by Calculated Risk on 11/15/2011 08:40:00 PM

Tuesday, November 15, 2011

HARP Updates

Here are the new Home Affordable Refinance Program (HARP) guidelines from Fannie Mae: Selling Guide Announcement SEL-2011-12

As noted by the FHFA last month, the HARP deadline will be extended, there is no maximum LTV (except in certain cases), and most Reps and warrants have been eliminated.

On the timing, according to Fannie Mae: "The expansion of the LTV ratio limits is effective for Refi Plus mortgage loans with application dates on or after December 1, 2011." Desktop Underwriter® (DU) will be updated in March.

One of the keys is the elimination of most Reps and warrants, from Fannie Mae:

For DU Refi Plus:

• The lender is not responsible for any of the representations and warranties associated with the original loan.

• The lender is relieved of the standard underwriting representations and warranties (eligibility, credit history, liabilities, income and asset assessment) with respect to the new mortgage loan if the lender meets all of the following requirements:

- All data in the loan casefile is complete, accurate, and not fraudulent.

- The lender follows the instructions in the DU Underwriting Findings Report regarding income, employment, asset, and fieldwork documentation.

- The lender complies with all other requirements documented in the Selling Guide, A2-2.1-04, Limited Waiver of Contractual Warranties for Mortgages Submitted to DU.

For Refi Plus:

• With respect to the original loan, the lender must represent and warrant to the following:If I'm reading this correctly, the elimination of Reps and warrants for the original loan applies to Desktop Underwriter® (DU) and that will not be updated until March.

- The loan was eligible for sale in accordance with Fannie Mae’s Charter at the time of delivery to Fannie Mae.

- The loan was originated in compliance with laws. See the A3-2-01, Compliance with Laws.

- The lender represents and warrants that the original loan being refinanced by a Refi Plus mortgage loan was not originated or sold pursuant to any scheme or pattern of fraud ...

DataQuick: SoCal October Home Sales decline

by Calculated Risk on 11/15/2011 06:44:00 PM

From DataQuick: Southland Home Sales Inch Up from 2010; Median Price Down Again

Southland home sales rose slightly in October compared with a year earlier but were still nearly 30 percent below the long-term average. ...New home sales were at a record low (Note: DataQuick reports new home sales at closing - the Census Bureau reports new home sales when contracts are signed - usually about six months earlier). Also over half of existing home sales in SoCal were distressed sales in October; a very unhealthy market.

A total of 16,829 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October. That was down 7.3 percent from 18,149 in September and up 0.5 percent from 16,744 in October 2010, according to San Diego-based DataQuick.

A drop in sales between September and October is not unusual, but last month’s decline was larger than the average change – a decline of 0.7 percent – between those months since 1988, when DataQuick's statistics begin.

...

While October sales of existing (not new) houses and condos rose 2.2 percent and 1.3 percent, respectively, from a year earlier, sales of newly built homes dropped 18.4 percent to the lowest level on record for an October.

...

“The lower conforming loan limits implemented last month help explain the relatively sharp drop in mid- to high-end sales during October. Now we’ll have to see if the private loan market can fill the void,” said John Walsh, DataQuick president.

...

Distressed property sales accounted for 52.5 percent of the Southland resale market last month, up from 50.8 percent in September but down from 53.7 percent a year earlier. Nearly one out of three homes resold last month was a foreclosure, while roughly one in five was a “short sale.”

NAR is scheduled to reported October existing home sales on Monday, November 21st and so far it appears sales will be down in October (seasonally adjusted) compared to September.

Lawler on FHA MMIF Actuarial Review for FY 2011

by Calculated Risk on 11/15/2011 04:04:00 PM

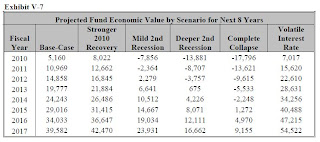

From economist Tom Lawler: HUD released the annual Actuarial Review of the FHA’s Mutual Mortgage Insurance Fund for FY 2011, which is required by law and which is performed by an independent entity (lately IFE Group) to assess the “economic net worth” and “financial soundness” of the fund. According to the latest review, the estimated “economic net worth” of the MMIF (ex HECMs) at the end of FY 2011 (9/30/11) – defined as the sum of existing capital resources plus the net present value of the current books of business (using “base-case” economic scenarios) – was just $1.19 billion, down from $5.16 billion at the end of FY 2010. The “base case” scenario for home prices is based on Moody’s July 2011 forecast for the FHFA home price index, which I guess IFE Group uses because the FHFA HPIs cover a large number of MSAs, even though these HPIs are widely viewed as not being the “best” measures of home price trends. This forecast shows home price declining modestly next year.

