:00 PM

As was widely rumored, Standard & Poor's lowered its long-term sovereign credit rating on France to AA+ and Spain to A.

From CNBC: S&P Downgrades Credit Ratings on Nine Euro Zone Nations, Including France, Spain, Italy, Portugal and Austria

The Greek debt talks are more important. From Bloomberg: Greece Creditors Break Off Debt Talks

Greece’s creditor banks broke off talks after failing to agree with the government about how much money investors will lose by swapping their bonds, increasing the risk of the euro-area’s first sovereign default.A few of key dates this month:

Proposals by a committee representing financial firms haven’t produced a “constructive consolidated response by all parties,” the Washington-based Institute of International Finance said in a statement today. Talks with Greece and the official sector are “paused for reflection on the benefits of a voluntary approach,” the group said.

Jan 20th: The "troika" discussions with Greece are set to conclude.

Jan 24th: EU finance ministers meet in Brussels.

Jan 30th: European Union leaders meet in Brussels on crisis.

Meanwhile the Italian 10 year yield is up to 6.64%, and the Spanish 10 year yield is up to 5.22%.

Ceridian-UCLA: Diesel Fuel index increased 0.2% in December

by Calculated Risk on 1/13/2012 01:49:00 PM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.2 Percent in December

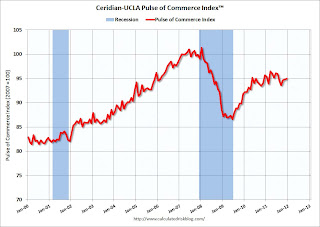

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.2 percent in December following the 0.1 percent increase in November and the 1.1 percent increase in October.

Although December’s news is positive, the combined effect of the three consecutive positive months was not enough to offset the weakness of trucking last summer and the PCI in December 2011 is 1.2 percent below its June 2011 level.

...

Based on the latest PCI data, the forecast for December Industrial Production is a 0.29 percent increase when the government estimate is released on January 18.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index declined sharply in late summer and has only partially rebounded over the last three months. Mostly this index moved sideways in 2011 (down 0.7% from December 2010).

Note: This index does appear to track Industrial Production over time (with plenty of noise).

Financial Times: France and Austria face Downgrades, Greek Debt talks "collapse"

by Calculated Risk on 1/13/2012 11:39:00 AM

From the Financial Times: Eurozone nations face S&P downgrade

Eurozone governments are bracing ... after Standard & Poor’s, the rating agency, told them it would downgrade two of the eurozone’s six triple A nations.From the Financial Times: Greek debt restructuring talks collapse

One official told the Financial Times that France and Austria were due to be downgraded but this was not confirmed ...

excerpt with permission

Talks over Greece’s debt restructuring collapsed on Friday ... makes it more likely Athens will become the first government of a developed country in more than 60 years to suffer a full-scale default on its debt.

Lead negotiators for Greek bondholders said the latest offer made by Athens “has not produced a constructive consolidated response from all parties”– a clear reference to International Monetary Fund conclusions that bondholder losses must be increased significantly or a second Greek bail-out would have to be bigger than the agreed €130bn.excerpt with permission