by Calculated Risk on 11/08/2011 12:44:00 PM

Tuesday, November 08, 2011

Europe Update

Update: Reports are Italian Prime Minister Silvio Berlusconi will resign after 2012 budget is approved.

First Greece:

• The Athens News is reporting Lucas Papademos will be the interim Prime Minister and that elections will be held on Feb 19th. "Lucas Papademos, an economist and former central banker, will be the new prime minister of Greece, a ruling Pasok source has told Reuters."

• The EU is asking for all parties in Greece to sign a committment letter. However New Democracy leader Antonis Samaras is balking. From the Athens Times: Samaras sees written committments unnecessary

New Democracy leader Antonis Samaras has maintained his opposition this evening to European demands that Greek leaders sign a letter in support of the October 27 Eurogroup agreements for Greece as a condition for disbursing the 6th tranche of bailout loans.The Greek 2 year yield is up to 105%, and the Greek 1 year yield is down to 221%.

"There is national dignity. I have already and repeatedly explained why, in order to protect the Greek economy and the euro, the implementation of the decisions of October 26 has become inevitable. I will not allow anyone to doubt my word" he emphasised, in an official announcment.

The European Union has asked Greece to produce a letter promising implementation the bailout deal and have it signed by the outgoing and new Greek prime minister, the finance minister, the opposition leader and the central bank chief, a minister told reporters on Tuesday.

On Italy:

• The Italian 10 year yield is at 6.77%.

• From the NY Times: Berlusconi Loses Majority After Ally Asks Him to Resign

Prime Minister Silvio Berlusconi of Italy won a budget vote in Parliament on Tuesday but the tally showed that he no longer has the support of the majority, a huge humiliation that raised the pressure on him to resign in the face of an escalating debt crisis that has hobbled Greece, threatens Italy and could infect the rest of Europe.• From the Financial Times: Live blog: Eurozone crisis

Berlusconi is due to meet Giorgio Napolitano, head of state, in just over an hour. Napolitano, 86, the most respected political figure in Italy according to opinion polls, is expected to suggest that the prime minister step down in the national interest.Greece is just a sideshow now - this is now about Italy and the entire EMU.

BLS: Job Openings increase in September

by Calculated Risk on 11/08/2011 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in September was 3.4 million, up from 3.1 million in August. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in September was 1.2 million higher than in July 2009 (the most recent trough for the series). The number of jobThe following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

openings has increased 38 percent since the end of the recession in June 2009.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general, the number of job openings (yellow) has been trending up, and are up about 22% year-over-year compared to September 2010.

Quits increased in September, and have been trending up - and quits are now up about 11% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

NFIB: Small Business Optimism Index increases slightly in October

by Calculated Risk on 11/08/2011 07:46:00 AM

From the National Federation of Independent Business (NFIB): Small Business Confidence Has Minor Uptick

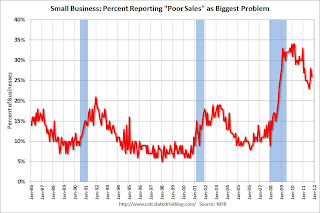

NFIB’s Small-Business Optimism Index gained 1.3 points, nudging the Index up to 90.2. This is below the year-to-date average of 91.1, only slightly better than the average since January 2009 of 89.1.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“Consumer sentiment remains at very low levels and is reflected in the 26 percent of small business owners who cite ‘poor sales’ as their biggest problem,” said NFIB Chief Economist Bill Dunkelberg. ...

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 90.2 in October from 88.9 in September. This is the second increase in a row after declining for six consecutive months.

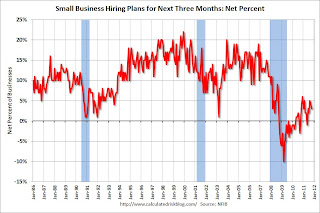

The second graph shows the net hiring plans for the next three months.

Hiring plans were low in October, but still positive and the trend is up.

Hiring plans were low in October, but still positive and the trend is up. According to NFIB: “Over the next three months ... a seasonally adjusted net three percent of owners planning to create new jobs. This is down 1 point from September and 2 points below August, the month that has, thus far, posted the strongest reading for 2011. For some context, in an expansion, this number should exhibit double digit readings."

Twenty six percent of small business owners reported that weak sales continued to be their top business problem in September.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly in September and October. This index has been slow to recover - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

Monday, November 07, 2011

Foreclosure Filings Slow Sharply in Nevada after new Law takes Effect

by Calculated Risk on 11/07/2011 10:14:00 PM

From Nick Timiraos at the WSJ: Nevada Foreclosure Filings Dry Up After ‘Robo-Signing’ Law

Foreclosure filings in Nevada plunged in October during the first month of a new state law stiffening foreclosure-processing requirements.BofA uses ReconTrust, a wholly owned subsidiary, to handle foreclosures. With this new law, BofA will have to use another trustee.

...

Nevada’s state Assembly passed a measure that took effect on Oct. 1 ... the Nevada law makes it a felony—and threatens to hold individuals criminally liable—for making false representations concerning real estate title. Individuals are also subject to civil penalties of $5,000 for each violation.

...

The Nevada law makes an important technical change to those rules by forbidding trustees from handling foreclosures if the trustee is a subsidiary of foreclosing bank.

According to DataQuick, foreclosure resales were about 56% of the Las Vegas market in September - and this probably means Nevada existing home sales will decline sharply in October. Foreclosures will probably pick up again once the lenders feel they are complying with the new law.

Econoparody: "In the Greek Midwinter"

by Calculated Risk on 11/07/2011 07:31:00 PM

Another song below from our friends at versusplus.com: "In the Greek Midwinter"

Earlier the Fed released their quarterly Senior Loan Officer survey. This showed banks tightening lending to European banks and firms, but not in the U.S ...

Other earlier posts:

• Sluggish Growth and Payroll Employment

• CoreLogic: House Price Index declined 1.1% in September

• Italy: 10 Year bond yields continue to increase