Last year, the actuarial review estimated that by the end of FY 2011 the MMIF’s “economic value” would rise to $10.969 billion, as opposed to the latest report’s decline to $1.1193 billion. The FHFA “national” HPI fell in 2010 and early 2011 by more than was projected in the “base-case” used for the FY2010 actuarial review. However, Moody’s forecast for home price appreciation is a bit above last July’s, and as a result the “base-case” economic assumptions actually were a PLUS to IFE’s estimate of the FY 2011 “economic value.”

The major “negative hit” to the MMIF EV was related to “updated econometric model and portfolio status” factors, especially (1) much slower prepayment forecasts, and (2) the elimination of last year’s questionable “policy year dummy variables.” In addition, there was a negative “adjustment for foreclosure loans,” reflecting the unusually large number of loans in the foreclosure process at the time of the review, including a larger-than-normal number of properties where foreclosures had apparently been completed but servicers had not yet filed claims.

CR Note: here are the house price scenarios used in the analysis.

As with last year, this year’s review included some “sensitivity analysis,” which suggested that the MMIF’s exposure to “bad” scenarios had worsened from last year. [Below] are tables showing the estimated “economic value” of the MMIF under alternative scenarios from the FY 2010 Actuarial Review, and from the FY 2011 Actuarial Review.

And the second table is from the 2011 review. As Tom Lawler notes, the FHA has performed worse than the base case for 2010 - and there are much bigger expected losses under the “Worse-than-Base-Case” scenarios.

Folks who want to read the whole thing can find it here.

Misc: Empire Manufacturing survey improves, Farmland Prices "surge"

by Calculated Risk on 11/15/2011 01:15:00 PM

From the NY Fed earlier today: Conditions for New York manufacturers held steady in November

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers held steady in November. After a string of five consecutive months of negative readings, the general business conditions index rose nine points, to 0.6. While the new orders index edged down to -2.1, indicating that orders were a little lower, the shipments index rose to 9.4, indicating an increase in shipments. The inventories index fell to -12.2 — a sign that inventory levels dropped.This was slightly above the consensus forecast. The futures indexes really "surged" indicating

...

Employment indexes were mixed: employment levels were slightly lower and the average workweek slightly longer.

"a widespread expectation that conditions would improve in the months ahead".

And from the Chicago Fed: Third Quarter Midwest Farmland Values Surge

At 25 percent, the year-over-year gain in agricultural land values in the third quarter of 2011 for the Seventh Federal Reserve District was the largest in just over three decades. Moreover, at 7 percent, the quarterly increase in the value of “good” farmland matched the highest since the late 1970s.I just hope farmers and farm land lenders remember the lessons of the '80s - and that farmers don't borrow too much, and lenders think about tighter lending standards.

European Bond Yields Rising as Euro zone economy slows

by Calculated Risk on 11/15/2011 11:34:00 AM

From the WSJ: Recession Fears Haunt Euro Zone

The euro-zone economy barely grew in the third quarter despite a temporary bounce in Germany and France, raising fears that the euro bloc may already be sliding into recession ... Gross domestic product in the 17-nation euro zone grew 0.6% at an annualized rate during the third quarter ... Germany's economy recovered to post a 2% annualized growth rate ... France grew 1.6% after stagnating in the second quarter.Below is a table for several European bond yields (links to Bloomberg).

Those two countries comprise half of euro-zone GDP, indicating that the rest of the euro bloc contracted as a whole ...

The Italian 10 year bond yield is up to 7.07%. The Italian 2 year yield is up to 6.54%.

The Spanish 10 year bond yield has increased to 6.34%. The Spanish 2 year yield is up to 5.3%.

The French 10 year bond yield is at 3.67%. The Belgium 10 year yield is up to 4.9%.

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |