by Calculated Risk on 11/08/2011 10:00:00 AM

Tuesday, November 08, 2011

BLS: Job Openings increase in September

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in September was 3.4 million, up from 3.1 million in August. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in September was 1.2 million higher than in July 2009 (the most recent trough for the series). The number of jobThe following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

openings has increased 38 percent since the end of the recession in June 2009.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general, the number of job openings (yellow) has been trending up, and are up about 22% year-over-year compared to September 2010.

Quits increased in September, and have been trending up - and quits are now up about 11% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

NFIB: Small Business Optimism Index increases slightly in October

by Calculated Risk on 11/08/2011 07:46:00 AM

From the National Federation of Independent Business (NFIB): Small Business Confidence Has Minor Uptick

NFIB’s Small-Business Optimism Index gained 1.3 points, nudging the Index up to 90.2. This is below the year-to-date average of 91.1, only slightly better than the average since January 2009 of 89.1.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

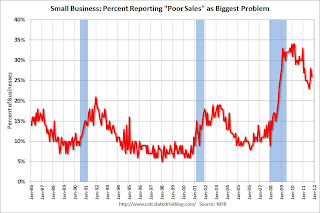

“Consumer sentiment remains at very low levels and is reflected in the 26 percent of small business owners who cite ‘poor sales’ as their biggest problem,” said NFIB Chief Economist Bill Dunkelberg. ...

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 90.2 in October from 88.9 in September. This is the second increase in a row after declining for six consecutive months.

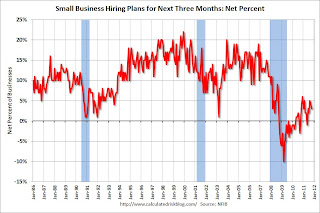

The second graph shows the net hiring plans for the next three months.

Hiring plans were low in October, but still positive and the trend is up.

Hiring plans were low in October, but still positive and the trend is up. According to NFIB: “Over the next three months ... a seasonally adjusted net three percent of owners planning to create new jobs. This is down 1 point from September and 2 points below August, the month that has, thus far, posted the strongest reading for 2011. For some context, in an expansion, this number should exhibit double digit readings."

Twenty six percent of small business owners reported that weak sales continued to be their top business problem in September.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly in September and October. This index has been slow to recover - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

Monday, November 07, 2011

Foreclosure Filings Slow Sharply in Nevada after new Law takes Effect

by Calculated Risk on 11/07/2011 10:14:00 PM

From Nick Timiraos at the WSJ: Nevada Foreclosure Filings Dry Up After ‘Robo-Signing’ Law

Foreclosure filings in Nevada plunged in October during the first month of a new state law stiffening foreclosure-processing requirements.BofA uses ReconTrust, a wholly owned subsidiary, to handle foreclosures. With this new law, BofA will have to use another trustee.

...

Nevada’s state Assembly passed a measure that took effect on Oct. 1 ... the Nevada law makes it a felony—and threatens to hold individuals criminally liable—for making false representations concerning real estate title. Individuals are also subject to civil penalties of $5,000 for each violation.

...

The Nevada law makes an important technical change to those rules by forbidding trustees from handling foreclosures if the trustee is a subsidiary of foreclosing bank.

According to DataQuick, foreclosure resales were about 56% of the Las Vegas market in September - and this probably means Nevada existing home sales will decline sharply in October. Foreclosures will probably pick up again once the lenders feel they are complying with the new law.

Econoparody: "In the Greek Midwinter"

by Calculated Risk on 11/07/2011 07:31:00 PM

Another song below from our friends at versusplus.com: "In the Greek Midwinter"

Earlier the Fed released their quarterly Senior Loan Officer survey. This showed banks tightening lending to European banks and firms, but not in the U.S ...

Other earlier posts:

• Sluggish Growth and Payroll Employment

• CoreLogic: House Price Index declined 1.1% in September

• Italy: 10 Year bond yields continue to increase

Visible Existing Home Inventory declines 16% year-over-year in early November

by Calculated Risk on 11/07/2011 04:40:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

• In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales revisions will be down (the NAR has pre-announced this), and the inventory is expected to be revised down too.

• Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to late 2005 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through September (left axis) and the HousingTracker data for the 54 metro areas through October. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the November listings - for the 54 metro areas - declined 16.8% from the same week last year. The graph shows monthly inventory change (this is preliminary for November).

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too.