by Calculated Risk on 11/15/2011 10:04:00 AM

Tuesday, November 15, 2011

HUD report on FHA Financial Status

This report shows some improvement from the report last year, but the house price assumptions seem optimistic.

From HUD: FHA Issues Annual Financial Status Report to Congress

In reporting on findings of the annual independent actuarial study, HUD indicates that, in the midst of continued weakness in housing markets across the county, the MMI Fund capital ratio remains positive this year at 0.24 percent. With new risk controls and premiums put in place by the Obama Administration, the independent actuaries predict the Fund will return to the Congressionally-mandated threshold of two percent capital more quickly than was projected by last year’s review.Long term readers will remember the many posts by Tanta and myself warning about the negative impact of "DAPs" (the seller-funded downpayment assistance programs that allowed buyers to put no money down). The DAPs were finally banned, but they caused significant losses for the FHA.

...

As was the case last year, the new actuarial study shows that FHA is expected to sustain significant losses from loans insured prior to 2009, and thus its capital reserve remains below the congressionally mandated threshold of two percent of total insurance-in-force. However, the actuaries’ report concludes that, barring a further significant downturn in home prices, the MMI Fund will start to rebuild capital in 2012, and return to a level of two percent by 2014 – outpacing last year’s prediction.

...

Losses on loans insured through the first quarter of fiscal year 2009 continue to place a significant strain on the Fund and are expected to reach $26 billion within a few more years. Though they were prohibited in 2009, the ongoing effect of so-called “seller-funded downpayment assistance loans” is still significant. The net expected cost of those loans, as projected by the independent actuaries, grew by $1.8 billion over the past year to $14.1 billion. Conversely, the actuaries found that the FY2010 and FY2011 books are expected to be very profitable, providing significant net revenues to offset losses on earlier books.

This assumes prices increase slightly next year: "The base-case scenario provided by Moody’s Analytics indicates price declines in 2011 of 5.6% and predicts a small amount of growth in prices in 2012 (1.3%), followed by ore steady growth starting in 2013."

Here is the HUD report - and the graph below shows the house price scenarios included in the report.

Click on graph for larger image.

Click on graph for larger image.NOTE: Prices are for the FHFA index (GSE loans only), and the FHFA index didn't increase as rapidly as Case-Shiller, and didn't decline as fast either (the GSE loans have performed significantly better than the Wall Street originate-to-distribute loans).

The “Mild Second Recession” utilized by the actuaries poses an additional 9 percent decline in home prices beyond the 5.6 percent base-case decline, for a total two-year decline of 14.6 percent.I don't think we will see another sharp decline in house prices - although I think prices will fall to new post-bubble lows this winter. I also don't think we will see the steady increase in prices as shown by all of these forecasts. Usually prices move sideways for a few years at the end of a housing bust (especially in real terms).

FHA estimates that the fund could withstand an additional decline in house prices of 4% beyond the base-case decline without experiencing a negative capital situation.

Special note: Tanta's birthday was November 15th. Tanta vive!

Retail Sales increased 0.5% in October

by Calculated Risk on 11/15/2011 08:30:00 AM

On a monthly basis, retail sales were up 0.5% from September to October (seasonally adjusted, after revisions), and sales were up 7.9% from October 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $397.7 billion, an increase of 0.5 percent (±0.5%) from the previous month and 7.2 percent (±0.7%) above October 2010. Total sales for the August through October 2011 period were up 7.6 percent (±0.5%) from the same period a year ago. The August to September 2011 percent change was unrevised from +1.1 percent (±0.3%).Retail sales excluding autos increased 0.6% in October. Sales for September were unrevised with a 1.1% increase.

Click on graph for larger image.

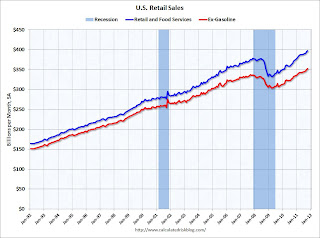

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 19.5% from the bottom, and now 5.1% above the pre-recession peak (not inflation adjusted)

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.0% on a YoY basis (7.2% for all retail sales).

Retail sales ex-gasoline increased by 6.0% on a YoY basis (7.2% for all retail sales). This was well above the consensus forecast for retail sales of a 0.2% increase in October, and no change ex-auto.

This was a solid report, especially following the very strong September report.

Monday, November 14, 2011

State by state exports to Europe

by Calculated Risk on 11/14/2011 09:16:00 PM

From the Miami Herald: Florida’s economy faces ‘moderate’ risk from European recession

Florida would fare better than many states should Europe slip into recession, a new study [by Wells Fargo] found. ... The report makes no mention of another key concern for Florida: European tourism. The United Kingdom is Florida’s second largest source of international travelers behind Canada, with Germany holding the fifth slot behind Brazil and Mexico.Here is a map from the referenced report by economist Mark Vitner and Michael Brown at Wells Fargo. The map shows European exports as a percent of state GDP.

Click on graph for larger image.

Click on graph for larger image.Utah has a very high percentage of exports to Europe - mostly silver and gold to the United Kingdom. West Virginia exports coal.

As the Miami Herald article notes, Florida will probably also be impacted by less tourism too.

However the largest potential impact is probably from financial contagion as opposed to trade and tourism. Catherine Rampell has a summary of the various channels of contagion: The Euro Zone Crisis and the U.S.: A Primer

Schedule Update: MBA's 3rd Quarter 2011 National Delinquency Survey will be released Thursday

by Calculated Risk on 11/14/2011 06:31:00 PM

An update to the weekly schedule ...

10:00 AM: Mortgage Bankers Association (MBA) 3rd Quarter 2011 National Delinquency Survey (NDS)

The following graph shows the percent of loans delinquent by days past due for Q2.

The MBA reported 8.44% of mortgage loans were delinquent at the end of Q2, seasonally adjusted, and another 4.43% were in the foreclosure process (total of 12.87%, essentially unchanged from Q1).

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due in Q2. Based on other data, the delinquency rate probably decreased slightly in Q3.

However the key problem is the large number of seriously delinquent loans (90+ days and in the foreclosure process). And there probably was little change in those percentages in Q3.

SF Fed: Recession odds in 2012 are greater than 50% due to European Crisis

by Calculated Risk on 11/14/2011 03:37:00 PM

An economic letter from the SF Fed: Future Recession Risks: An Update(ht Rickkk)

Gathering storms across the Atlantic threaten a U.S. economy not yet recovered from the last recession. ... In the next few months, the odds of recession due to domestic factors appear reasonably contained. ... However, the curve reflecting the international odds suggests more imminent danger to the economy, although this threat is harder to calibrate using historical data and only indirectly reflects the health of the European financial system. Recession odds based on international factors peak at about 45% toward the end of 2011 ... The combination of these two recession coins, shown in the combined risks line of Figure 2, is quite disconcerting. It indicates that the odds are greater than 50% that we will experience a recession sometime early in 2012. Because the international odds of recession are more imprecisely estimated, one must be careful with a strict interpretation of this result. But the message is clear. Prudence suggests that the fragile state of the U.S. economy would not easily withstand turbulence coming across the Atlantic.Based on domestic data, I think a recession is unlikely. However the European crisis is definitely a significant downside risk to U.S. economic growth. The spillover from Europe depends on how the crisis unfolds ...