by Calculated Risk on 11/10/2011 12:11:00 PM

Thursday, November 10, 2011

RealtyTrac: Foreclosure Activity Hits 7-Month High in October

From RealtyTrac: U.S. Foreclosure Activity Hits 7-Month High in October

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for October 2011, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 230,678 U.S. properties in October, a 7 percent increase from the previous month, but still down nearly 31 percent from October 2010.It appears the pace of foreclosure activity is picking up again. I don't think we will see a huge increase in activity until the mortgage settlement is announced - and that might lead to more modifications too.

...

“The October foreclosure numbers continue to show strong signs that foreclosure activity is coming out of the rain delay we’ve been in for the past year as lenders corrected foreclosure paperwork and processing problems,” said James Saccacio, chief executive officer of RealtyTrac.

...

Default notices (NOD, LIS) were filed for the first time on a total of 77,733 U.S. properties in October, a 10 percent increase from September, but still down 23 percent from October 2010. Default notices in states using the judicial process (LIS) reached an 11-month high of 39,282 in October, a 16 percent increase from the previous month, but still down 31 percent from October 2010.

...

Foreclosure auctions (NTS, NFS) were scheduled on 85,321 U.S. properties in October, up 8 percent from the previous month, but still down 38 percent from October 2010.

...

Lenders repossessed a total of 67,624 U.S. properties (REO) in October, a 4 percent increase from the previous month, but still a 27 percent decrease from October 2010.

Earlier:

• Weekly Initial Unemployment Claims decline to 390,000

• Trade Deficit declines in September as Exports increase

Trade Deficit declines in September as Exports increase

by Calculated Risk on 11/10/2011 09:15:00 AM

The Department of Commerce reports:

[T]otal September exports of $180.4 billion and imports of $223.5 billion resulted in a goods and services deficit of $43.1 billion, down from $44.9 billion in August, revised. September exports were $2.5 billion more than August exports of $177.9 billion. September imports were $0.7 billion more than August imports of $222.8 billion.The trade deficit was below the consensus forecast of $46.3 billion and the deficit for August was revised down.

The first graph shows the monthly U.S. exports and imports in dollars through September 2011.

Click on graph for larger image.

Click on graph for larger image.Exports increased in September, and imports have been mostly moving sideways for the last five months (seasonally adjusted). Exports are well above the pre-recession peak and up 16% compared to September 2010; imports have stalled recently and are up about 12% compared to September 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $101.02 per barrel in September, and import oil prices have been declining slowly from $108.70 per barrel in May. The trade deficit with China declined slightly to $28 billion.

Imports have been moving sideways for the last several months - partially due to slightly lower oil prices. However the trade deficit with China continues to be a significant issue. Exports are still trending up.

Weekly Initial Unemployment Claims decline to 390,000

by Calculated Risk on 11/10/2011 08:30:00 AM

The DOL reports:

In the week ending November 5, the advance figure for seasonally adjusted initial claims was 390,000, a decrease of 10,000 from the previous week's revised figure of 400,000. The 4-week moving average was 400,000, a decrease of 5,250 from the previous week's revised average of 405,250.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 400,000.

This is the lowest level for the 4 week average since April - although this is still elevated.

And here is a long term graph of weekly claims:

Italian Update: Bond yields decline

by Calculated Risk on 11/10/2011 07:32:00 AM

• The Italian 10 year bond yield fell to 6.89% after hitting 7.48% yesterday.

• From Bloomberg: Italy’s Senate Speeds Austerity Vote

Italy’s Senate rushed to pass debt- reduction measures that clear the way for establishing a new government that may be led by former European Union Competition Commissioner Mario Monti in a bid to restore confidence in Europe’s second-biggest debtor.• From the NY Times: Debt Sale in Italy Steadies Markets

The Senate is set to vote tomorrow on a package of measures including asset sales and an increase in the retirement age. The Chamber of Deputies may vote the following day ... Monti may be nominated as soon as Nov. 13, newspaper Il Sole 24 Ore reported.

Italy raised €5 billion, or $6.8 billion, in an auction Thursday of one-year securities. The Italian Treasury sold the full allotment of bonds on offer, but it paid an average rate of 6.09 percent to do so, far above the 3.57 percent it paid for a similar offering on Oct. 3. It also marked the most Italy has had paid for such debt since September 1997, when the country still used the lira.UPDATE on Greece: Reports are Former ECB Vice President Lucas Papademos will be named Prime Minister. From the Athens News:

"The new Greek interim government will be sworn in at 2:00 p.m. on Friday, according to sources.

Dr. Lucas Papademos, former governor of the central bank of Greece and former vice president of the European Central Bank (ECB), was on Thursday named as the new prime minister of Greece.

Papoulias gave Papademos a mandate to form the new interim government, a Presidency announcement said.

The 64-year-old Papademos, economic adviser to outgoing Premier Papandreou since 2010, was on Thursday named as the prime minister who will head a coalition government in Greece agreed by prime minister George Papandreou (ruling PASOK party leader) and main opposition New Democracy (ND) leader Antonis Samaras that is being formed to pass through parliament a second EU-IMF bailout package for Greece agreed at an extraordinary eurozone summit on October 26 before leading the country to early general elections in three months' time, with the most likely date being February 19.

Wednesday, November 09, 2011

Distressed House Sales using Sacramento Data for October

by Calculated Risk on 11/09/2011 08:15:00 PM

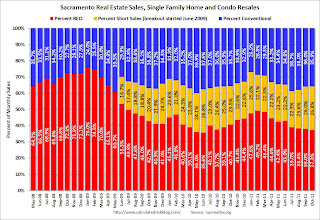

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes - and that hasn't happened yet. At some point, the number (and percent) of distressed sales should start to decline without market distortions.

The percent of distressed sales in Sacramento increased in October compared to September. In October 2011, 64.1% of all resales (single family homes and condos) were distressed sales. This is up from 64.0% in September, and down slightly from 64.3% in October 2010.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 19.6% compared to October 2010. Active Listing Inventory is down 34.6% from last October, although "short sale contingent" has increased. Cash buyers accounted for 28.7% of all sales (frequently investors), and mean/medium prices are off about 10% from last October.

Once the foreclosure delays end, this data might be helpful in determining when the market is improving. So far it looks like REO sales have declined slightly, offset by an increase in short sales, so overall there is no improvement.